Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello. please provide all workings and in proper format using UK nation system. thank you QUESTION 2: (35 MARKS) Topwood Ltd is a 40-year-old company

hello. please provide all workings and in proper format using UK nation system. thank you

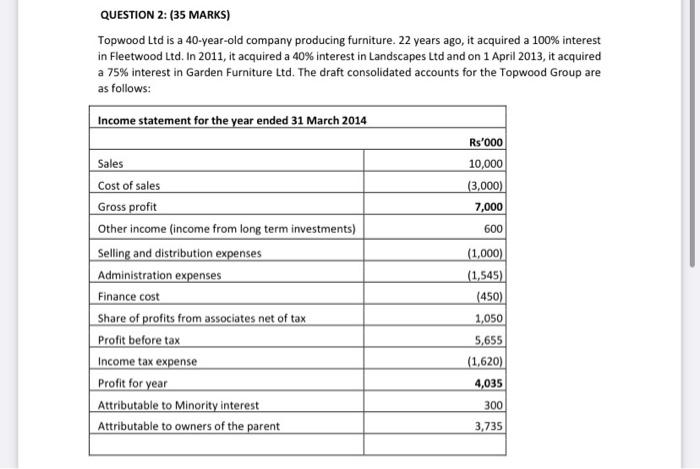

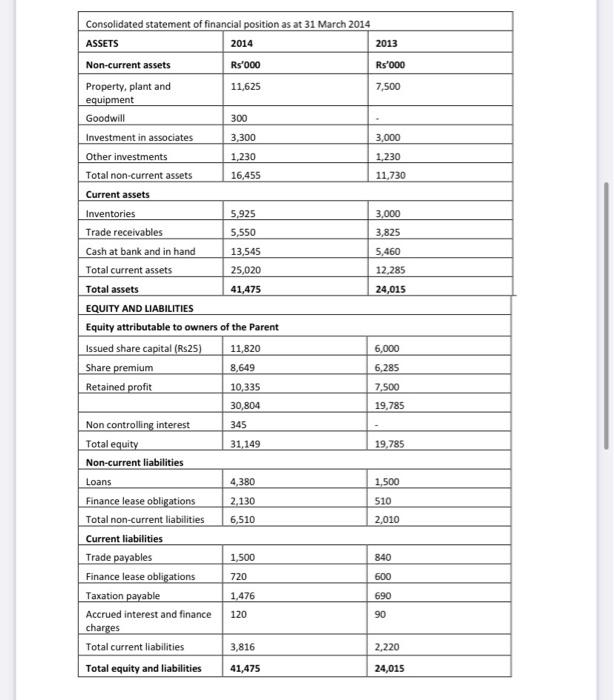

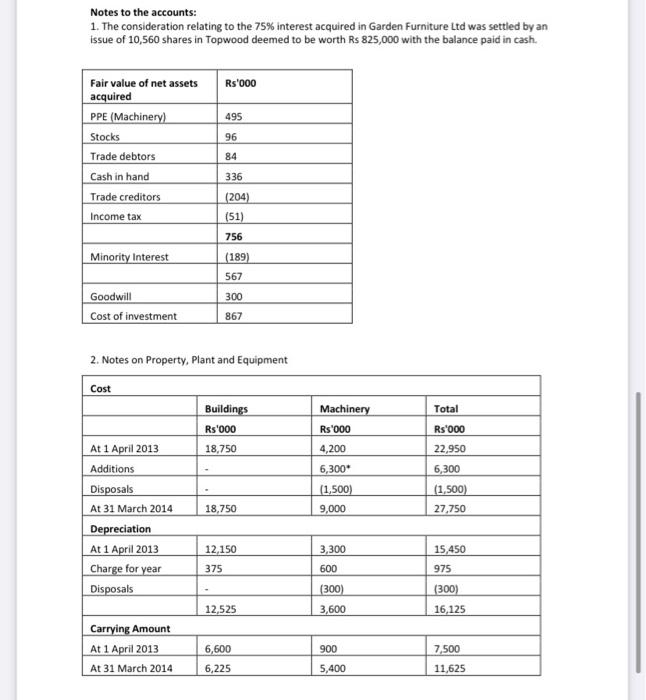

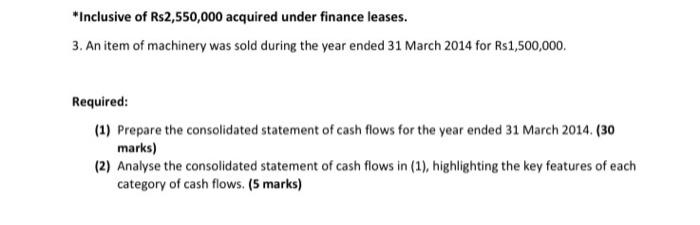

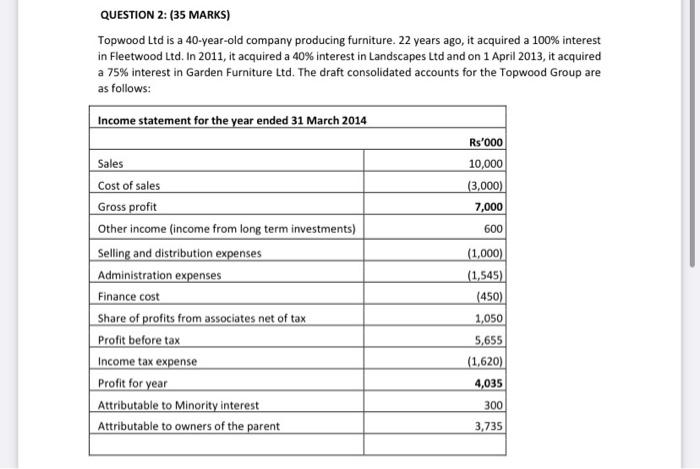

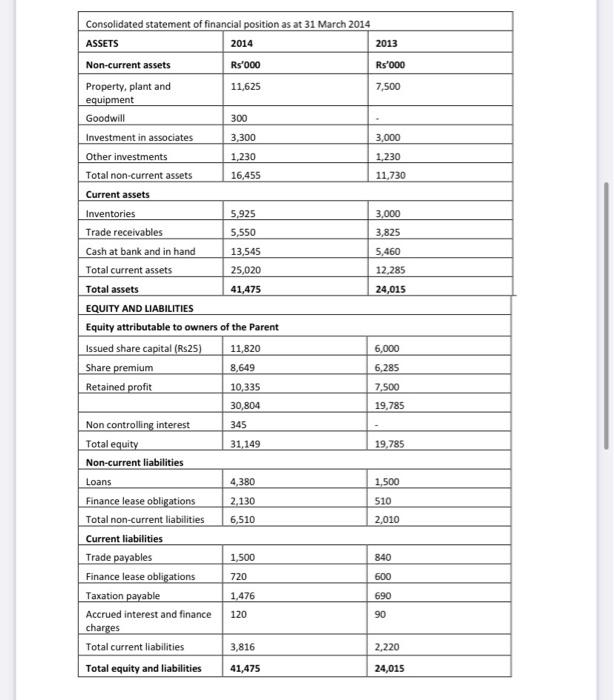

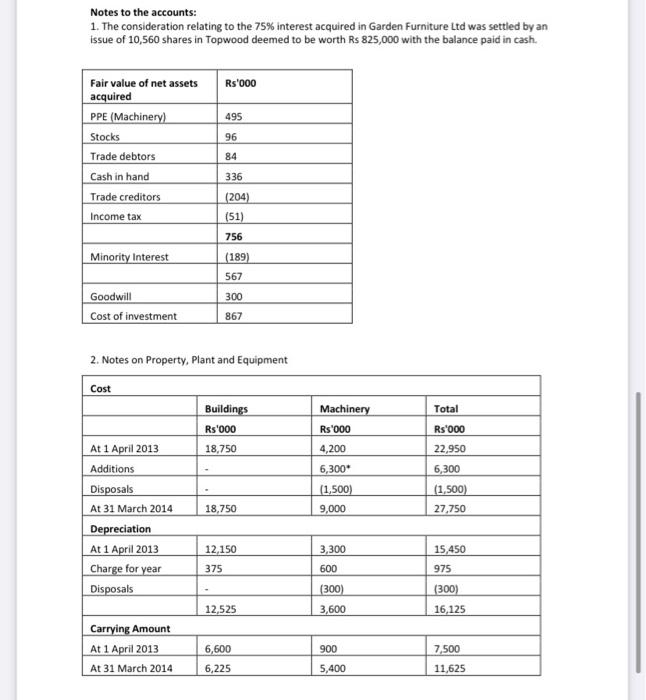

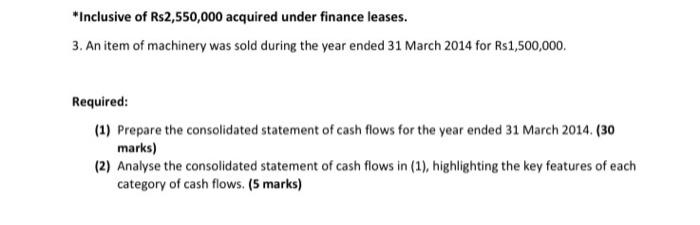

QUESTION 2: (35 MARKS) Topwood Ltd is a 40-year-old company producing furniture. 22 years ago, it acquired a 100% interest in Fleetwood Ltd. In 2011, it acquired a 40% interest in Landscapes Ltd and on 1 April 2013, it acquired a 75% interest in Garden Furniture Ltd. The draft consolidated accounts for the Topwood Group are as follows: Income statement for the year ended 31 March 2014 Rs'000 10,000 (3,000) 7,000 600 Sales Cost of sales Gross profit Other income income from long term investments) Selling and distribution expenses Administration expenses Finance cost Share of profits from associates net of tax Profit before tax Income tax expense Profit for year Attributable to Minority interest Attributable to owners of the parent (1,000) (1,545) (450) 1,050 5,655 (1,620) 4,035 300 3,735 Consolidated statement of financial position as at 31 March 2014 ASSETS 2014 2013 Non-current assets Rs'000 Rs'000 Property, plant and 11,625 7,500 equipment Goodwill 300 Investment in associates 3,300 3,000 Other investments 1,230 1,230 Total non-current assets 16,455 11,730 Current assets Inventories 5,925 3,000 