Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, please help me to solve part f Assume the following information for Shamrock Corp. Accounts receivable (beginning balance Allowance for doubtful accounts (beginning balance

Hello, please help me to solve part f

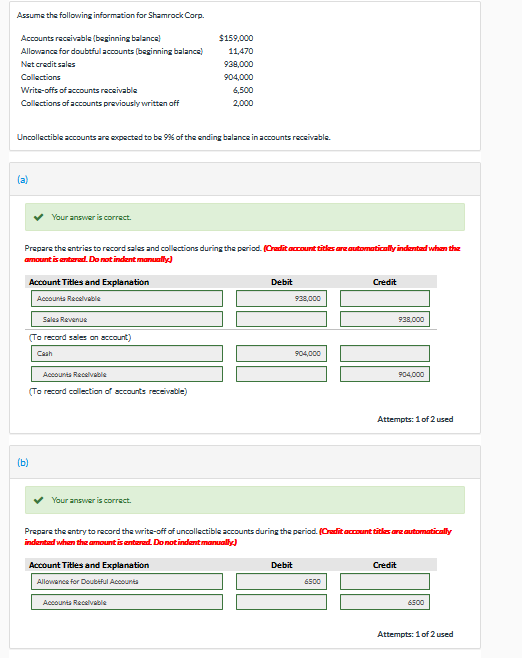

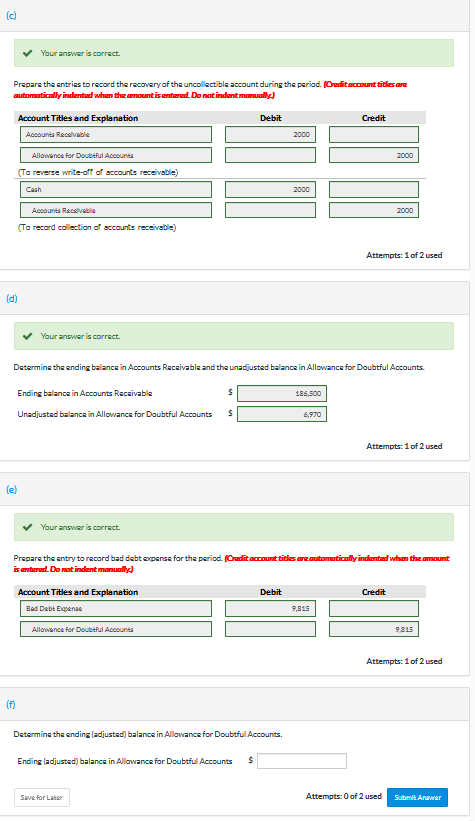

Assume the following information for Shamrock Corp. Accounts receivable (beginning balance Allowance for doubtful accounts (beginning balance Net credit sales Collections Write-offs of accounts receivable Collections of accounts previously written off $159,000 11,470 939,000 904,000 6,500 2,000 Uncollectible accounts are expected to be 9% of the ending balance in accounts receivable. (a) Your answer is correct. Prepare the entries to record sales and collections during the period. (Credit account titles are automatically indented when the amount is contrad. Do not indent manually Debit Credit Account Titles and Explanation Accounts Receivable 938,000 Sales Revenue 938.000 (To record sales on account) Cash 904,000 904,000 Accounts Receivable (To record collection of accounts receivable) Attempts: 1 of 2 used (b) Your answer is correct. Prepare the entry to record the write-off of uncollectible accounts during the period. (Credit account tits are automatically indented when the amount is entered. Do not indent manually) Debit Credit Account Titles and Explanation Allowance for Doubtful Accounts 6500 Accounts Receivable 6500 Attempts: 1 of 2 used (c) Your answer is correct. Prepare the entries to record the recovery of the uncollectible account during the period. (Credit account titkosare automatically indented when the amount is entered. Do not indent manually) Debit Credit Account Titles and Explanation Accounts Receivable 2000 Allowance for Doubtful Account 2000 (Torrese write-off of accounts receivable) 2000 2000 Accounts Receivable (To record collection of accounts receivable) Attempts: 1 of 2 used (d) Your answer is correct. Determine the ending balance in Accounts Receivable and the unadjusted balance in Allowance for Doubtful Accounts. Ending balance in Accounts Receivable $ 186,500 Unadjusted balance in Allowance for Doubtful Accounts $ 6,970 Attempts: 1 of 2 used Your answer is correct. Prepare the entry to record bad debt expense for the period. (Credit account titles are automatically indented when the amount contrad. Do not indent manually Debit Credit Account Titles and Explanation Bed Debt Expense 9,815 Allowance for Doubtful Accounts 9.815 Attempts: 1 of 2 used (f) Determine the ending ladjusted) balance in Allowance for Doubtful Accounts. Ending ladjusted) balance in Allowance for Doubtful Accounts $ Save for LAR Attempts: 0 of 2 used Submit AntwerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started