Question

Hello, I would really appreciate some help studying. I am trying to practice for an exam, and I found a multi-step extra help question online

Hello, I would really appreciate some help studying. I am trying to practice for an exam, and I found a multi-step extra help question online from Chase Bank's 2020 financial statement (which I've attached in the screenshots.) Thank you so so much :)

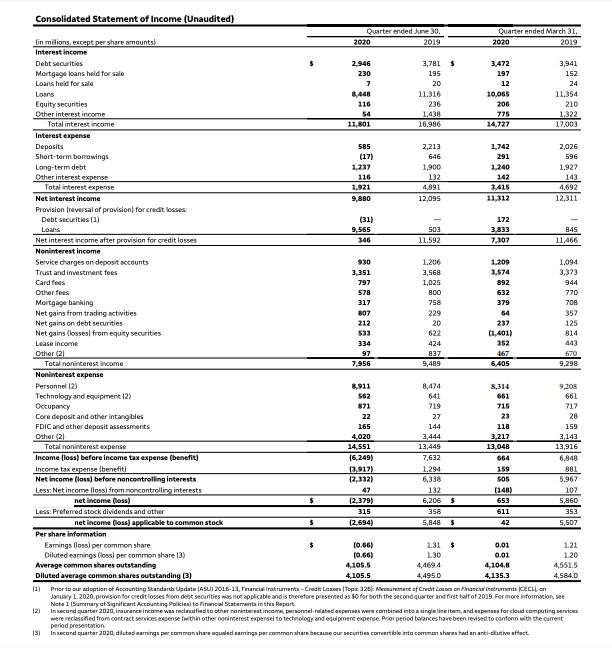

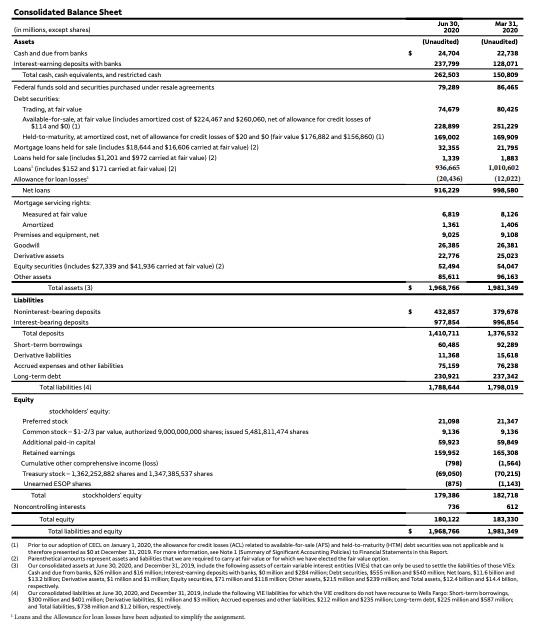

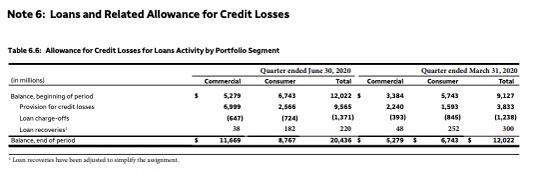

1. a. What is the amount of outstanding loans that Chase Bank expects to receive as of June 30, 2020? What about March 31, 2020?

1 b. What was the dollar amount of loans written off net of recoveries by Chase Bank in quarter 2 of 2020?

1 c. How did the write-off affect net income and also total assets?

1 d. Assume that $50,000 of new loans were initiated in quarter 2 of 2020. What is the estimated amount of loan payments that were collected by Chase Bank during this quarter? (Hint: for the Gross Loans account, use the equation Ending Balance = Beginning Balance + New Loans + Interest Income Loan Payments Net Write-offs.)

1 e. What percentage of its loans did Chase Bank expect to collect as of March 31, 2020? How would Chase Bank's provision for credit losses, net income, net loans, and leverage ratio change had it retained this same percentage in the second quarter? For simplicity, define leverage as the ratio of total assets to stockholders equity. Ignore any income tax effects.

