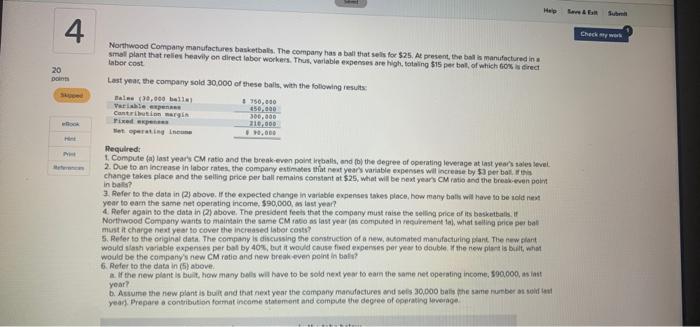

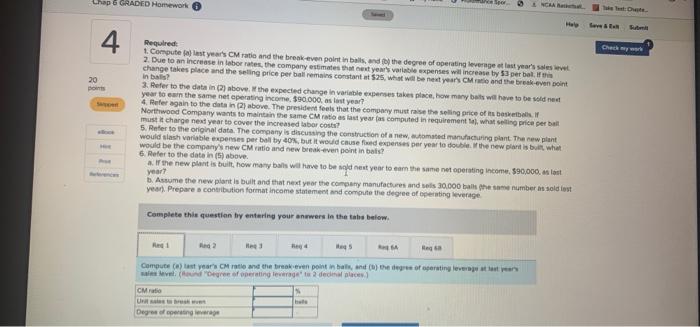

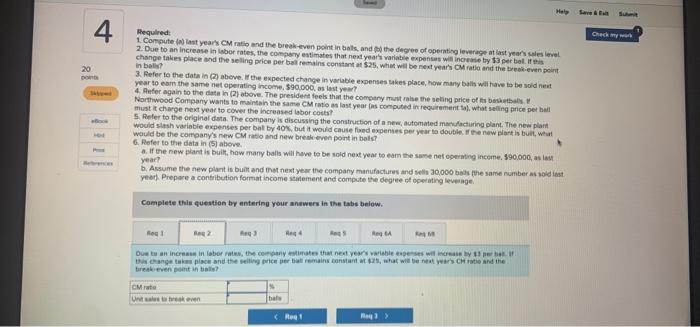

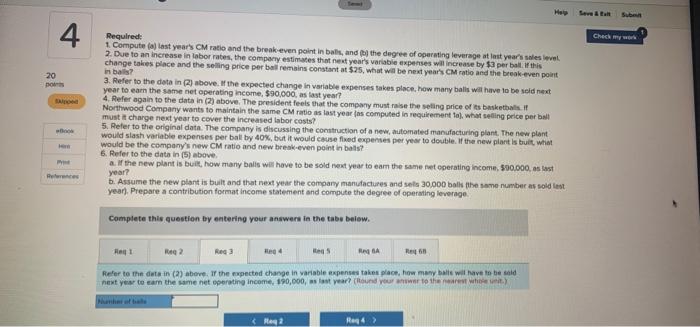

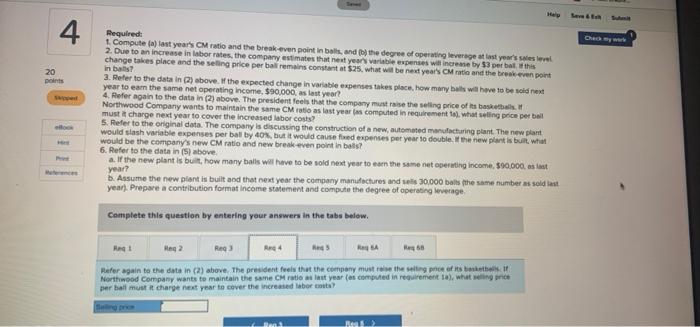

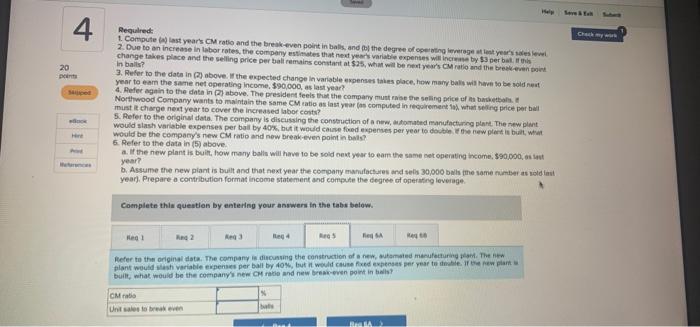

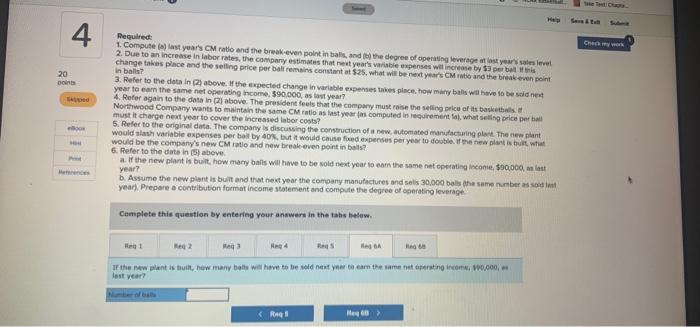

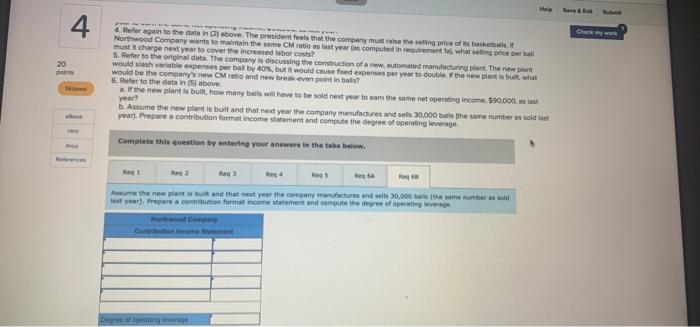

Help 4 Checker 20 Don Northwood Company manufactures basketballs. The company has a balat sells for $25. Apresent the ball manufactured in a small plant that relies heavily on direct labor workers. Thus, variable expenses are high ting 55 per bol of which odred Labor cost Last year, the company sold 30,000 of these balls, with the following results malu 7,000 ball # 750,000 Variable expen 450.000 Contribution margin 300,000 Pid 210,000 10.000 Required: 1. Compute la last year's CM ratio and the break-even pointballs, and the degree of operating leverage at last year's sales devel 2. Due to an increase in laborates the company times that next year's variable expenses will increase by $3 per bal change takes place and the seling price per ball remains constant at $25. What will be next year's CM ratio and the break even point in bat? 3. Refer to the data in above. If the expected change in variable expenses takes place, how many bath will have to be sold next year to earn the same net operating income, 590,000, last year? 4. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketball, Northwood Company wants to maintain the same CMrations last year (a computed in requirement to what selling price per bal must it charge next year to cover the increased labor costs? 5. Refer to the original data. The company has discussing the construction of a new automated manufacturing plant. The new plant would sath variable expenses perbal by 40%, but it would cause fred expenses per year to double the new plant is built what would be the company's new CM ratio and new break even point in bals? 6. Refer to the data in (5) above If the new plant is buit, how many bells will have to be sold next year to earn the same net operating income, 590,000, it year? b. Assume the new plant is built and that next year the company manufactures and ses 30,000 batis the same numbers years. Prepare a contribution format income statement and compute the degree of operating everage Chap & GRADED Homework por Hale 4 Check my werk 20 Points Required 1. Computer last year's CM rate and the break-even point in balls, and the degree of pering evergeefstyr's eve 2. Due to an increase in laborates the company states that next year's vorable expenses will increase by 53 per bal change takes place and the selling price per ball remains constant 525, what will be next year's read the break-even point in bat? 3. Refer to the data in ) above the expected change in variable expenses the place, how many als will have to be sold med year to earn the same net operating income $90.000 as last year 4. Refer again to the data in (2) above. The president feels that the company use these price of the Northwood Company wants to maintain the same CM atas last year computed in regiment what so prica per bal must it charge next year to cover the increased abort? 