Answered step by step

Verified Expert Solution

Question

1 Approved Answer

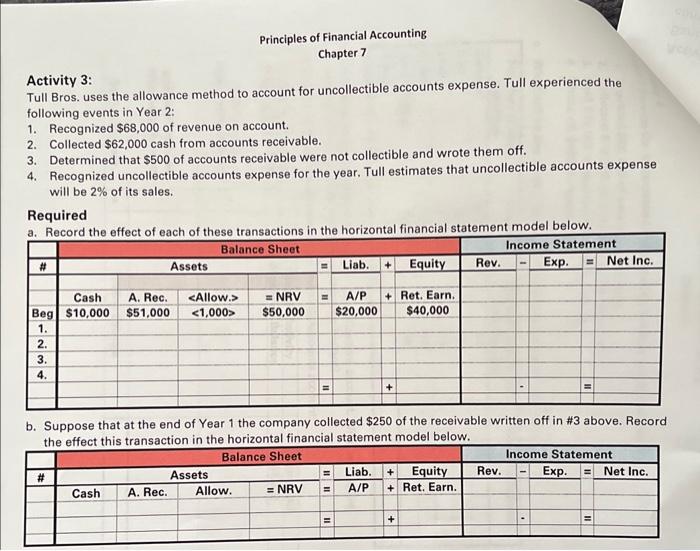

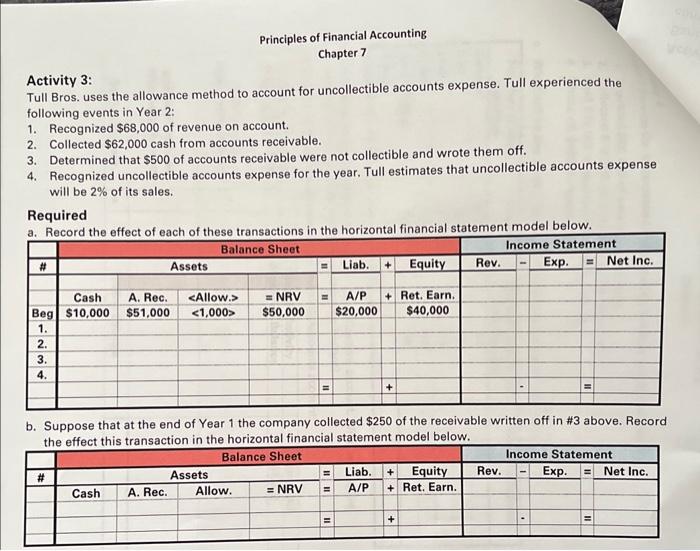

help Chapter 7 Tull Bros. uses the allowance method to account for uncollectible accounts expense. Tull experienced the Activity 3: following events in Year 2:

