Question

Hello! I've been working on the problem below as shown on the image pasted. I feel okay with my calculations for part a & b

Hello!

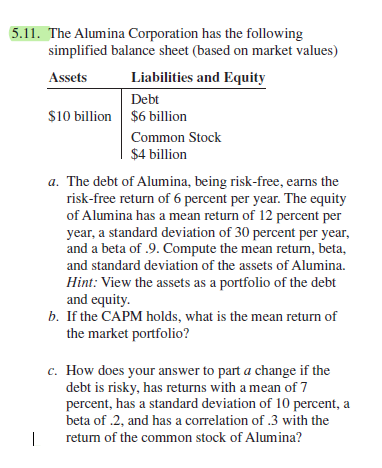

I've been working on the problem below as shown on the image pasted. I feel okay with my calculations for part a & b of the question. However, I'm struggling with part c. I'm not sure if I understand the question and how to use the inputs provided in the question for part c. I also don't really know what to do with the correlation of .3, can you help me and show me the steps I need to take to calculate it? Here's how I've calculated what I have so far for part c:

Part C asks how does your answer to part a change if the debt is risky, has returns with a mean of 7%, has a standard deviation of 10%, and beta of .2, and has correlation of .3. I really wasn't sure how to approach this question. What I did was take 6/(6=4)*7%+4/(6+4)*12% which gave me 9%. I then calculated Beta as 6/(6+4)*.2+4/(6+4)*.9 to get 0.48. However, I don't know what else I'm supposed to do.

My answers for a:

Mean Return = 8.4%

Beta = 0.36

Stdv = 0.12

My answer for b:

Mean Return Portfolio = 12.67%

My answer for c:

Mean Return of 7% increases to = 9% return

New Beta = 0.48

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started