Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help! At the end of Year 3, when the carrying amount of the lease liability and the Right-ofUse asset were both $53,893, Walmart experienced a

help!

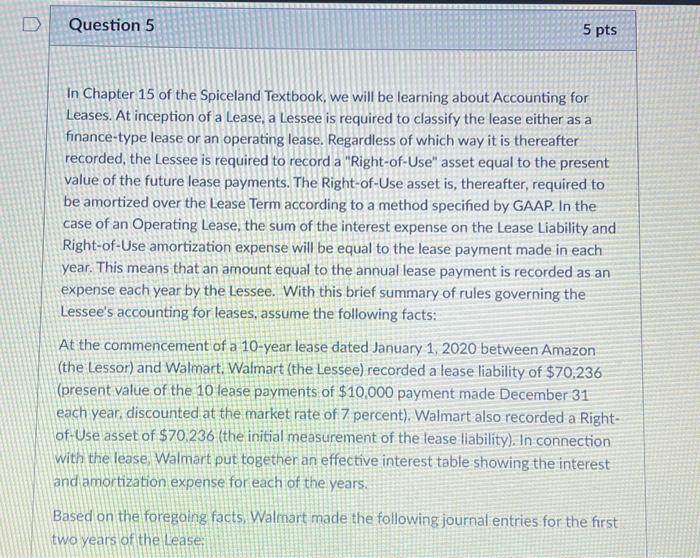

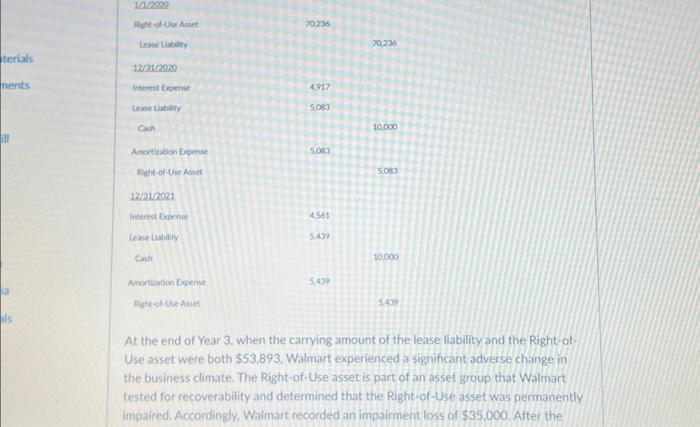

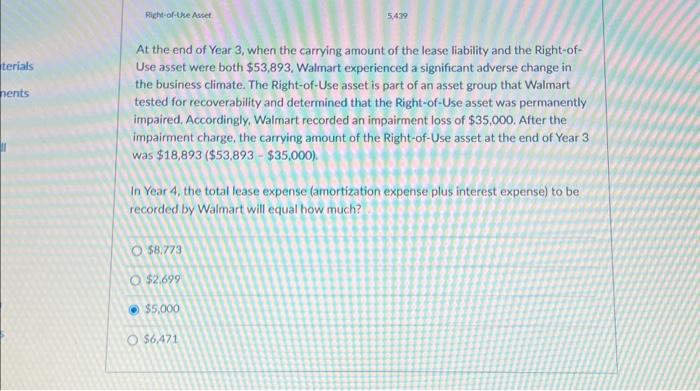

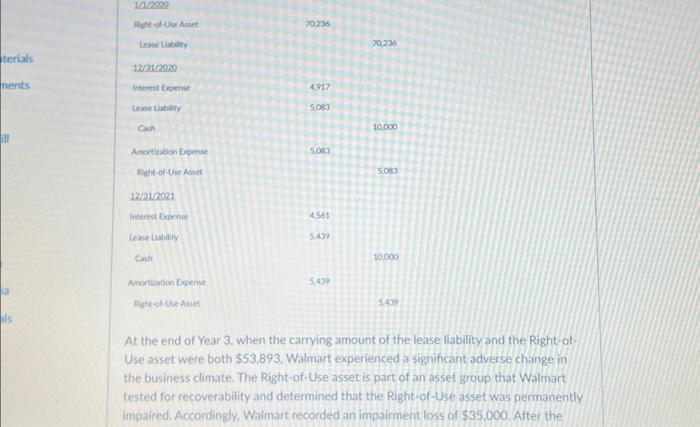

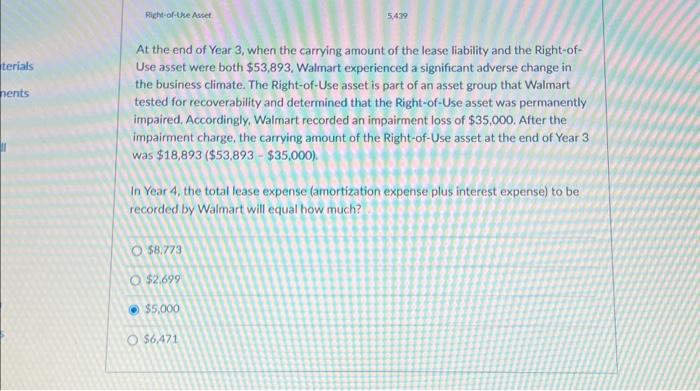

At the end of Year 3, when the carrying amount of the lease liability and the Right-ofUse asset were both $53,893, Walmart experienced a significant adverse change in the business climate. The Right-of-Use asset is part of an asset group that Walmart tested for recoverability and determined that the Right-of-Use asset was permanently impaired. Accordingly, Walmart recorded an impairment los of $35.000. After the At the end of Year 3, when the carrying amount of the lease liability and the Right-ofUse asset were both $53,893, Walmart experienced a significant adverse change in the business climate. The Right-of-Use asset is part of an asset group that Walmart tested for recoverability and determined that the Right-of-Use asset was permanently impaired. Accordingly, Walmart recorded an impairment los $ of $35,000. After the impairment charge, the carrying amount of the Right-of-Use asset at the end of Year 3 was $18,893($53,893$35,000). In Year 4, the total lease expense (amortization expense plus interest expense) to be recorded by Walmart will equal how much? $8.773 $2.699 $5,000 $6,471 In Chapter 15 of the Spiceland Textbook, we will be learning about Accounting for Leases. At inception of a Lease, a Lessee is required to classify the lease either as a finance-type lease or an operating lease. Regardless of which way it is thereafter recorded, the Lessee is required to record a "Right-of-Use" asset equal to the present value of the future lease payments. The Right-of-Use asset is, thereafter, required to be amortized over the Lease Term according to a method specified by GAAP. In the case of an Operating Lease, the sum of the interest expense on the Lease Liability and Right-of-Use amortization expense will be equal to the lease payment made in each year. This means that an amount equal to the annual lease payment is recorded as an expense each year by the Lessee. With this brief summary of rules governing the Lessee's accounting for leases, assume the following facts: At the commencement of a 10-year lease dated January 1,2020 between Amazon (the Lessor) and Walmart, Walmart (the Lessee) recorded a lease liability of $70,236 (present value of the 10 lease payments of $10,000 payment made December 31 each year, discounted at the market rate of 7 percent). Walmart also recorded a Rightof-Use asset of $70,236 (the initial measurement of the lease liability). In connection with the lease, Walmart put together an effective interest table