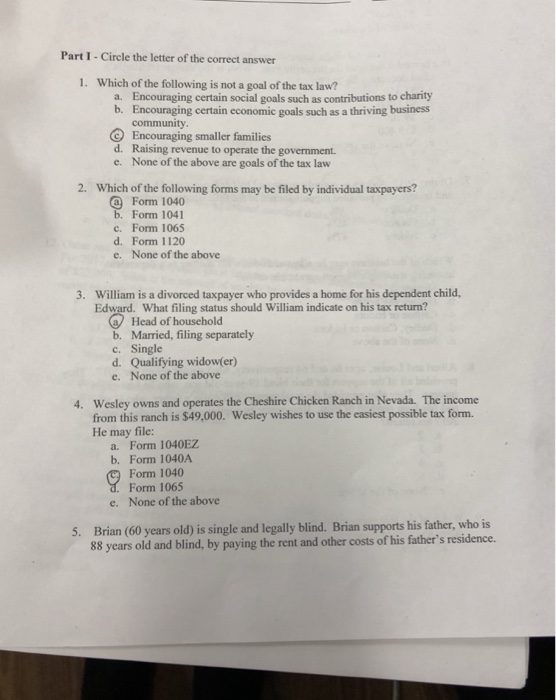

Part I-Circle the letter of the correct answer 1. Which of the following is not a goal of the tax law? Encouraging certain social goals such as contributions to charity Encouraging certain economic goals such as a thriving business community Encouraging smaller families Raising revenue to operate the government. None of the above are goals of the tax law a. b. d. e. 2. Which of the following forms may be filed by individual taxpayers? @Form 1040 b. Form 1041 c. Form 1065 d. Form 1120 e. None of the above William is a divorced taxpayer who provides a home for his dependent child, Edward. What filing status should William indicate on his tax return? 3. Head of household b. Married, filing separately c. Single d. Qualifying widow(er) e. None of the above Wesley owns and operates the Cheshire Chicken Ranch in Nevada. The income from this ranch is $49,000. Wesley wishes to use the easiest possible tax form. He may file: 4. a. Form 1040EZ b. Form 1040A Form 1040 Form 1065 None of the above e. Brian (60 years old) is single and legally blind. Brian supports his father, who is 88 years old and blind, by paying the rent and other costs of his father's residence. 5. Part I-Circle the letter of the correct answer 1. Which of the following is not a goal of the tax law? Encouraging certain social goals such as contributions to charity Encouraging certain economic goals such as a thriving business community Encouraging smaller families Raising revenue to operate the government. None of the above are goals of the tax law a. b. d. e. 2. Which of the following forms may be filed by individual taxpayers? @Form 1040 b. Form 1041 c. Form 1065 d. Form 1120 e. None of the above William is a divorced taxpayer who provides a home for his dependent child, Edward. What filing status should William indicate on his tax return? 3. Head of household b. Married, filing separately c. Single d. Qualifying widow(er) e. None of the above Wesley owns and operates the Cheshire Chicken Ranch in Nevada. The income from this ranch is $49,000. Wesley wishes to use the easiest possible tax form. He may file: 4. a. Form 1040EZ b. Form 1040A Form 1040 Form 1065 None of the above e. Brian (60 years old) is single and legally blind. Brian supports his father, who is 88 years old and blind, by paying the rent and other costs of his father's residence. 5