Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, please advise, thanks I think this is the formula: Net operating working capital = (cash + inventories + account receivable) - (Account payable +

Hello, please advise, thanks

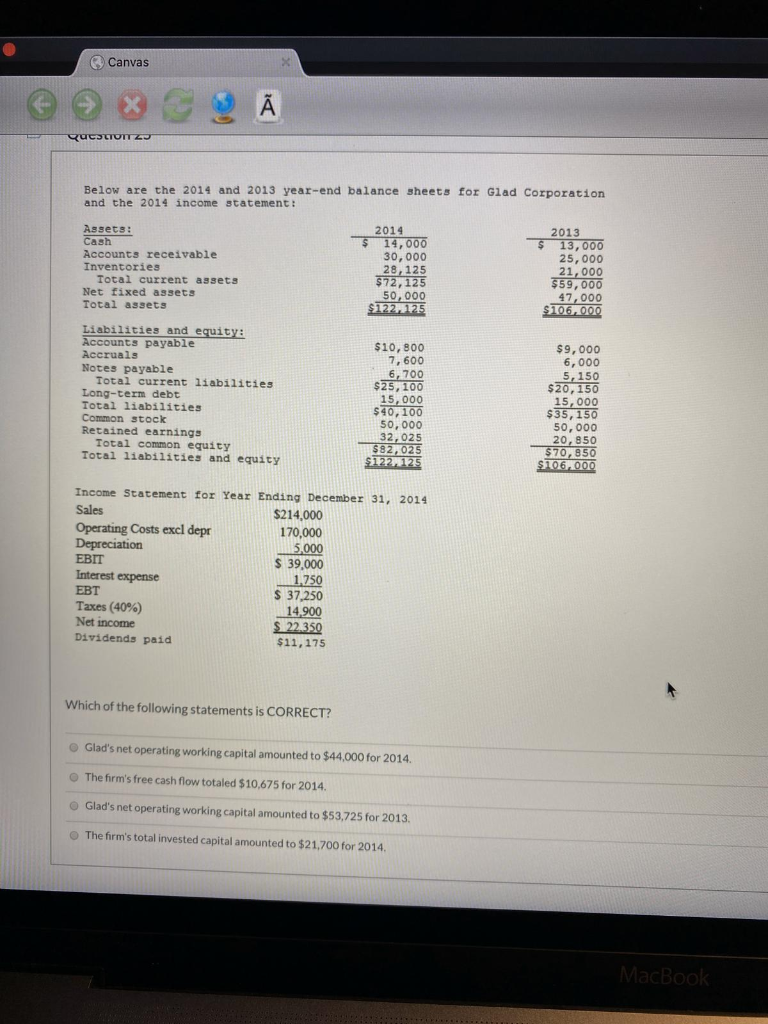

I think this is the formula: Net operating working capital = (cash + inventories + account receivable) - (Account payable + Accrued expense)

So, (13,000 +25,000+21,000) - (9,000 & 6,000) = 59,000 - 15,000= 44,000

Canvas X S9 Quc UITZO Below are the 2014 and 2013 year-end balance sheets for Glad Corporation and the 2014 income statement : Assets: Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets 2014 $ 14,000 30,000 28,125 $72, 125 50,000 $122, 125 2013 $ 13,000 25,000 21,000 $59,000 47,000 $106.000 Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $10,800 7,600 6,700 $25,100 15,000 $40,100 50,000 32,025 $82,025 $122, 125 $9,000 6,000 5,150 $20,150 15,000 $35, 150 50,000 20,850 $70,850 $106.000 Income Statement for Year Ending December 31, 2014 Sales $214,000 Operating Costs excl depr 170,000 Depreciation 5,000 EBIT $ 39,000 Interest expense 1.750 EBT $ 37,250 Taxes (40%) 14,900 Net income $ 22.350 Dividends paid $11,175 Which of the following statements is CORRECT? Glad's net operating working capital amounted to $44,000 for 2014. The firm's free cash flow totaled $10,675 for 2014 Glad's net operating working capital amounted to $53.725 for 2013. The firm's total invested capital amounted to $21,700 for 2014. MacBook

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started