5. Refer to the original data. The company is discussing the construction of a new tomated manufacturing plant. The new plant would slash variable expenses per ball by 40, but it would cause fed expenses per year to double the new plant is what would be the company's new CM ratio and new break-even point in balls? 6. Refer to the data in (5) above. If the new plant is built how many balls will have to be next year to earn the same net operating income, 590,000 slot year? b. Assume the new plant is built and that next year the company manufactures and sets 30.000 balls the same number is sold out year). Prepare a contribution format income statement and compute the degree of operating leverage Complete this question by entering your newers in the the below Had 2 Here Hes Hea Compute() last year's Create and the trakeven point in bal, and the degree of earsting leverans waveler of operating leverage de ces CM Uw Degree of condage 4 Check my 20 Required: 1. Computer last year's CM ratio and the break-even point in balls, and the degree of leverage at last years as wel 2. Due to an increase in laborates, the company estimates that next year's variable expense by 13 perbal change takes place and the selling prica per ball remains constant at $25, what will be next years rute and the break even point in bat 3. Refer to the data in ) above the expected change in variable expenses takes place, how many balls will have to be soldat year to earn the same net operating income $90.000, as last year? 4. Refer again to the data in (2) above. The president feels that the company straise the seting price of its bases Northwood Company wants to maintain the same CM ratios last year is computed in recurement, what selling price perball must it charge next year to cover the increased labor costs 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per al by 40%, but it would cause foed expenses per year to double the new plantis bull, what would be the company's new CM ratio and new break even point in bols 6. Refer to the data in (5) above if the new plant is built, how many balls will have to be sold next year to earn the same net operating income, 590.000, asam year? b. Assume the new plant is built and that next year the company manufactures and see 30,000 basme same numbers soldest year). Prepare a contribution format income statement and compute the degree of operating leverage Complete this question by entering your answers in the tabs below. Reg 4 Reg Due to an increase in laborate the company estimate that never bees will be change takes place and the selling price raremains constant, what will benestars Cand the treven poti ba? CM Uittrekoven tale 4 Check my work 20 po Required: 1. Computea last year's CM ratio and the break even point in balls, and the degree of operating leverage at last year's sales level 2. Due to an increase in labor rates, the company estimates that next year's variable expenses will increase by $3 per ball this change takes place and the selling price per ball remains constant at $25, what will be next year's CM ratio and the break even point in bali? 3. Refer to the data in 2) above. If the expected change in variable expenses takes place. How many balls will have to be sold next year to earn the same net operating income, $90,000, as fast year? 4. