Answered step by step

Verified Expert Solution

Question

1 Approved Answer

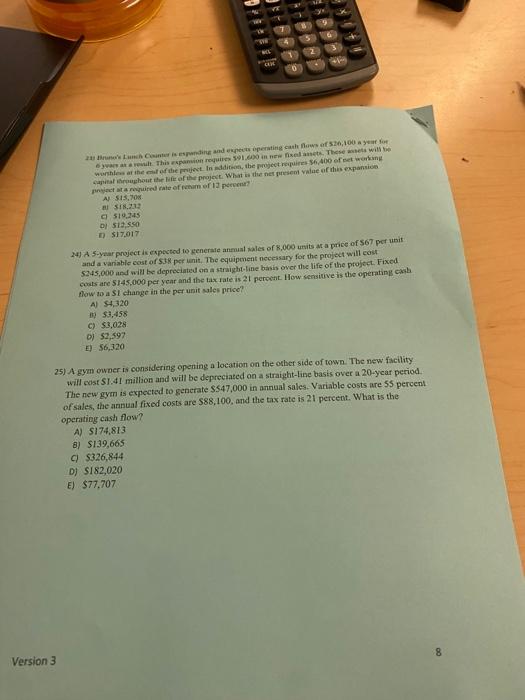

help A) 515,708 . (i) 518,21+ el 510,245 (4) 514,500 (1) $17,617 24) A 5-year project is expectod to kenerale antual wales of 8,000 uvits

help

A) 515,708 . (i) 518,21+ el 510,245 (4) 514,500 (1) $17,617 24) A 5-year project is expectod to kenerale antual wales of 8,000 uvits at a price of 567 per ubit and a variable cost of $38 per unit. The equipenent necessary for the project will eost and a varabie cost of 330 per anit, The equipenent nccessary for the project will cost cucts are 5145,000 per year and the tax rate is 21 perovat. How sensivive is the operating eista Alow to a 51 change it the per unit sles price? A) 54,320 it) 33,458 c) 53,028 (b) 52,597 E) 56,320 25) A gym ewaer if constdering opening a location on the other side of ogwn. Tbe new facitity Wil colst SI.4 I million and wvill be depreciated on a stratght-line basts over a 20 -ycar period. The new gym is expected to generate $547,000 in annual sales. Variable costs are 55 percent of sales, the aranal fixed costs are 588,100 , and the tax rate is 21 percent. What is the operiting cash flow? A) 5174,813 ) $139,665 c) 5326,844 D) 5182,020 E) 577,707

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started