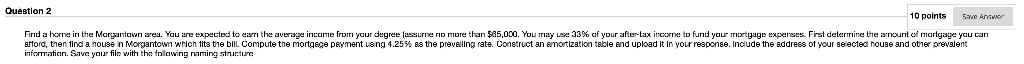

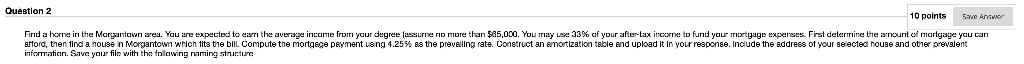

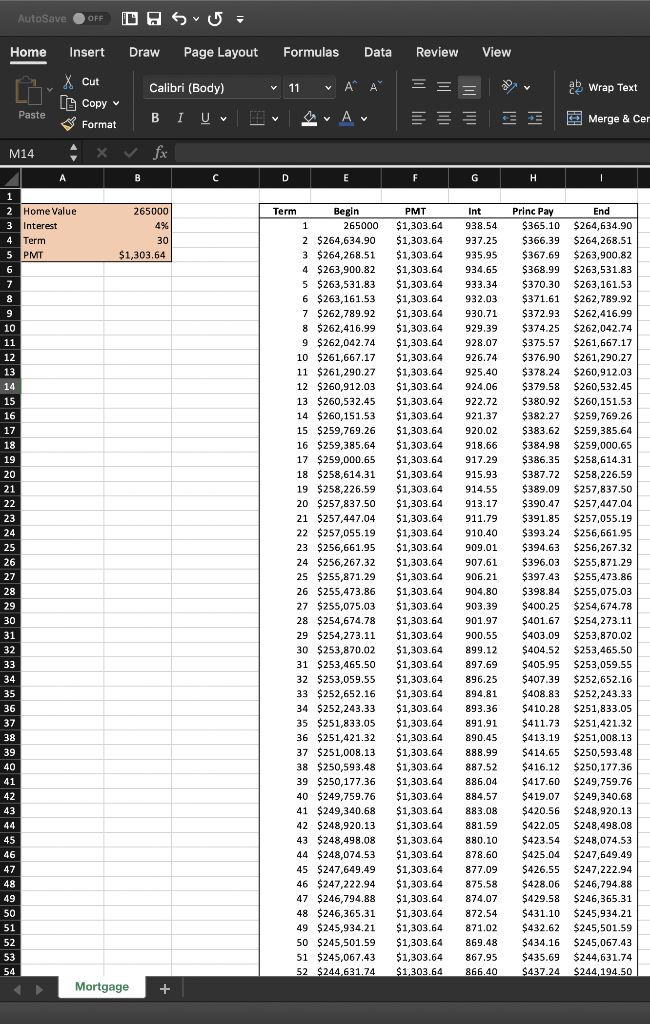

Hello!, Quick question. I just finished Question 2. I just want somebody to confirm if what I'm doing is correct. For term nunber 360, I have a balance of 0. Am I missing something from the question? Am I putting any numbers into the wrong cell for home value, Interest, Term, and PMT? Thanks

If letters are to small for that picture, here is the question:

Question : Find a home in the Morgantown area. You are expected to earn the average income from your degree (assume no more than $65,000. You may use 33% of your after-tax income to fund your mortgage expenses. First determine the amount of mortgage you can afford, then find a house in Morgantown which fits the bill. Compute the mortgage payment using 4.25% as the prevailing rate. Construct an amortization table and upload it in your response. Include the address of your selected house and other prevalent information. Save your file with the following naming structure

