Hello, just looking for a little help on tjis question(s)!

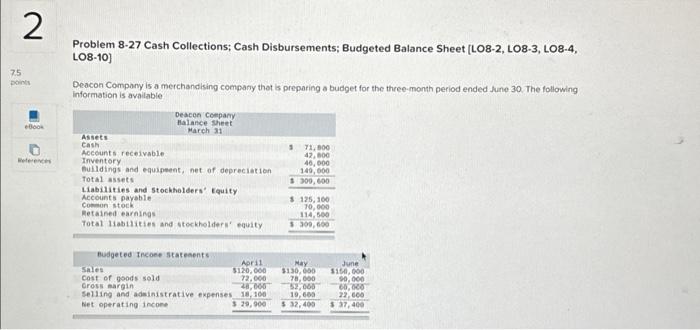

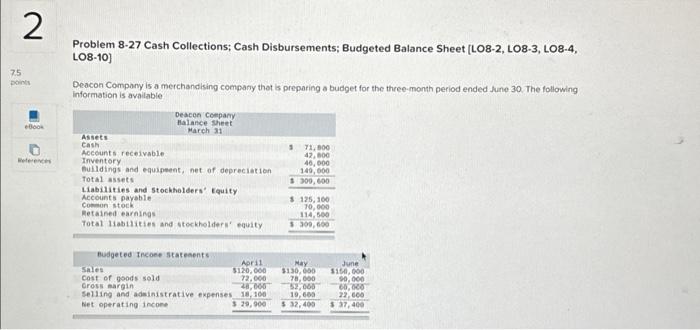

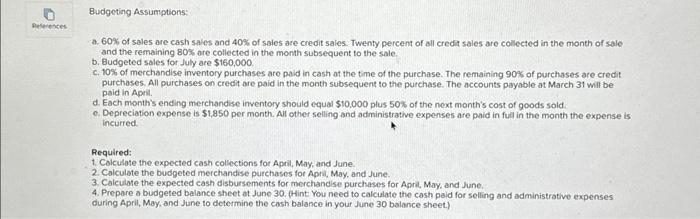

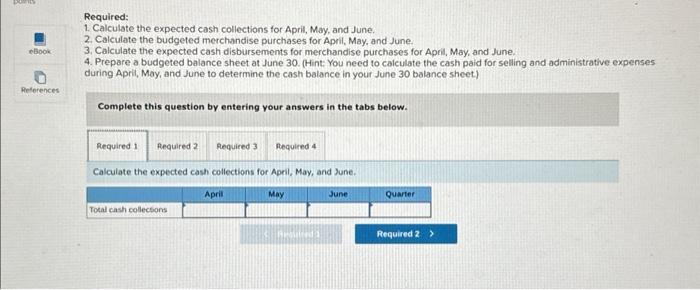

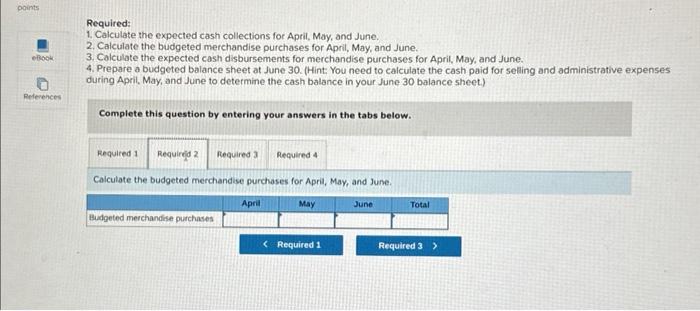

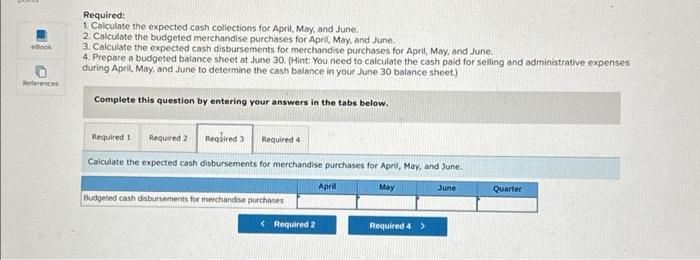

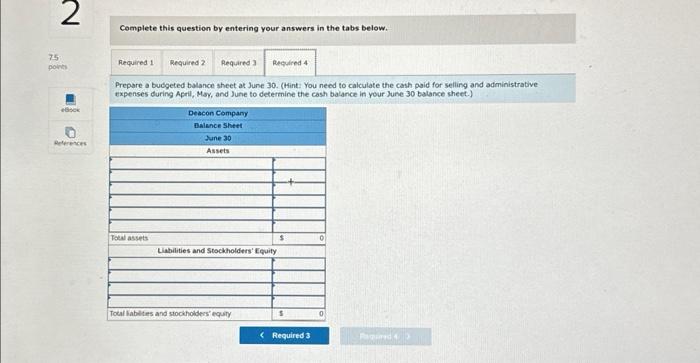

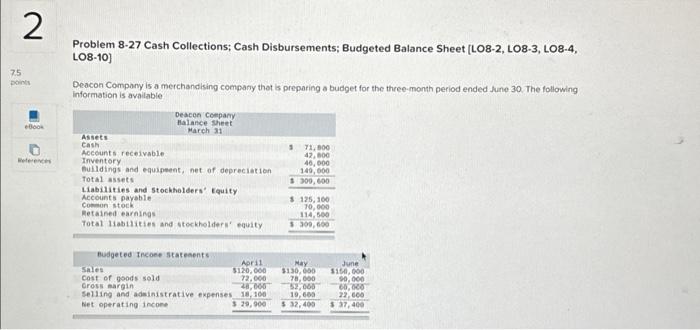

a. 60% of sales are cosh sales and 40% of sales are credit sales. Twenty percent of all credit sales are collected in the month of sale and the remaining 80% are collected in the month subsequent to the sale. b. Budgeted sales for July are $160,000 c. 10% of merchandise inventory purchases are paid in cash at the time of the purchase. The remaining 90% of purchases are credit purchases. All purchases on credit are paid in the month subsequent to the purchase. The accounts payable at March 31 will be paid in Aperi. d. Each month's ending merchandise inventory should equal $10,000 plus 50% of the next month's cost of goods sold. c. Depreciation expense is $1,850 per month. All other selling and administrative expenses are paid in full in the month the expense is incurred. Required: 1. Colculate the expected cash collections for April, May, and June. 2. Calculote the budgeted merchandise purchases for April, May, and June- 3. Calculate the expected cash disbursements for merchandise purchases for April, May, and June. 4. Prepare a budgeted balance sheet at June 30. (Hint You need to calculate the cash paid for selling and administrotive expenses during April, May, and June to determine the cash balance in your June 30 bslance sheet) Problem 8-27 Cash Collections; Cash Disbursements; Budgeted Balance Sheet [LO8-2, LO8-3, LO8-4, LO8-10] Deacon Company is a merchandising company thet is preparing a budget for the three-month period ended June 30 . The following information is available Required: 1. Calculate the expected cash collections for April, May, and