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketbal if Northwood Company wants to maintain the same CM ratio as last year in computed in requirement to what selling price perball must charge next year to cover the increased labor costs? 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40%, but it would cause fixed expenses per year to double. If the new plant is built, what would be the company's new CM ratio and new break-even point in bails? 6. Refer to the data in (5) above a. If the new plant is built, how many balls will have to be sold next year to earn the same ret operating Income. 500.000, as fast b. Assume the new plant is built and that next year the company manufactures and sets 20,000 ball the same number as told test year). Prepare a contribution format income statement and compute the degree of operating leverage. year? Complete this question by entering your answers in the tube below. Het R2 Red es RA R Refer to the data in (2) above. If the expected change in variable expenses takes place, how many balls will have to be sold next year to earn the same net operating income, 190,000, as last year? (Round your new to the whole 4 Chy 20 DOS Required: 1. Compute fallast year's CM ratio and the break even point in balls, and the degree of operating leverage last year's sales del 2. Due to an increase in laborates the company estimates that next year's variable expenses increase by $3 per bal change takes place and the selling price per ball remains constant at $25, what will be next year's Mind the break even point in bals? 3. Refer to the data in (2) above the expected change in variable expenses takes place, how many balls will have to be det year to earn the same net operating Income $90,000, as last year? 4. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketball Northwood Company wants to maintain the same CM ratio as last year la computed in requirement to what selling price perball must charge next year to cover the increased labor costs? 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40%, but it would cause we expenses per year to double the new plant is built, what would be the company's new CM ratio and new break even point in bals? 6. Refer to the data in (5) above a. If the new plant is buit, how many balls will have to be sold best year to the same net operating income, 590.000, estost year? b. Assume the new plant is built and that next year the company manufactures and 30,000 balls the same number as sold at year). Prepare a contribution format income statement and compute the degree of operating leverage Complete this question by entering your answers in the tabs below. Het Mega Re 4 68 Refer again to the data in (2) above. The president feels that the company must the selling price of its bases Norwood Company wants to maintain the same CM ratios a year (as computed in requirement ta), which per ball must it charge next year to cover the increased abort? BA 4 20 Required: t Computer last year's CM ratio and the break-even point in base and the degree of operating leverest year's 2. Due to an increase in laborates, the company was that next years are expenses will increase by $5 per bal