Trade receivables 5,550 3,825 Cash at bank and in hand 13,545 5,460 Total current assets 25,020 12,285 Total assets 41,475 24,015 EQUITY AND LIABILITIES Equity attributable to owners of the Parent Issued share capital (R$25) 11,820 6,000 Share premium 8,649 6,285 Retained profit 10,335 7.500 30,804 19,785 Non controlling interest Total equity 31,149 19.785 Non-current liabilities Loans 4,380 1,500 Finance lease obligations 2,130 Total non-current liabilities 6,510 2,010 Current liabilities Trade payables 1,500 840 Finance lease obligations 720 Taxation payable 1,476 690 Accrued interest and finance 120 90 345 510 600 charges Total current liabilities 3,816 2,220 Total equity and liabilities 41,475 24,015 Notes to the accounts: 1. The consideration relating to the 75% interest acquired in Garden Furniture Ltd was settled by an issue of 10,560 shares in Topwood deemed to be worth Rs 825,000 with the balance paid in cash. Rs'000 495 96 Fair value of net assets acquired PPE (Machinery) Stocks Trade debtors Cash in hand Trade creditors Income tax 84 336 (204) (51) 756 Minority Interest (189) 567 300 Goodwill Cost of investment 867 Total Machinery Rs'000 Rs'000 4,200 22,950 6,300 2. Notes on Property, Plant and Equipment Cost Buildings Rs'000 At 1 April 2013 18,750 Additions Disposals At 31 March 2014 18,750 Depreciation At 1 April 2013 12.150 Charge for year 375 Disposals 12,525 Carrying Amount At 1 April 2013 6,600 At 31 March 2014 6,225 6,300 (1,500) 9,000 (1,500) 27,750 3,300 15,450 975 600 (300) 3,600 (300) 16,125 900 7,500 11,625 5,400 *Inclusive of Rs2,550,000 acquired under finance leases. 