1 f. What percentage of its loan-related interest income was Chase Banks provision for credit losses in the first quarter of 2020? How would Chase Banks provision for credit losses, net income, net loans, and leverage ratio change had it retained this same percentage in the second quarter? For simplicity, define leverage as the ratio of total assets to stockholders equity. Ignore any income tax effects.

1 g. What percentage of its loan-related interest income was Chase Bank's provision for credit losses in quarter 2 of 2020? Do you think this provision is reasonable? Why or why not? Should Chase Bank be concerned about the effect of this provision on its leverage ratio?

116 206 29 1.025 892 379 Consolidated Statement of Income (Unaudited) Quarter ended June 30. Quarter ended Much 31, lin milions, except per share amounts) 2020 2019 2020 2019 Interest income Debt Securities 2.946 3,781 $ 3,472 3,941 Mortgage loans held for sale 230 195 197 152 Loans held for sale 7 20 12 24 Loans 8,448 11.316 10,065 11,354 Equity securities 236 210 Other interest income 54 1,438 775 1.322 Total interest income 11,801 16.986 14,727 17.003 Interest expense Deposits 585 2,213 1742 2,026 Short-term borrowings (17) 646 596 Long-term debt 1.237 1,900 1.240 1.922 Other interest expense 116 132 142 143 Total interest expense 1,921 4,891 1,415 4,692 Net interest income 9,880 12,095 11.112 12,311 Provision Treversal or provision for credit losses. Debt Securities (11 (31) 172 Loans 9,565 503 3.833 845 Net interest income after provision for credit losses 146 11,592 7,307 11,466 Noninterest income Service charges on deposit accounts 1,206 1,209 1,094 Trust and investment foes 3,351 3,568 1,574 3,373 Card fees 797 944 Other fees 578 632 770 Mortgage banking 317 758 706 Net gains from trading activities 807 229 64 357 Net gains on debt securities 212 20 237 125 Net gains (losses from equity curities 533 622 (1,401) 814 Lease income 334 424 352 443 Other 21 97 837 467 670 Total noninterest income 7,956 9,489 6,405 9,298 Noninterest expense Personnel (2) 4,911 8,474 8,314 9,205 Technology and equipment (2) 562 641 661 661 Occupancy 871 719 715 717 Core deposit and other intangibles 22 27 23 28 FDIC and other deposit assessments 165 144 159 Other 21 4,020 3,444 3,217 3,143 Total noninterest expense 14,551 13,449 13,048 13,916 Income (loss) before income tax expense (benefit) 16,249) 7,632 664 6.848 Income tax expense benefit 10,917) 1.294 159 801 Net income foss) before noncontrolling interests 12,332) 6,338 sos 5.967 Less: Net income lloss) from non controlling interests 47 132 (148) 102 net income loss) $ 12.379) 6,206 $ 653 5,860 Less: Preferred stock dividends and other 315 358 611 353 net income foss) applicable to common stock $ 12.694) 5,848 $ 42 5,507 Per share information Eamings loss) per common share $ (0.66) 1.31 $ 0.01 1.21 Diluted earings lossl per common share 13) 10.66) 1.30 0.01 1.20 Average common shares outstanding 4.105.5 4,469.4 4,104.8 4,551.5 Diluted average common shares outstanding (3) 4,105.5 4,495.0 4.135.3 4,584.0 111 Prior to our adoption of Accounting Standarch Update ASU) 2016-11, Pinanciratruments - Credit Lentope 320 eurement of Credit Comment Financial instruccion January 1.2020. provision for credit losses from det securities was not applicable and is therefore presented as 50 for both the second quarter and first half of 2019. For more information, see Niste 1 Summary of Significant Accounting Policisternal Statement in this apart In second cuarter 2020 inaurance income was redesfiadto other contra income, personnel related aspers were combined into a ungline item, and esperans far cloud computing were reclassified from contract services egense within other noninterest expersel to technology and equipment experse. Prior period balances have been revised to conform with the current period presentation 131 in second quarter 2020, dlated earrings per common share equaled mina per common share because our un certalent common shares had an anti-cutive effect. 