June. 2. Calculate the budgeted merchandise purchases for Aprit, May, and June. 3. Calculate the expected cash disbursements for merchandise purchases for April, May, and June. 4. Prepare a budgeted balance sheet at June 30. (Hint: You need to calculate the cash paid for selling and administrative expenses during Aprit. May, and June to determine the cash balance in your June 30 balance sheet.) Complete this question by entering your answers in the tabs below. Calculate the budgetnd merchandise purchases for April, May, and June. Complete this question by entering your answers in the tabs below. Prepare a budgeted balance sheet at June 30. (Hint: You need to calculate the cash paid for selling and administrative expenses during April, Msy, and lune to determine the cash balance in your rune 30 balance sheet.) Required: 1. Calculate the expected cash collections for April, May, and June. 2. Calculate the budgeted merchandise purchases for April, May, and June. 3. Calculate the expected cash disbursements for merchandise purchases for April, May, and June, 4. Prepare a budgeted balance sheet at June 30 . (Hint: You need to calculate the cash paid for selling and administrative expenses during April. May, and June to determine the cash balance in your June 30 balance sheet) Complete this question by entering your answers in the tabs below. Required: 1. Calculate the expected cash collections for April, May, and June. 2. Calculate the budgeted merchandise purchases for April, May, and June. 3. Calculate the expected cash disbursements for merchandise purchases for April, May, and June. 4. Prepare a budgeted balance sheet at June 30. (Hint: You need to calculate the cash paid for selling and administrative expenses during Aprit, May, and June to determine the cash batance in your June 30 batance sheet) Complete this question by entering your answers in the tabs below. Calculate the expected cash collections for April, May, and June