Question

Hello. Please refer to the attachment for details. Question: How would we prepare the journal entries according to IAS 36? According to the scenario, land

Hello.

Please refer to the attachment for details.

Question: How would we prepare the journal entries according to IAS 36? According to the scenario, land was revalued, I am not sure whether inventory is subject to IAS 36 in this scenario, and do not know how to do the accounting treatment of the cash-generating unit of R 4500 000. Please assist me with regards to the journal entries - include the journal narrations, calculations (with a table - carrying amount, recoverable amount, impairment amount) and more importantly explanations (to understand the process of accounting treatment/journal entries for learning purposes).

NOTE: For purposes of this revision, ignore any depreciation and tax implications. Use the given information available from the scenario/attachment provided.

Thank you.

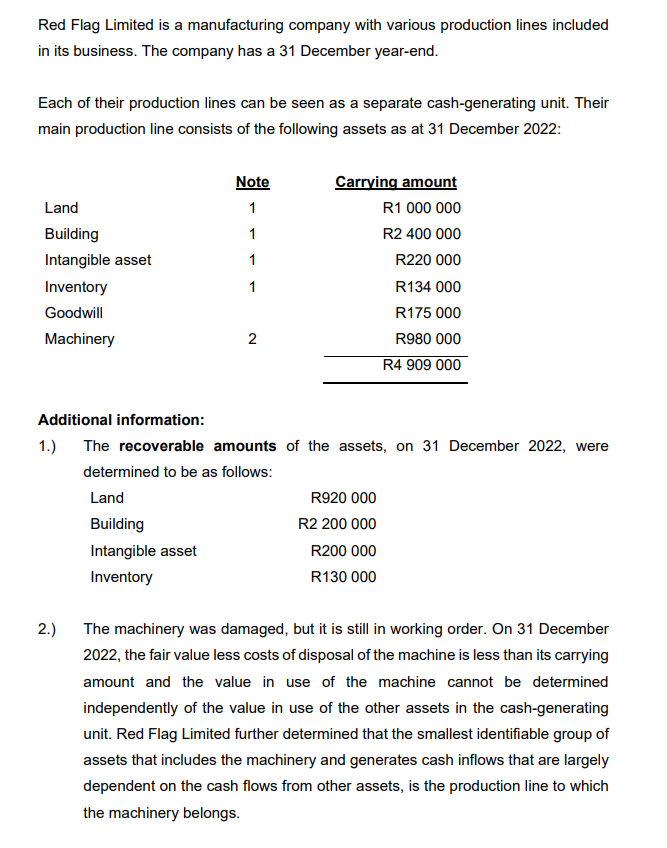

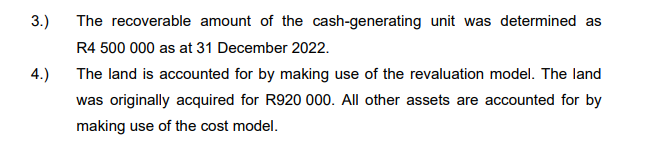

Red Flag Limited is a manufacturing company with various production lines included in its business. The company has a 31 December year-end. Each of their production lines can be seen as a separate cash-generating unit. Their main production line consists of the following assets as at 31 December 2022 : Additional information: 1.) The recoverable amounts of the assets, on 31 December 2022, were determined to be as follows: 2.) The machinery was damaged, but it is still in working order. On 31 December 2022, the fair value less costs of disposal of the machine is less than its carrying amount and the value in use of the machine cannot be determined independently of the value in use of the other assets in the cash-generating unit. Red Flag Limited further determined that the smallest identifiable group of assets that includes the machinery and generates cash inflows that are largely dependent on the cash flows from other assets, is the production line to which the machinery belongs. 3.) The recoverable amount of the cash-generating unit was determined as R4 500000 as at 31 December 2022. 4.) The land is accounted for by making use of the revaluation model. The land was originally acquired for R920 000. All other assets are accounted for by making use of the cost model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started