118 Consolidated Balance Sheet Jun 30, Mar 31 in millions, except shares 2020 2020 Assets Unaudited) (Unaudited) Cash and due from banks 24,704 22,738 Interesteaming deposits with barks 237,799 128,071 Total casil, cash equivalents, and restricted cash 262,503 150,809 Federal funds sold and securities purchased under resale agreements 79,289 86,465 Debt Securities Trading, in value 74.679 80,425 Available for sale, at fair value lindudes amortised cost of $224,467 and $260.000, net of allowance for credit losses of 5114 and 500 (1) 228,899 251,229 Held-to-maturity, at amortized cost, net of allowance for credit is of $20 and so fair value $176 882 and $256,850) (1) 169,000 169,900 Mortgage loans held for sale includes $10,644 and $16.606 carried at fair value 121 32,355 21,795 Loans held for sale includes $1,201 and $972 carried at far va 21 1,339 1,883 Loans includes $152 and $171 carried at fair valul 121 936,665 1,010,602 Allowance forloan losses (20,436) (12,022) Net loans 916229 998,500 Mortgage servicing rights Measured at far value 6819 4,126 Amortized 1,361 1,406 Premises and equipment, net 9,025 9,108 Goodwill 26,385 26,381 Derivative assets 22,776 25,023 Equity securities oncludes $27,339 and 541.936 carried at far value) (2) 57.494 $4,047 Others 85,611 96,163 Totalasset 131 $ 1,968.766 1.981,349 Liabilities Noninterest-bearing deposits 432,857 379,678 Interest-bearing deposits 977,854 995,854 Total deposits 1,410,711 1.376,532 Short-term borrings 50,485 92,289 Derivative abilities 11,368 15,618 Accrued expenses and other abilities 75,159 78,238 Long-term debt 270,921 237,342 Total abilities 141 1,788,644 1,798,019 Equity stockholders' uity Preferred stock 21,098 21,347 Common stock - $1-2/3 par value, authorized 9,000,000,000 shares issued 5,481,811,474 shares 9,136 9,136 Additional pald-in capital 59,923 59,849 Retained earnings 159,952 165,308 Cumulative other comprehensive income foss) (798) (1,6641 Treasury stock - 1,362 252,882 shares and 1,347,385,537 shares (69,050) (70,215) Unearned ESOP Shares (875) (1,1431 Total stockholders' equity 179.386 182,718 Nencontrolling interests 736 612 Total equity 180, 122 183,230 Total abilities and equity $ 1,966,766 1981,349 (11 Prior to our adoption of Calauay 1, 2020, the lowance for credit (ACL) rolated to available-for-wale TAFS) and hald-ta- maturity TM debt cut not applicable and a therefore and a 50 at December 31, 20. D. For more informatie Note 1 Summary of Significant Accounting Policial to Francial Statements in this apert el Parentheticalaurspressamentoured to any file or foi edected the file option 31 Our consolidated assets a une 30, 2000, and December 3, 2013.indade the folowing sets of certain ruble interesentis IV that can be used to settle the boties of those VIES Cashs due from bank. 526 rion and $16 milionitering deposits with Barks somon and $284 millor Debt securities 6555 milioane 5540 ion Networ. 526 bilion $23.7 or Derivatista $1 million and 51 milion Equity secure 571 milion and $12 miliore Other aut. 5215 million and 52 million and Tobalausta, 5124 bin and $144 bisa respective Our complicated into at June 30, 2020, and December 11,2019, Indude the following Min for which the creditor donat we recurre te Wells Farge: Short-term borrowing 5300dbrandsc02 mifer Derivative bil na 3 Accruede pense and other sites $212 dior and 5235 miles Long-term 5225 tinand 3587 and abilities, 573 and 12 an and the Allence for lokale bonded to simplify the women. Note 6: Loans and Related Allowance for Credit Losses Quarter ended March 31, 2020 Consumer Total Commerdal Table 6.6. Allowance for Credit Losses for Loans Activity by Portfolio Segment Quarter ended June 30, 2020 in millons! Commercial