Answered step by step

Verified Expert Solution

Question

1 Approved Answer

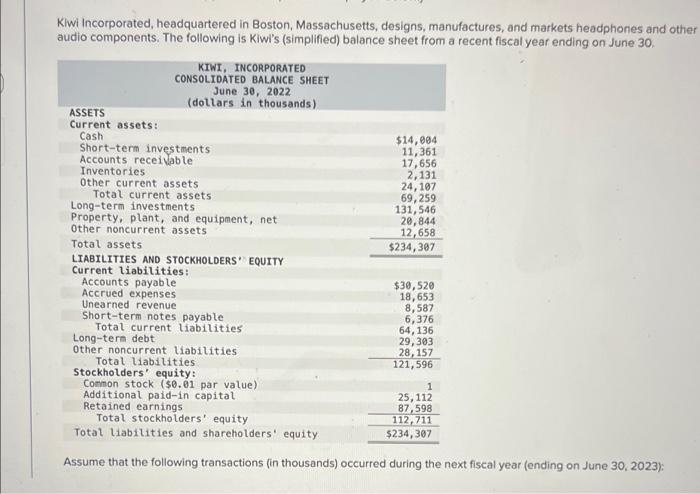

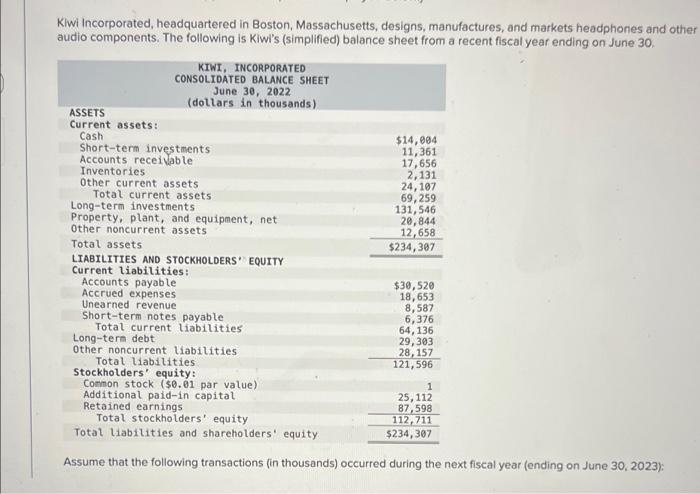

help ASAP Kiwi Incorporated, headquartered in Boston, Massachusetts, designs, manufactures, and markets headphones and other audio components. The following is Kiwi's (simplified) balance sheet from