help

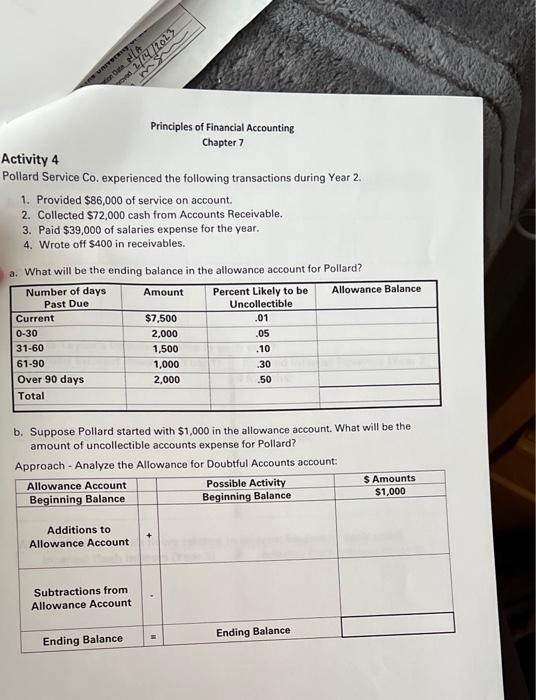

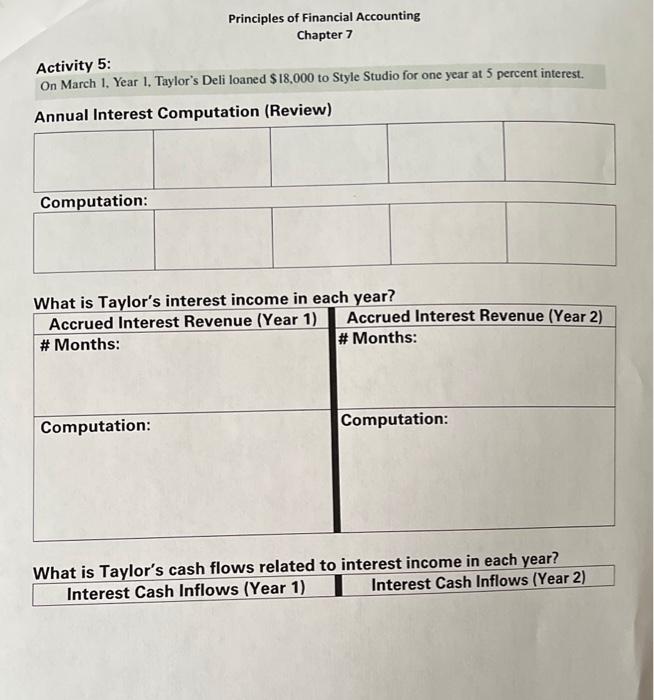

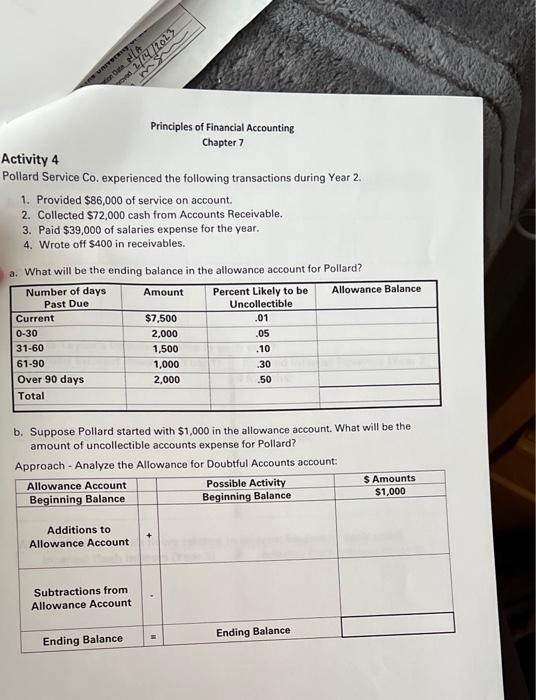

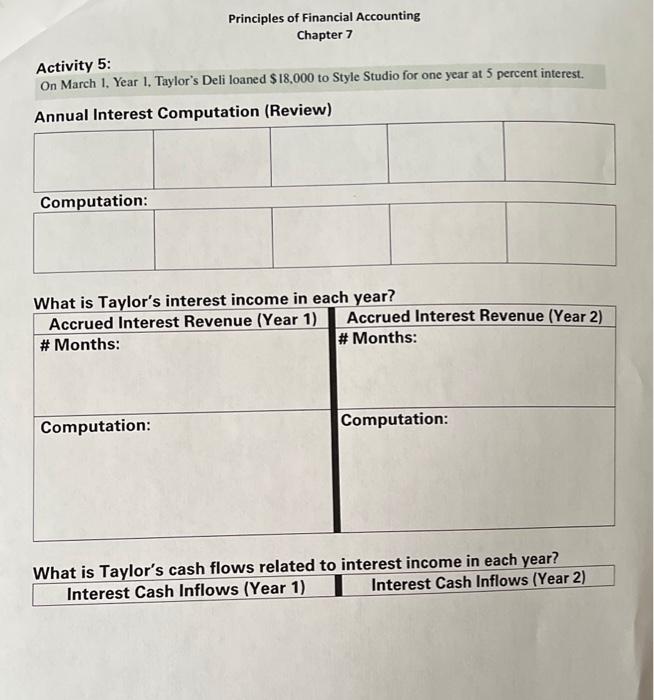

Chapter 7 Tull Bros. uses the allowance method to account for uncollectible accounts expense. Tull experienced the Activity 3: following events in Year 2: 1. Recognized $68,000 of revenue on account. 2. Collected $62,000 cash from accounts receivable. 3. Determined that $500 of accounts receivable were not collectible and wrote them off. 4. Recognized uncollectible accounts expense for the year. Tull estimates that uncollectible accounts expense will be 2% of its sales. Required a. Record the effect of each of these transactions in the horizontal financial statement model below. b. Suppose that at the end of Year 1 the company collected $250 of the receivable written off in #3 above. Recoro the effect this transaction in the horizontal financial statement model below. Principles of Financial Accounting Chapter 7 Activity 4 Pollard Service Co. experienced the following transactions during Year 2. 1. Provided $86,000 of service on account. 2. Collected $72,000 cash from Accounts Receivable. 3. Paid $39,000 of salaries expense for the year. 4. Wrote off $400 in receivables. a. What will be the ending balance in the allowance account for Pollard? b. Suppose Pollard started with $1,000 in the allowance account. What will be the amount of uncollectible accounts expense for Pollard? Approach - Analyze the Allowance for Doubtful Accounts account: Activity 5 : On March 1. Year 1. Taylor's Deli loaned $18,000 to Style Studio for one year at 5 percent interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started