Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello, im having a hard tome understanding these questions from the book Fundamental Accounting Principales. please i need help somving this thank you:) Problem 7-2B

hello, im having a hard tome understanding these questions from the book Fundamental Accounting Principales. please i need help somving this thank you:)

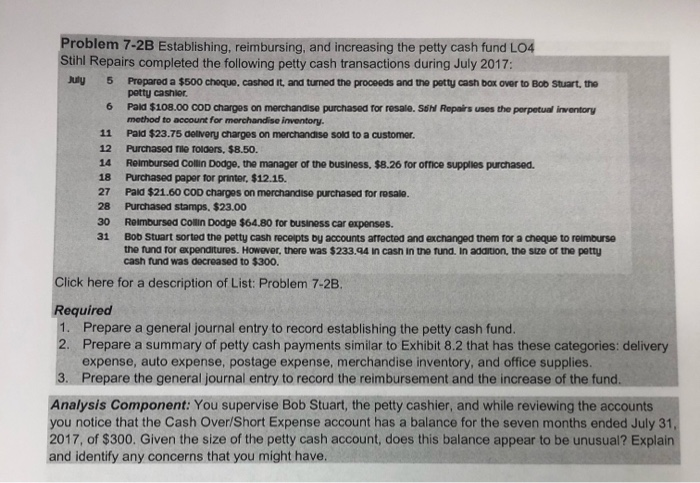

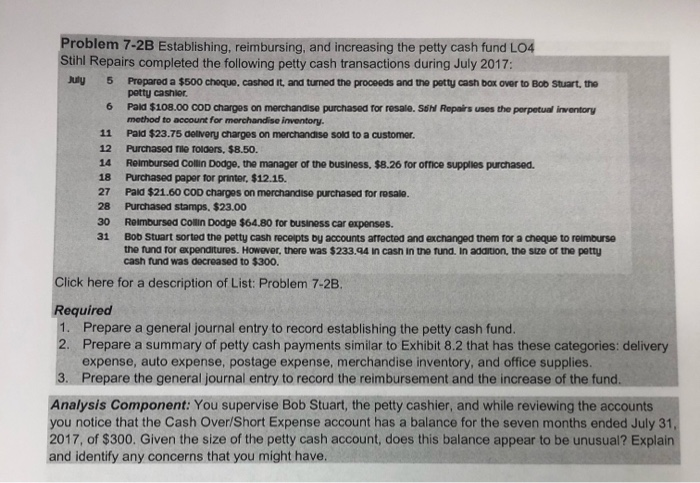

Problem 7-2B Establishing, reimbursing, and increasing the petty cash fund L04 Suhl Repairs completed the following petty cash transactions during July 2017: sy 5 Propared a $500 cheque, cashed it, and turned the proceeds and the potty cash box over to Bob Stuart, the potty cashier 6 Paid $108.00 COD charges on merchandise purchased for resale. S6 Repairs uses the perpetual inventory method to account for merchandise inventory. 11 Paid $23.75 delivery charges on merchandise sold to a customer. 12 Purchased file folders, $8.50. 14 Reimbursed Colin Dodgo, the manager of the business, $8.26 for office supplies purchased. 18 Purchased paper for printer, $12.15. 27 Paid $21.60 COD charges on merchandise purchased for rosale. 28 Purchased stamps. $23.00 30 Reimbursed Collin Dodge $64.80 for business car expenses. 31 Bob Stuart sorted the petty cash receipts by accounts affected and exchanged them for a choque to reimburse the fund for expenditures. However, there was $233.94 in cash in the fund. In addition, the size of the potty cash fund was decreased to $300. Click here for a description of List: Problem 7-2B. Required 1. Prepare a general journal entry to record establishing the petty cash fund. 2. Prepare a summary of petty cash payments similar to Exhibit 8.2 that has these categories: delivery expense, auto expense, postage expense, merchandise inventory, and office supplies. 3. Prepare the general journal entry to record the reimbursement and the increase of the fund. Analysis Component: You supervise Bob Stuart, the petty cashier, and while reviewing the accounts you notice that the Cash Over/Short Expense account has a balance for the seven months ended July 31. 2017, of $300. Given the size of the petty cash account, does this balance appear to be unusual? Explain and identify any concerns that you might have

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started