Consumer Total Balance beginning of period $ 5,279 6,743 12,022 Provision for credits 6.999 2.566 9,565 Loan charge-ofts 16471 (724) 11,371) Loans recoveries 182 220 Balance, end of period 5 11.669 2240 1793) 5,743 1,593 (845) 252 5 9,127 3,833 11,228) 300 12,022 18 5279 $ Love been added to simply the games 116 206 29 1.025 892 379 Consolidated Statement of Income (Unaudited) Quarter ended June 30. Quarter ended Much 31, lin milions, except per share amounts) 2020 2019 2020 2019 Interest income Debt Securities 2.946 3,781 $ 3,472 3,941 Mortgage loans held for sale 230 195 197 152 Loans held for sale 7 20 12 24 Loans 8,448 11.316 10,065 11,354 Equity securities 236 210 Other interest income 54 1,438 775 1.322 Total interest income 11,801 16.986 14,727 17.003 Interest expense Deposits 585 2,213 1742 2,026 Short-term borrowings (17) 646 596 Long-term debt 1.237 1,900 1.240 1.922 Other interest expense 116 132 142 143 Total interest expense 1,921 4,891 1,415 4,692 Net interest income 9,880 12,095 11.112 12,311 Provision Treversal or provision for credit losses. Debt Securities (11 (31) 172 Loans 9,565 503 3.833 845 Net interest income after provision for credit losses 146 11,592 7,307 11,466 Noninterest income Service charges on deposit accounts 1,206 1,209 1,094 Trust and investment foes 3,351 3,568 1,574 3,373 Card fees 797 944 Other fees 578 632 770 Mortgage banking 317 758 706 Net gains from trading activities 807 229 64 357 Net gains on debt securities 212 20 237 125 Net gains (losses from equity curities 533 622 (1,401) 814 Lease income 334 424 352 443 Other 21 97 837 467 670 Total noninterest income 7,956 9,489 6,405 9,298 Noninterest expense Personnel (2) 4,911 8,474 8,314 9,205 Technology and equipment (2) 562 641 661 661 Occupancy 871 719 715 717 Core deposit and other intangibles 22 27 23 28 FDIC and other deposit assessments 165 144 159 Other 21 4,020 3,444 3,217 3,143 Total noninterest expense 14,551 13,449 13,048 13,916 Income (loss) before income tax expense (benefit) 16,249) 7,632 664 6.848 Income tax expense benefit 10,917) 1.294 159 801 Net income foss) before noncontrolling interests 12,332) 6,338 sos 5.967 Less: Net income lloss) from non controlling interests 47 132 (148) 102 net income loss) $ 12.379) 6,206 $ 653 5,860 Less: Preferred stock dividends and other 315 358 611 353 net income foss) applicable to common stock $ 12.694) 5,848 $ 42 5,507 Per share information Eamings loss) per common share $ (0.66) 1.31 $ 0.01 1.21 Diluted earings lossl per common share 13) 10.66) 1.30 0.01 1.20 Average common shares outstanding 4.105.5 4,469.4 4,104.8 4,551.5 Diluted average common shares outstanding (3) 4,105.5 4,495.0 4.135.3 4,584.0 111 Prior to our adoption of Accounting Standarch Update ASU) 2016-11, Pinanciratruments - Credit Lentope 320 eurement of Credit Comment Financial instruccion January 1.2020. provision for credit losses from det securities was not applicable and is therefore presented as 50 for both the second quarter and first half of 2019. For more information, see Niste 1 Summary of Significant Accounting Policisternal Statement in this apart In second cuarter 2020 inaurance income was redesfiadto other contra income, personnel related aspers were combined into a ungline item, and esperans far cloud computing were reclassified from contract services egense within other noninterest expersel to technology and equipment experse. Prior period balances have been revised to conform with the current period presentation 131 in second quarter 2020, dlated earrings per common share equaled mina per common share because our un certalent common shares had an anti-cutive effect. 