3. An item of machinery was sold during the year ended 31 March 2014 for Rs1,500,000 Required: (1) Prepare the consolidated statement of cash flows for the year ended 31 March 2014 (30 marks) (2) Analyse the consolidated statement of cash flows in (1), highlighting the key features of each category of cash flows. (5 marks) QUESTION 2: (35 MARKS) Topwood Ltd is a 40-year-old company producing furniture. 22 years ago, it acquired a 100% interest in Fleetwood Ltd. In 2011, it acquired a 40% interest in Landscapes Ltd and on 1 April 2013, it acquired a 75% interest in Garden Furniture Ltd. The draft consolidated accounts for the Topwood Group are as follows: Income statement for the year ended 31 March 2014 Rs'000 10,000 (3,000) 7,000 600 Sales Cost of sales Gross profit Other income income from long term investments) Selling and distribution expenses Administration expenses Finance cost Share of profits from associates net of tax Profit before tax Income tax expense Profit for year Attributable to Minority interest Attributable to owners of the parent (1,000) (1,545) (450) 1,050 5,655 (1,620) 4,035 300 3,735 Consolidated statement of financial position as at 31 March 2014 ASSETS 2014 2013 Non-current assets Rs'000 Rs'000 Property, plant and 11,625 7,500 equipment Goodwill 300 Investment in associates 3,300 3,000 Other investments 1,230 1,230 Total non-current assets 16,455 11,730 Current assets Inventories 5,925 3,000 Trade receivables 5,550 3,825 Cash at bank and in hand 13,545 5,460 Total current assets 25,020 12,285 Total assets 41,475 24,015 EQUITY AND LIABILITIES Equity attributable to owners of the Parent Issued share capital (R$25) 11,820 6,000 Share premium 8,649 6,285 Retained profit 10,335 7.500 30,804 19,785 Non controlling interest Total equity 31,149 19.785 Non-current liabilities Loans 4,380 1,500 Finance lease obligations 