help ASAP

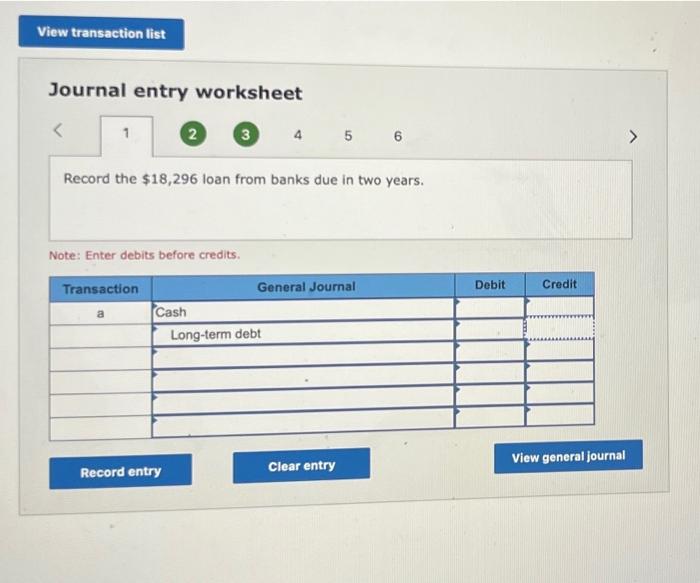

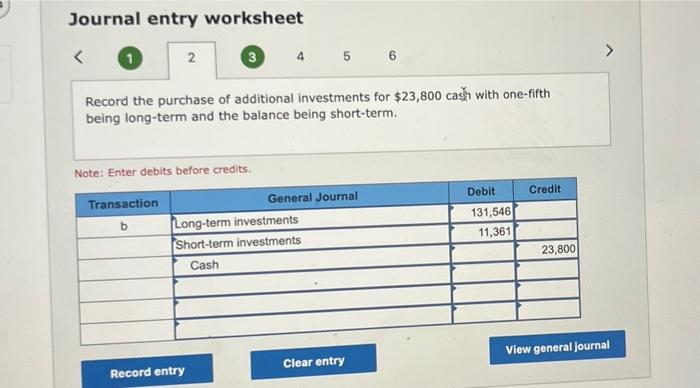

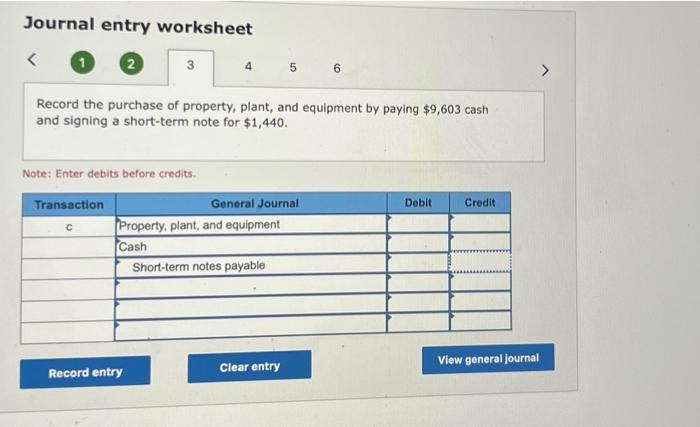

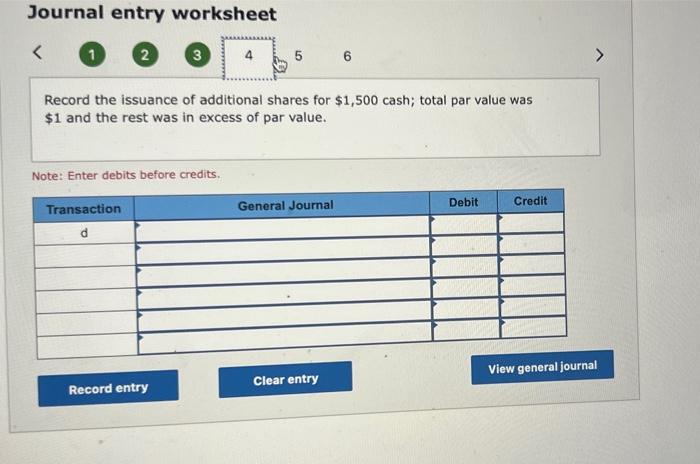

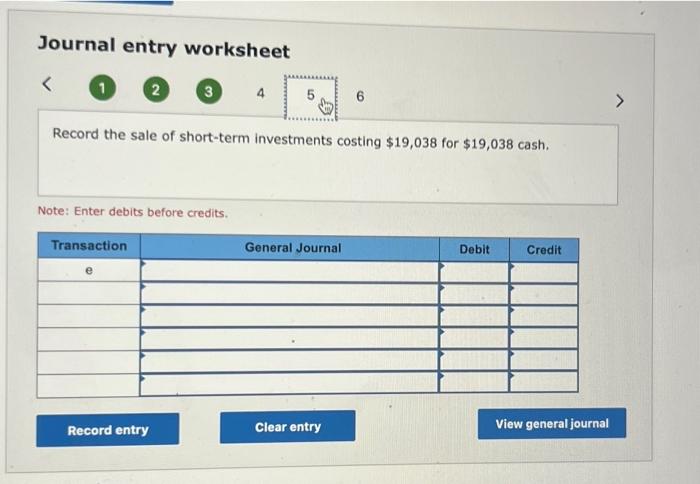

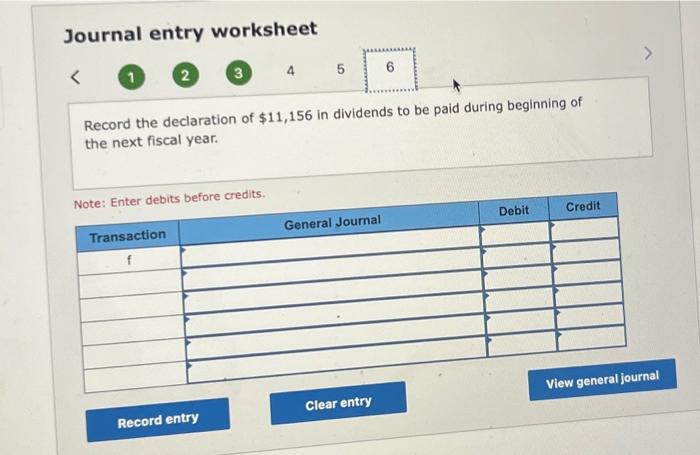

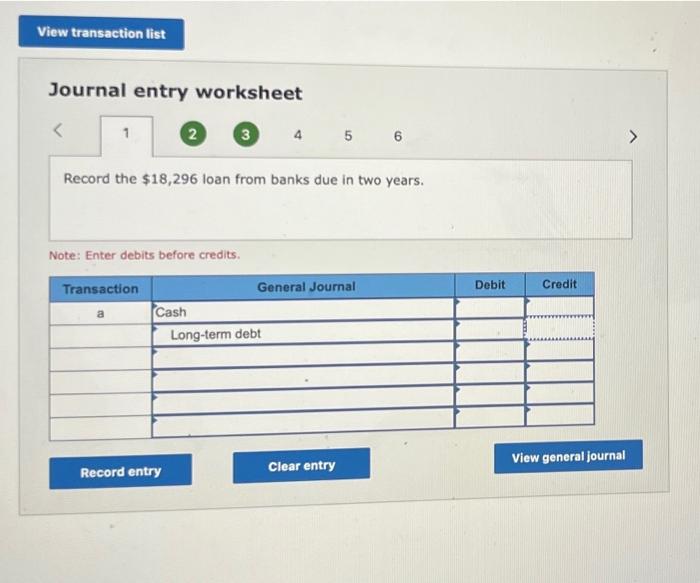

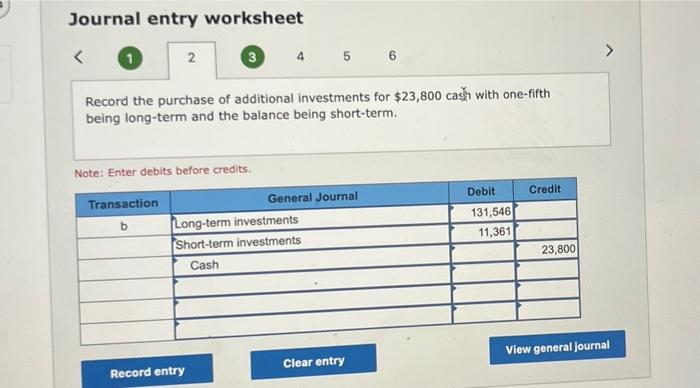

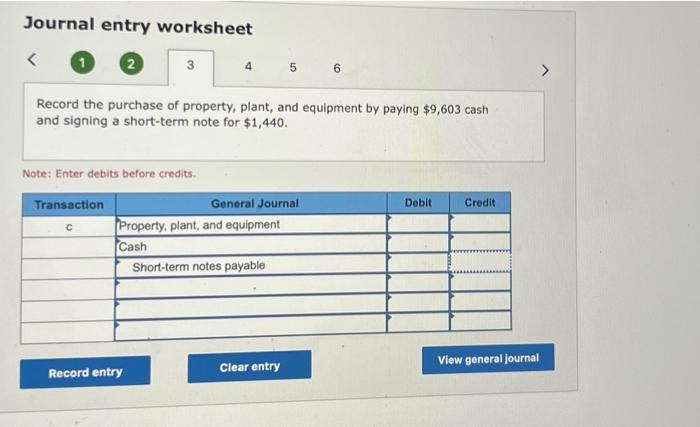

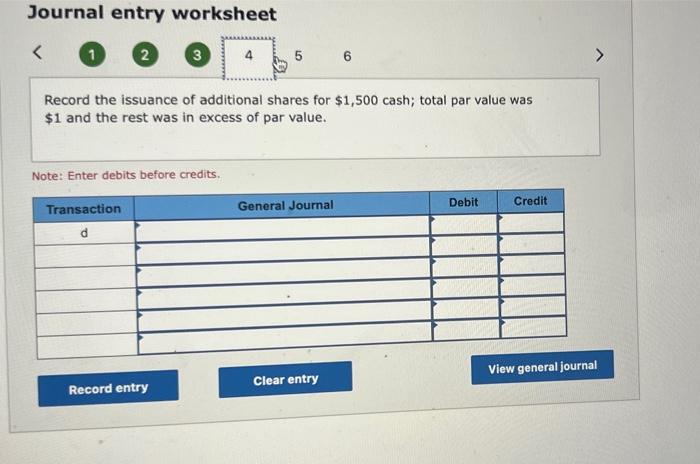

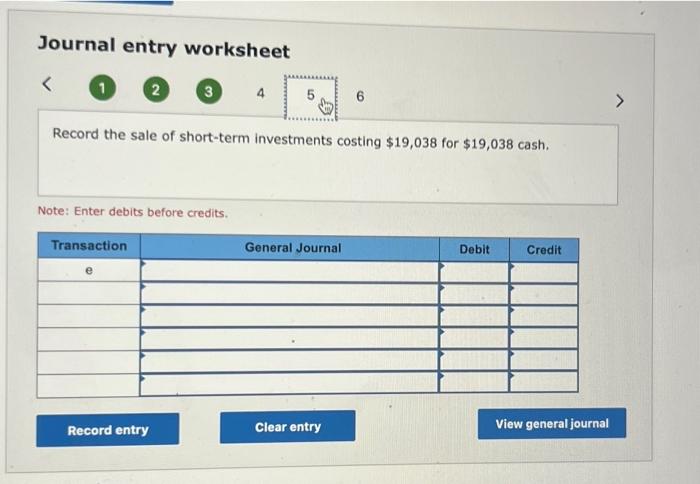

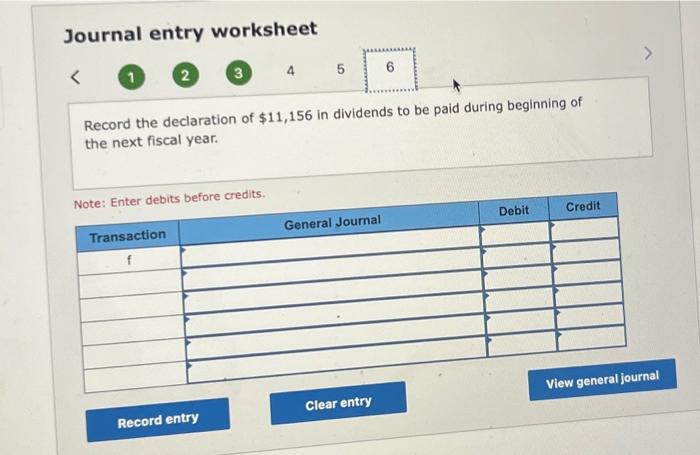

Kiwi Incorporated, headquartered in Boston, Massachusetts, designs, manufactures, and markets headphones and other audio components. The following is Kiwi's (simplified) balance sheet from a recent fiscal year ending on June 30 . Assume that the Tonowing transactions (in thousands) occurred during the next fiscal year (ending on June 30, 2023): Journal entry worksheet (3) 456 Record the $18,296 loan from banks due in two years. Note: Enter debits before credits. Journal entry worksheet 4 Record the purchase of additional investments for $23,800 cash with one-fifth being long-term and the balance being short-term. Note: Enter debits before credits. Journal entry worksheet 1 2 4 Record the purchase of property, plant, and equipment by paying $9,603 cash and signing a short-term note for $1,440. Note: Enter debits before credits. Journal entry worksheet 1 2 56 Record the issuance of additional shares for $1,500 cash; total par value was $1 and the rest was in excess of par value. Note: Enter debits before credits. Journal entry worksheet 1 2 Record the sale of short-term investments costing $19,038 for $19,038 cash. Note: Enter debits before credits. Journal entry worksheet 1 2 Record the declaration of $11,156 in dividends to be paid during beginning of the next fiscal year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started