Answered step by step

Verified Expert Solution

Question

1 Approved Answer

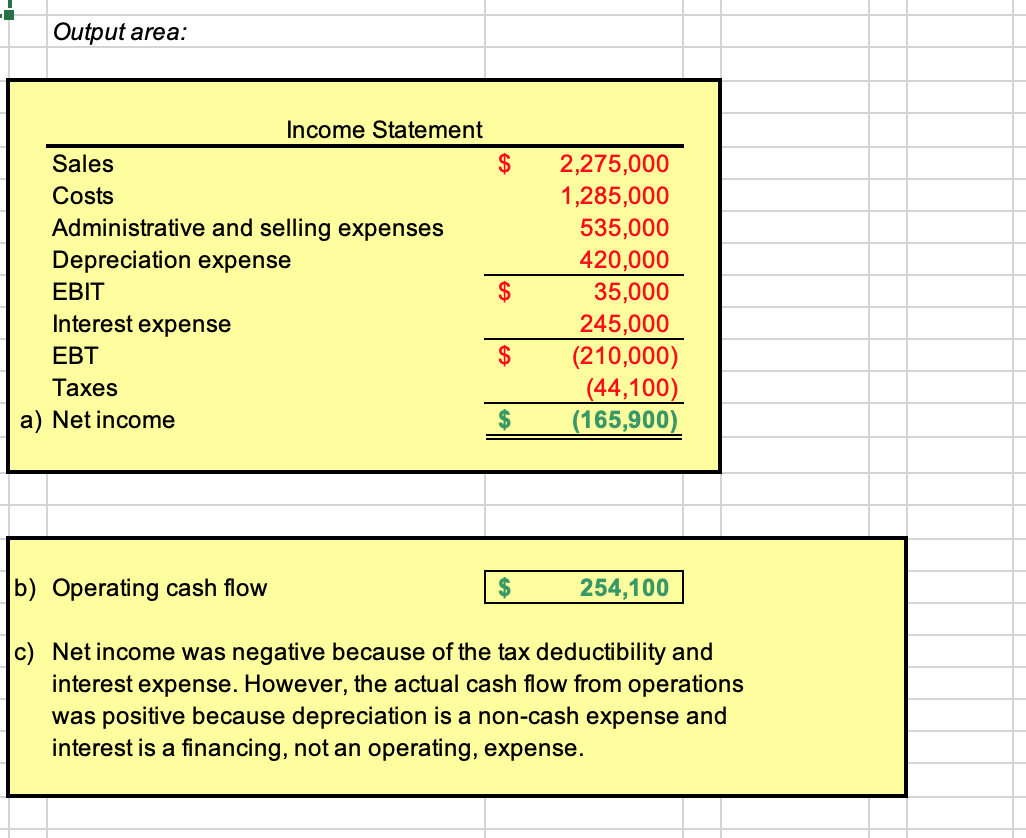

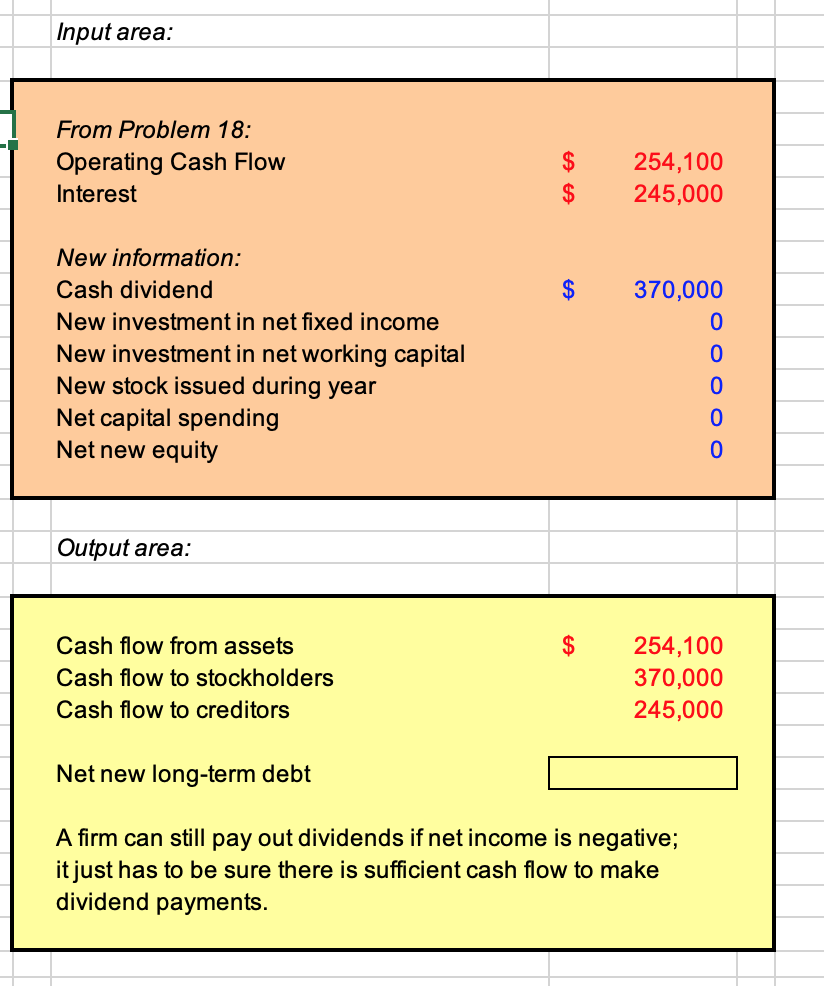

Hello the first picture must be used to get the answers for the second picture, they complete each other. In the second picture however, I

Hello the first picture must be used to get the answers for the second picture, they complete each other. In the second picture however, I don't know if my calculations are right and I don't know how to find the Net New Long-Term Debt. Please let me know the formula to use in the inputs to get the answer for that and if there is anything wrong with my original calculations do tell me what the correct formula is depending on the input. Thanks a bunch, just want to understand and learn :))!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started