Based on the book income to taxable income reconciliation you completed in week 2 (image below), use the attached spreadsheet to complete Palo Alto's Schedule

Based on the book income to taxable income reconciliation you completed in week 2 (image below), use the attached spreadsheet to complete Palo Alto's Schedule M-1.

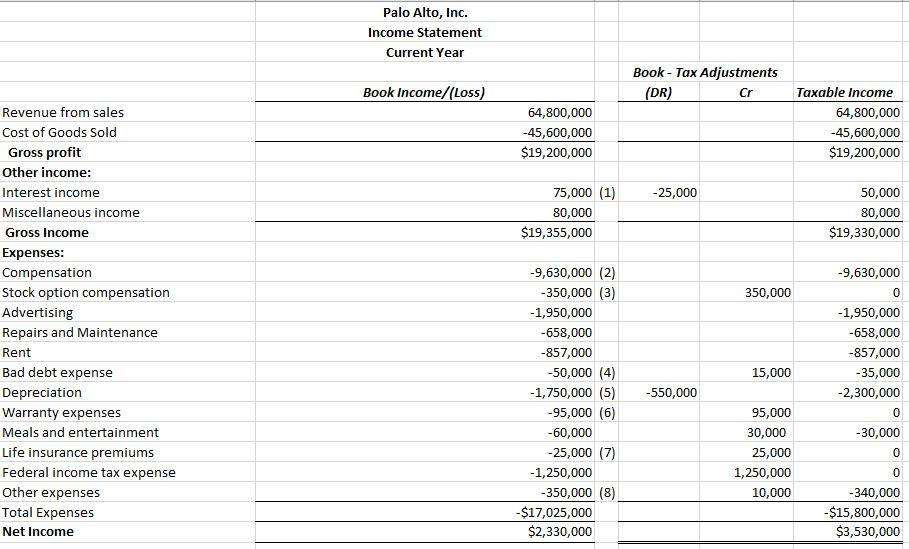

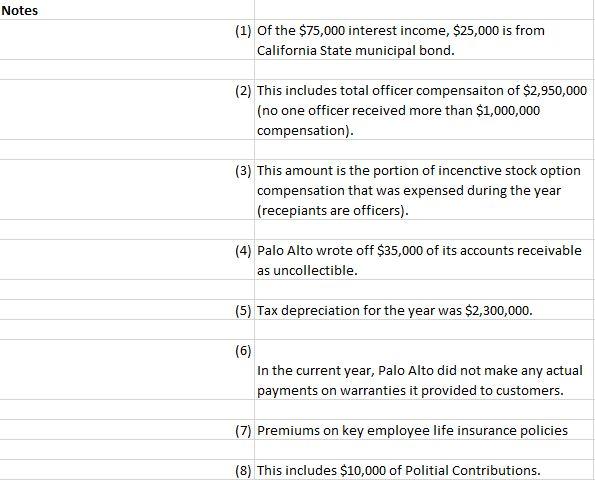

Completed week 2 assignment:

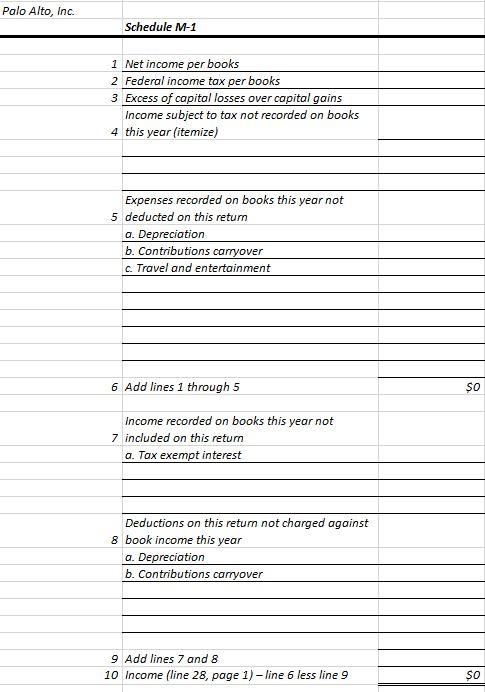

Blank Schedule M-1 that I need help filling out:

Palo Alto, Inc. Income Statement Current Year Book - Tax Adjustments Book Income/(Loss) (DR) Cr Taxable Income Revenue from sales 64,800,000 64,800,000 Cost of Goods Sold -45,600,000 -45,600,000 Gross profit $19,200,000 $19,200,000 Other income: Interest income 75,000 (1) -25,000 50,000 Miscellaneous income 80,000 $19,355,000 80,000 $19,330,000 Gross Income Expenses: Compensation -9,630,000 (2) -9,630,000 Stock option compensation -350,000 (3) 350,000 Advertising -1,950,000 -1,950,000 Repairs and Maintenance -658,000 -658,000 Rent -857,000 -857,000 Bad debt expense -50,000 (4) 15,000 -35,000 Depreciation -1,750,000 (5) -550,000 -2,300,000 Warranty expenses -95,000 (6) 95,000 Meals and entertainment -60,000 30,000 -30,000 Life insurance premiums -25,000 (7) 25,000 Federal income tax expense -1,250,000 1,250,000 -350,000 (8) -$17,025,000 $2,330,000 Other expenses 10,000 -340,000 Total Expenses -$15,800,000 $3,530,000 Net Income

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Palo Alto Inc Schedule M1 1 Net income per books 2330000 2 Federal income tax per bo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started