hello, im having a hard tome understanding these questions from the book Fundamental Accounting Principales. please i need help somving this thank you:)

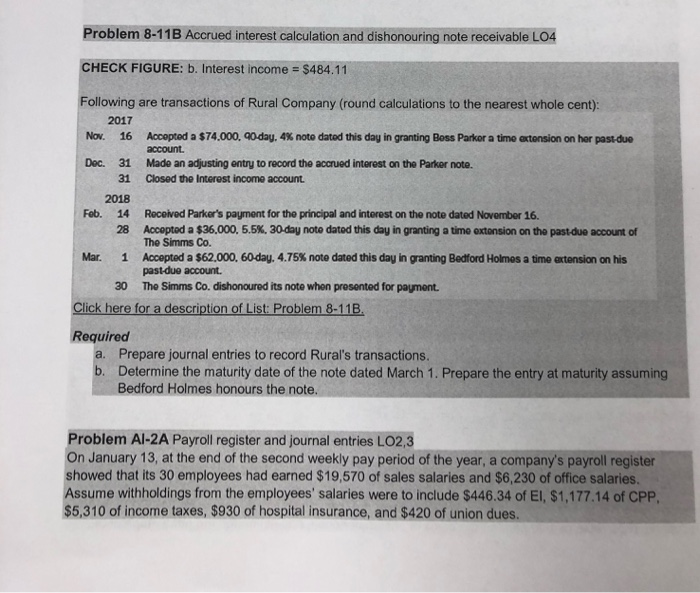

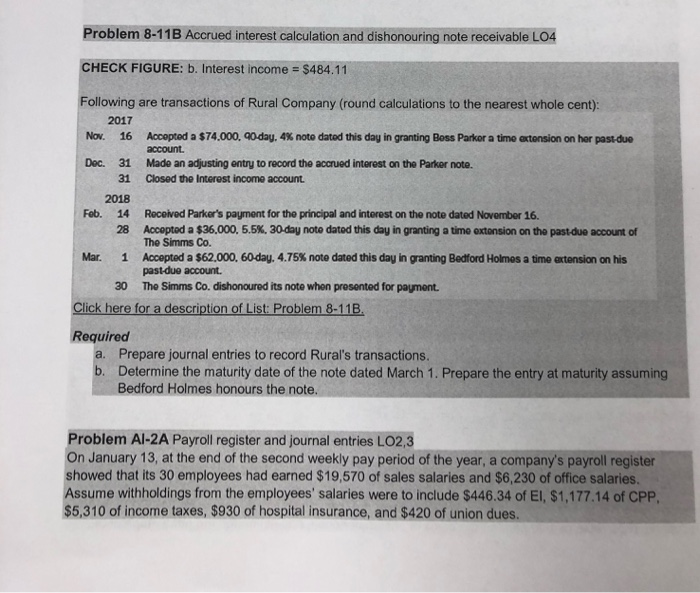

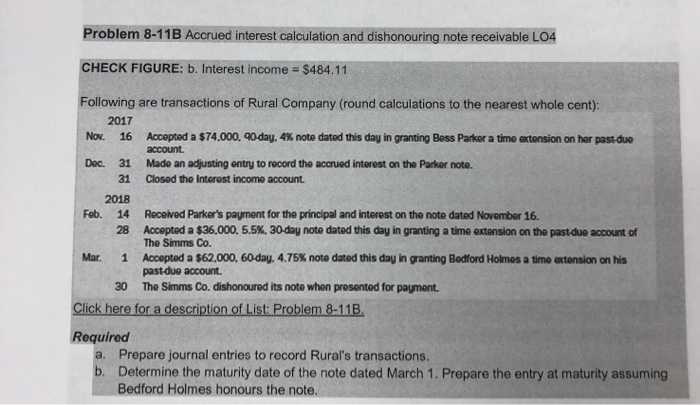

Problem 8-11B Accrued interest calculation and dishonouring note receivable LO4 CHECK FIGURE: b. Interest income = $484.11 Following are transactions of Rural Company (round calculations to the nearest whole cent): 2017 Nov. 16 Accopted a $74.000, 90-day, 4% noto dated this day in granting Boss Parker a time extension on her past due account. Dec. 31 Made an adjusting entry to record the accrued interest on the Parker note. 31 Closed the Interest income account 2018 Feb. 14 Received Parker's payment for the principal and interest on the note dated November 16. 28 Acceptod a $36.000, 5.5%, 30-day note dated this day in granting a time extension on the past due account of The Simms Co. Mar. 1 Accepted a $62.000, 60 day. 4.75% note dated this day in granting Bedford Holmes a time extension on his past due account. 30 The Simms Co. dishonoured its note when presented for payment. Click here for a description of List: Problem 8-11B. Required a. Prepare journal entries to record Rural's transactions. b. Determine the maturity date of the note dated March 1. Prepare the entry at maturity assuming Bedford Holmes honours the note. Problem Al-2A Payroll register and journal entries LO2,3 On January 13, at the end of the second weekly pay period of the year, a company's payroll register showed that its 30 employees had earned $19,570 of sales salaries and $6,230 of office salaries Assume withholdings from the employees' salaries were to include $446.34 of EI, $1,177,14 of CPP $5,310 of income taxes, $930 of hospital insurance, and $420 of union dues Problem 8-11B Accrued interest calculation and dishonouring note receivable LO4 CHECK FIGURE: b. Interest income = $484.11 Following are transactions of Rural Company (round calculations to the nearest whole cent): 2017 Nov. 16 Accepted a $74.000. 90 day. 4% note dated this day in granting Boss Parker a time extension on her past due account. Dec. 31 Made an adjusting entry to record the accrued interest on the Parker note. 31 Closed the Interest income account. 2018 Fob. 14 Received Parker's payment for the principal and interest on the note dated November 16. 28 Accepted a $36,000, 5.5%. 30-day note dated this day in granting a time extension on the past due account of The Simms Co. Mar. 1 Accepted a $62.000, 60 day. 4.75% note dated this day in granting Bedford Holmes a time extension on his past due account. 30 The Simms Co. dishonoured its note when presented for payment. Click here for a description of List: Problem 8-11B. Required a. Prepare journal entries to record Rural's transactions. b. Determine the maturity date of the note dated March 1. Prepare the entry at maturity assuming Bedford Holmes honours the