Answered step by step

Verified Expert Solution

Question

1 Approved Answer

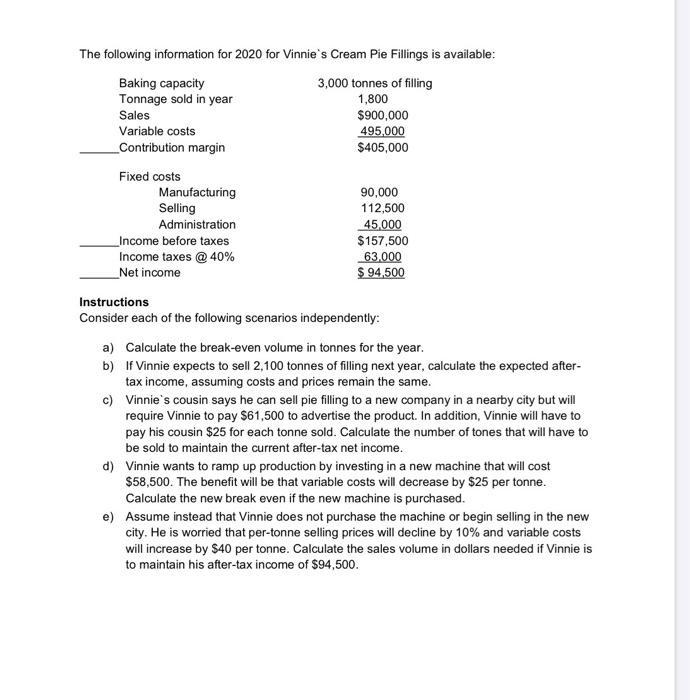

The following information for 2020 for Vinnie's Cream Pie Fillings is available: Baking capacity 3,000 tonnes of filling Tonnage sold in year 1,800 Sales

The following information for 2020 for Vinnie's Cream Pie Fillings is available: Baking capacity 3,000 tonnes of filling Tonnage sold in year 1,800 Sales Variable costs Contribution margin Fixed costs Manufacturing Selling Administration Income before taxes Income taxes @ 40% Net income $900,000 495,000 $405,000 90,000 112,500 45,000 $157,500 63,000 $ 94,500 Instructions Consider each of the following scenarios independently: a) Calculate the break-even volume in tonnes for the year. b) If Vinnie expects to sell 2,100 tonnes of filling next year, calculate the expected after- tax income, assuming costs and prices remain the same. c) Vinnie's cousin says he can sell pie filling to a new company in a nearby city but will require Vinnie to pay $61,500 to advertise the product. In addition, Vinnie will have to pay his cousin $25 for each tonne sold. Calculate the number of tones that will have to be sold to maintain the current after-tax net income. d) Vinnie wants to ramp up production by investing in a new machine that will cost $58,500. The benefit will be that variable costs will decrease by $25 per tonne. Calculate the new break even if the new machine is purchased. e) Assume instead that Vinnie does not purchase the machine or begin selling in the new city. He is worried that per-tonne selling prices will decline by 10% and variable costs will increase by $40 per tonne. Calculate the sales volume in dollars needed if Vinnie is to maintain his after-tax income of $94,500.

Step by Step Solution

★★★★★

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution A B CALCULATION OF BREAK EVEN SALES TONNES SOLD SELLING PRICE PER TONNE SE...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started