showing the interest and amortization expense for each of the years. Based on the foregoing facts, Watmart made the following journal entries for the first two years of the Lease: At the end of Year 3, when the carrying amount of the lease liability and the Right-ofUse asset were both $53,893, Walmart experienced a significant adverse change in the business climate. The Right-of-Use asset is part of an asset group that Walmart tested for recoverability and determined that the Right-of-Use asset was permanently impaired. Accordingly, Walmart recorded an impairment los of $35.000. After the At the end of Year 3, when the carrying amount of the lease liability and the Right-ofUse asset were both $53,893, Walmart experienced a significant adverse change in the business climate. The Right-of-Use asset is part of an asset group that Walmart tested for recoverability and determined that the Right-of-Use asset was permanently impaired. Accordingly, Walmart recorded an impairment los $ of $35,000. After the impairment charge, the carrying amount of the Right-of-Use asset at the end of Year 3 was $18,893($53,893$35,000). In Year 4, the total lease expense (amortization expense plus interest expense) to be recorded by Walmart will equal how much? $8.773 $2.699 $5,000 $6,471 In Chapter 15 of the Spiceland Textbook, we will be learning about Accounting for Leases. At inception of a Lease, a Lessee is required to classify the lease either as a finance-type lease or an operating lease. Regardless of which way it is thereafter recorded, the Lessee is required to record a "Right-of-Use" asset equal to the present value of the future lease payments. The Right-of-Use asset is, thereafter, required to be amortized over the Lease Term according to a method specified by GAAP. In the case of an Operating Lease, the sum of the interest expense on the Lease Liability and Right-of-Use amortization expense will be equal to the lease payment made in each year. This means that an amount equal to the annual lease payment is recorded as an expense each year by the Lessee. With this brief summary of rules governing the Lessee's accounting for leases, assume the following facts: At the commencement of a 10-year lease dated January 1,2020 between Amazon (the Lessor) and Walmart, Walmart (the Lessee) recorded a lease liability of $70,236 (present value of the 10 lease payments of $10,000 payment made December 31 each year, discounted at the market rate of 7 percent). Walmart also recorded a Rightof-Use asset of $70,236 (the initial measurement of the lease liability). In connection with the lease, Walmart put together an effective interest table showing the interest and amortization expense for each of the years. Based on the foregoing facts, Watmart made the following journal entries for the first two years of the Lease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started