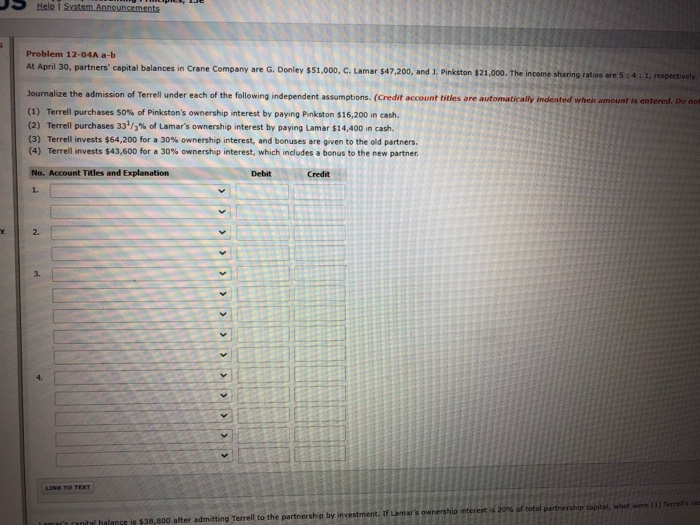

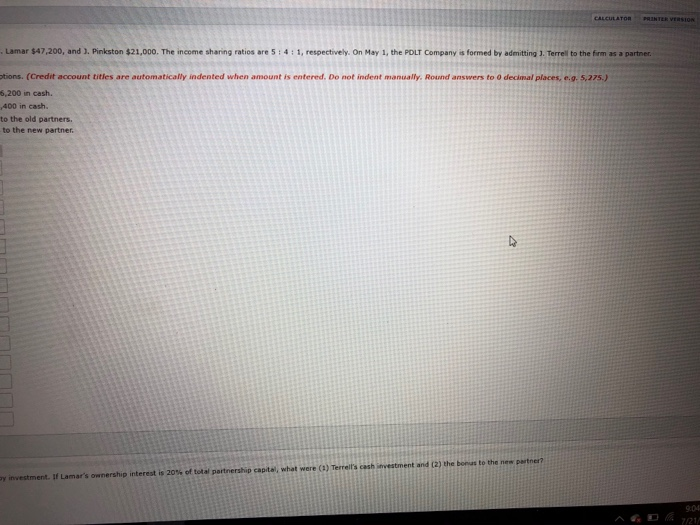

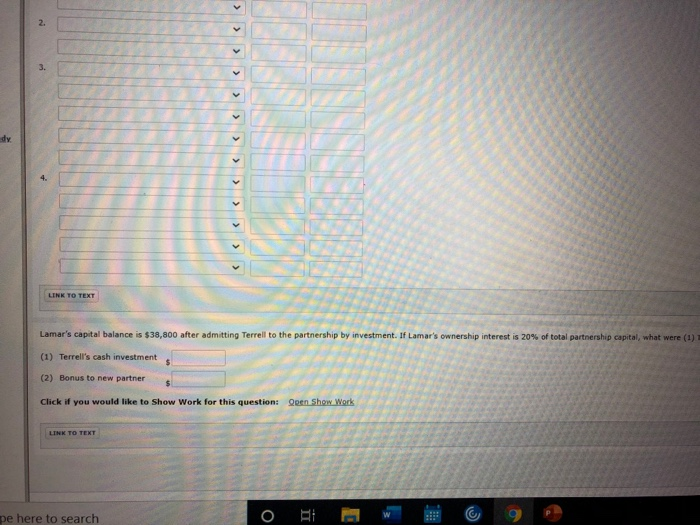

Helo l System Announcements Problem 12-04A a-b At April 30, partners' capital balances in Crane Company are G. Donley $51,000, C. Lamar $47,200, and ). Pinkston $21,000. The income sharing ratios are 5: 4:1, respectively Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do non (1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $16,200 in cash. (2) Terrell purchases 33/9% of Lamar's ownership interest by paying Lamar $14,400 in cash. (3) Terrell invests $64,200 for a 30% ownership interest, and bonuses are given to the old partners. (4) Terrell invests $43,600 for a 30% ownership interest, which includes a bonus to the new partner No. Account Titles and Explanation Debit Credit 1. 2. > > > > > > LINK TO TEXT Lamanitol holange is $38,800 alter admitting Terrell to the partnership by investment. If Lama's ownership interest is 20% of total partnership capital, what were (1) Terre CALCULATOR PRINTER VERSION Lamar $47,200, and ). Pinkston $21,000. The income sharing ratios are 5 : 4:1, respectively. On May 1, the POLT Company is formed by admitting ). Terrell to the firm as a partner. otions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) 6,200 in cash. 400 in cash. to the old partners. to the new partner. by investment. If Lamar's ownership interest is 20% of total partnership capital, what were (1) Terreils cash investment and (2) the bonus to the new partner? 9.04 7/21 2. 3. dv. LINK TO TEXT Lamar's capital balance is $38,800 after admitting Terrell to the partnership by investment. If Lamar's ownership interest is 20% of total partnership capital, what were (1) (1) Terrell's cash investment (2) Bonus to new partner Click if you would like to show Work for this question: Qeen Show Work LINK TO TEXT O pe here to search partnership by investment. If Lamar's ownership interest is 20% of total partnership capital, what were (1) Terrell's cash investment and (2) the bonus to the new partner? Open Show Work Question Attempts: 0 of 5 used