Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, please show work for B step by step with calculations. Who is the investor? Why does it matter? Assume that we have an acquisition.

Hello, please show work for B step by step with calculations.

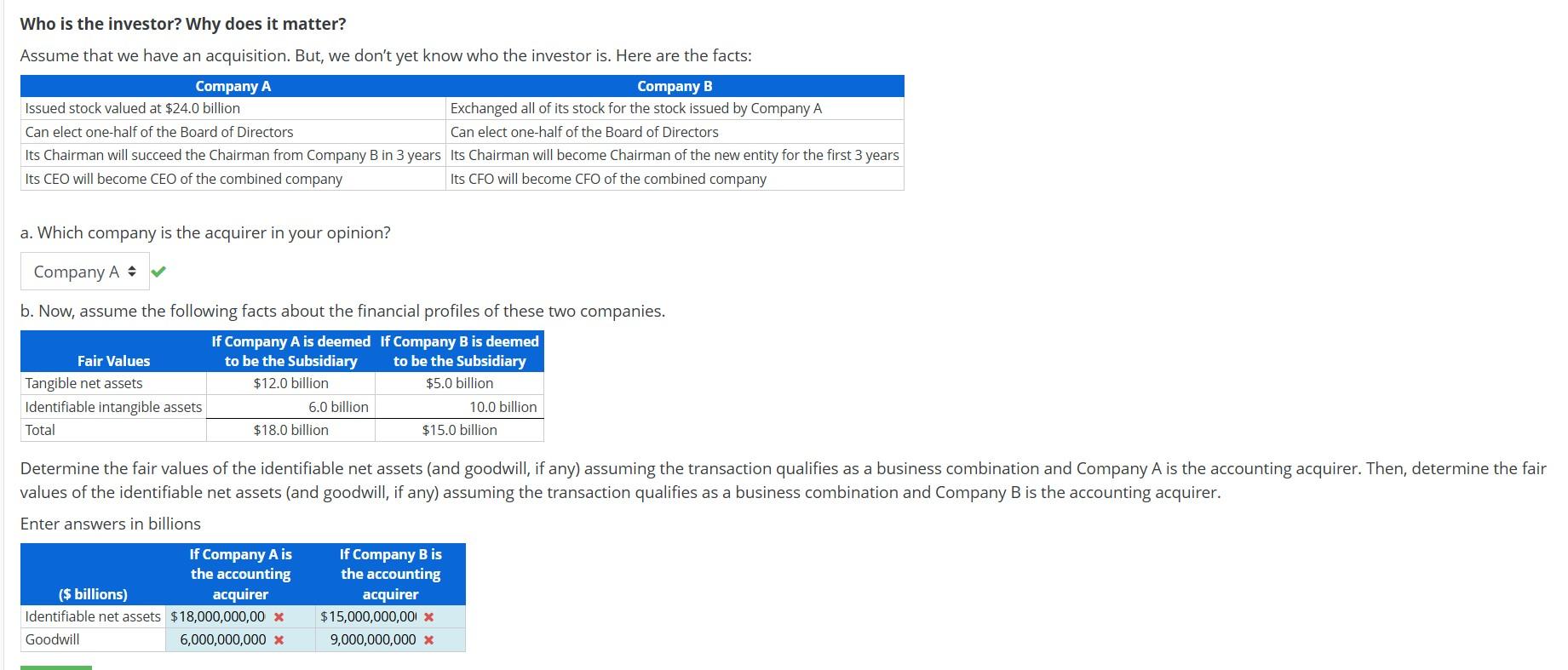

Who is the investor? Why does it matter? Assume that we have an acquisition. But, we don't yet know who the investor is. Here are the facts: \begin{tabular}{|l|l|} \hline \multicolumn{1}{c|}{ Company A } & \multicolumn{1}{c|}{ Company B } \\ \hline Issued stock valued at $24.0 billion & Exchanged all of its stock for the stock issued by Company A \\ \hline Can elect one-half of the Board of Directors & Can elect one-half of the Board of Directors \\ \hline Its Chairman will succeed the Chairman from Company B in 3 years & Its Chairman will become Chairman of the new entity for the first 3 years \\ \hline Its CEO will become CEO of the combined company & Its CFO will become CFO of the combined company \\ \hline \end{tabular} a. Which company is the acquirer in your opinion? b. Now, assume the following facts about the financial profiles of these two companies. values of the identifiable net assets (and goodwill, if any) assuming the transaction qualifies as a business combination and Company B is the accounting acquirer. Enter answers in billions \begin{tabular}{|l|c|c|} \hline If Company A is \\ the accounting \\ ( $ billions) & If Company B is the accounting acquirer \\ \hline Identifiable net assets & $18,000,000,00 & $15,000,000,001 \\ \hline Goodwill & 6,000,000,000 & 9,000,000,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started