118 Consolidated Balance Sheet Jun 30, Mar 31 in millions, except shares 2020 2020 Assets Unaudited) (Unaudited) Cash and due from banks 24,704 22,738 Interesteaming deposits with barks 237,799 128,071 Total casil, cash equivalents, and restricted cash 262,503 150,809 Federal funds sold and securities purchased under resale agreements 79,289 86,465 Debt Securities Trading, in value 74.679 80,425 Available for sale, at fair value lindudes amortised cost of $224,467 and $260.000, net of allowance for credit losses of 5114 and 500 (1) 228,899 251,229 Held-to-maturity, at amortized cost, net of allowance for credit is of $20 and so fair value $176 882 and $256,850) (1) 169,000 169,900 Mortgage loans held for sale includes $10,644 and $16.606 carried at fair value 121 32,355 21,795 Loans held for sale includes $1,201 and $972 carried at far va 21 1,339 1,883 Loans includes $152 and $171 carried at fair valul 121 936,665 1,010,602 Allowance forloan losses (20,436) (12,022) Net loans 916229 998,500 Mortgage servicing rights Measured at far value 6819 4,126 Amortized 1,361 1,406 Premises and equipment, net 9,025 9,108 Goodwill 26,385 26,381 Derivative assets 22,776 25,023 Equity securities oncludes $27,339 and 541.936 carried at far value) (2) 57.494 $4,047 Others 85,611 96,163 Totalasset 131 $ 1,968.766 1.981,349 Liabilities Noninterest-bearing deposits 432,857 379,678 Interest-bearing deposits 977,854 995,854 Total deposits 1,410,711 1.376,532 Short-term borrings 50,485 92,289 Derivative abilities 11,368 15,618 Accrued expenses and other abilities 75,159 78,238 Long-term debt 270,921 237,342 Total abilities 141 1,788,644 1,798,019 Equity stockholders' uity Preferred stock 21,098 21,347 Common stock - $1-2/3 par value, authorized 9,000,000,000 shares issued 5,481,811,474 shares 9,136 9,136 Additional pald-in capital 59,923 59,849 Retained earnings 159,952 165,308 Cumulative other comprehensive income foss) (798) (1,6641 Treasury stock - 1,362 252,882 shares and 1,347,385,537 shares (69,050) (70,215) Unearned ESOP Shares (875) (1,1431 Total stockholders' equity 179.386 182,718 Nencontrolling interests 736 612 Total equity 180, 122 183,230 Total abilities and equity $ 1,966,766 1981,349 (11 Prior to our adoption of Calauay 1, 2020, the lowance for credit (ACL) rolated to available-for-wale TAFS) and hald-ta- maturity TM debt cut not applicable and a therefore and a 50 at December 31, 20. D. For more informatie Note 1 Summary of Significant Accounting Policial to Francial Statements in this apert el Parentheticalaurspressamentoured to any file or foi edected the file option 31 Our consolidated assets a une 30, 2000, and December 3, 2013.indade the folowing sets of certain ruble interesentis IV that can be used to settle the boties of those VIES Cashs due from bank. 526 rion and $16 milionitering deposits with Barks somon and $284 millor Debt securities 6555 milioane 5540 ion Networ. 526 bilion $23.7 or Derivatista $1 million and 51 milion Equity secure 571 milion and $12 miliore Other aut. 5215 million and 52 million and Tobalausta, 5124 bin and $144 bisa respective Our complicated into at June 30, 2020, and December 11,2019, Indude the following Min for which the creditor donat we recurre te Wells Farge: Short-term borrowing 5300dbrandsc02 mifer Derivative bil na 3 Accruede pense and other sites $212 dior and 5235 miles Long-term 5225 tinand 3587 and abilities, 573 and 12 an and the Allence for lokale bonded to simplify the women. Note 6: Loans and Related Allowance for Credit Losses Quarter ended March 31, 2020 Consumer Total Commerdal Table 6.6. Allowance for Credit Losses for Loans Activity by Portfolio Segment Quarter ended June 30, 2020 in millons! Commercial Consumer Total Balance beginning of period $ 5,279 6,743 12,022 Provision for credits 6.999 2.566 9,565 Loan charge-ofts 16471 (724) 11,371) Loans recoveries 182 220 Balance, end of period 5 11.669 2240 1793) 5,743 1,593 (845) 252 5 9,127 3,833 11,228) 300 12,022 18 5279 $ Love been added to simply the gamesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started