2,130 Total non-current liabilities 6,510 2,010 Current liabilities Trade payables 1,500 840 Finance lease obligations 720 Taxation payable 1,476 690 Accrued interest and finance 120 90 345 510 600 charges Total current liabilities 3,816 2,220 Total equity and liabilities 41,475 24,015 Notes to the accounts: 1. The consideration relating to the 75% interest acquired in Garden Furniture Ltd was settled by an issue of 10,560 shares in Topwood deemed to be worth Rs 825,000 with the balance paid in cash. Rs'000 495 96 Fair value of net assets acquired PPE (Machinery) Stocks Trade debtors Cash in hand Trade creditors Income tax 84 336 (204) (51) 756 Minority Interest (189) 567 300 Goodwill Cost of investment 867 Total Machinery Rs'000 Rs'000 4,200 22,950 6,300 2. Notes on Property, Plant and Equipment Cost Buildings Rs'000 At 1 April 2013 18,750 Additions Disposals At 31 March 2014 18,750 Depreciation At 1 April 2013 12.150 Charge for year 375 Disposals 12,525 Carrying Amount At 1 April 2013 6,600 At 31 March 2014 6,225 6,300 (1,500) 9,000 (1,500) 27,750 3,300 15,450 975 600 (300) 3,600 (300) 16,125 900 7,500 11,625 5,400 *Inclusive of Rs2,550,000 acquired under finance leases. 3. An item of machinery was sold during the year ended 31 March 2014 for Rs1,500,000 Required: (1) Prepare the consolidated statement of cash flows for the year ended 31 March 2014 (30 marks) (2) Analyse the consolidated statement of cash flows in (1), highlighting the key features of each category of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the consolidated statement of cash flows for the year ended 31 March 2014 well use the indirect method Well calculate cash flows from opera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started