change takes place and the selling price per ball remains constant at $25, what will be next year's Corner In ball? 3. Refer to the data in (2) above the expected change in variable expenses takes place towany balls where to be solde year to earn the same net operating Income $90,000, as last year? 4. Refer again to the data in (2) above. The president feels that the company must is the selling price of basketbol Northwood Company wants to maintain the same CM ratio es last year is computed in regalement al what eng rice per bal must it charge next year to cover the increased labor costs? 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40%, but it would cause fod expenses per year to the new plant is bull, what would be the company's new CM ratio and now break-even point in baie 6. Refer to the data in (5) above. a. If the new plant is built, how many balls will have to be sold next year to eam the same met operating income $90,000 to b. Assume the new plant is built and that next year the company manufactures and ses 30,000 bis me some number assol year). Prepare a contribution format income statement and compute the degree of operating leverage year? Complete this question by entering your answers in the tabs below. He 1 2 SA Refer to the original data. The company is doing the construction of a new, automated manufacturing The plant would was variable expenses per ball by Out would des per year to be the plan built, what would be the company's new Chat and new breeven poinbas? CM radio Units to break even BA 4 Ceny 20 point Required 1. Compute(a) last year's CM radio and the break-even point in balls, and the degree of operating everage yerel 2. Due to an increase in laborates, the company that next year's variable speses will increase by permis change takes place and the selling price per ball remains constant at $25 what will be next year's Mind the break even point in balls? 3. Refer to the data in ) above the expected change in variable expenses place, how many balls will have to be sold year to earn the same net operating income, 390.000, as last year? 4. Refer again to the data in (2) above. The president feels that the company must rose the selling price of the best Northwood Company wants to maintain the same CM ratio estast year computer al wat ing price per must it charge next year to cover the increased labor costs? 5. Refer to the original data. The company is discussing the construction of new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40. but it would cause fed expenses per year to double the new plant is but what would be the company's new CM ratio and new break even point in balls? 6. Refer to the data in (5) above a. If the new plant is built how many balls will have to be sold next year to cam the same net operating income $90.000, an fast b. Assume the new plant is built and that next year the company manufactures and sellis 30,000 bal the same numbers at year). Prepare a contribution format income statement and compute the degree of cerating leverage year? Complete this question by entering your answers in the tahs below 2 Heg4 Hes Hege If that is built how many both will have to be sold next year to earn the same testing com, 0.000,- last year?