Question 2 10 points Answwer dere 33% af your after-tax incorre to find your mortgage exp ation table end upload It in your response. Incu Firid a horne in the Margantown aresa. Yau are expected to ear the average incame fro yur degree (assurne rio more than $85,000. You ay se me t sng 4.25% 88 the preveiling ate. Construct an e mortiza perses First deteriine the anount ofmarlgage yau can loro, t en tind a nouse n Mo anto m which tits te bill Compute tne mortgege pe nforrmatian. Save ynur file with tha fnlaiig strurturc dethe address ot your 8elected house and other ore alent Save your fie wihrtanouwnion tits the bil. Compute the AutoSave OFF Home InsertDraw Page Layout Formulas Data Review View Cut Format L" Calibri (Body) Wrap Text Paste a Merge & Cer M14 Home Value nterest Term PMT End 265000 4% Term Int Prine Pay 265000 1,303.64 938.54 365.10 $264,634.90 2 $264,634.90 $1,303.64 937.25 366.39 $264,268.51 3 $264,268.51 $1,303.64 935.95 $367.69 $263,900.82 4 $263,900.82 1,303.64 934.65 368.99 $263,531.83 5 $263,531.83 $1,303.64 933.34 $370.30 $263,161.53 6 $263,161.53 $1,303.64 932.03 $371.61 $262,789.92 7 $262,789.92 $1,303.64 930.71 372.93 $262,416.99 8 $262,416.99 $1,303.64 929.39 374.25 $262,042.74 9 $262,042.74 $1,303.64 928.07 $375.57 $261,667.17 10 $261,667.17 $1,303.64 926.74 376.90 $261,290.27 11 $261,290.27 $1,303.64 925.40 378.24 $260,912.03 12 $260,912.03 $1,303.64 924.06 379.58 $260,532.45 13 $260,532.45 $1,303.64 922.72 $380.92 $260,151.53 14 $260,151.53 $1,303.64 921.37 382.27 $259,769.26 15 $259,769.26 $1,303.64 920.02 $383.62 $259,385.64 16 $259,385.64 1,303.64 918.66 $384.98 $259,000.65 17 $259,000.65 $1,303.64 917.29 386.35 $258,614.31 18 $258,614.31 $1,303.64 915.93 $387.72 $258,226.59 19 $258,226.59 $1,303.64 914.55 $389.09 $257,837.50 20 $257,837.50 $1,303.64 913.17 390.47 $257,447.04 21 $257,447.04 51,303.64 911.79 $391.85 $257,055.19 22 $257,055.19 $1,303.64 910.40 393.24 $256,661.95 23 $256,661.95 1,303.64 909.01 394.63 $256,267.32 24 $256,267.32 $1,303.64 907.61 $396.03 $255,871.29 25 $255,871.29 $1,303.64 906.21 397.43 $255,473.86 26 $255,473.86 $1,303.64904.80$398.84 $255,075.03 27 $255,075.03 1,303.64 903.39 $400.25 $254,674.78 28 $254,674.78 $1,303.64 901.97401.67 $254,273.11 29 $254,273.11 $1,303.64 900.55 $403.09 $253,870.02 30 $253,870.02 $1,303.64 899.12 $404.52 $253,465.50 31 $253,465.50$1,303.64 897.69 405.95 $253,059.55 32 $253,059.55 $1,303.64 896.25 $407.39 $252,652.16 33 $252,652.16 $1,303.64 894.81 408.83 $252,243.33 34 $252,243.33 $1,303.64 893.36 $410.28 $251,833.05 35 $251,833.05 $1,303.64 891.91 $411.73 $251,421.32 36 $251,421.32 $1,303.64 890.45 $413.19 $251,008.13 37 $251,008.13 $1,303.64 888.99 $414.65 $250,593.48 38 $250,593.48 $1,303.64 887.52 $416.12 $250,177.36 39 $250,177.3 1,303.64 886.04 417.60 $249,759.76 40 $249,759.76 $1,303.64 884.57 $419.07 $249,340.68 41 $249,340.68 $1,303.64 883.08 $420.56 $248,920.13 42 $248,920.13 $1,303.64 881.59 422.05 $248,498.08 43 $248,498.08 $1,303.64 880.10 $423.54 $248,074.53 44 $248,074.53 1,303.64 878.60 $425.04 $247,649.49 45 $247,649.49 $1,303.64 877.09 $426.55 $247,222.94 46 $247,222.94 $1,303.64 875.58 $428.06 $246,794.88 47 $246,794.88 $1,303.64 874.07 $429.58 $246,365.31 48 $246,365.31 $1,303.64 872.54 $431.10 $245,934.21 49 $245,934.21 $1,303.64 871.02 432.62 $245,501.59 50 $245,501.59 $1,303.64 869.48 $434.16 $245,067.43 51 $245,067.43 $1,303.64 867.95 $435.69 $244,631.74 52 $244.631.74 $1303.64866.40S437 24$244 194.50 $1,303.64 15 25 29 30 38 46 50 Mortgage