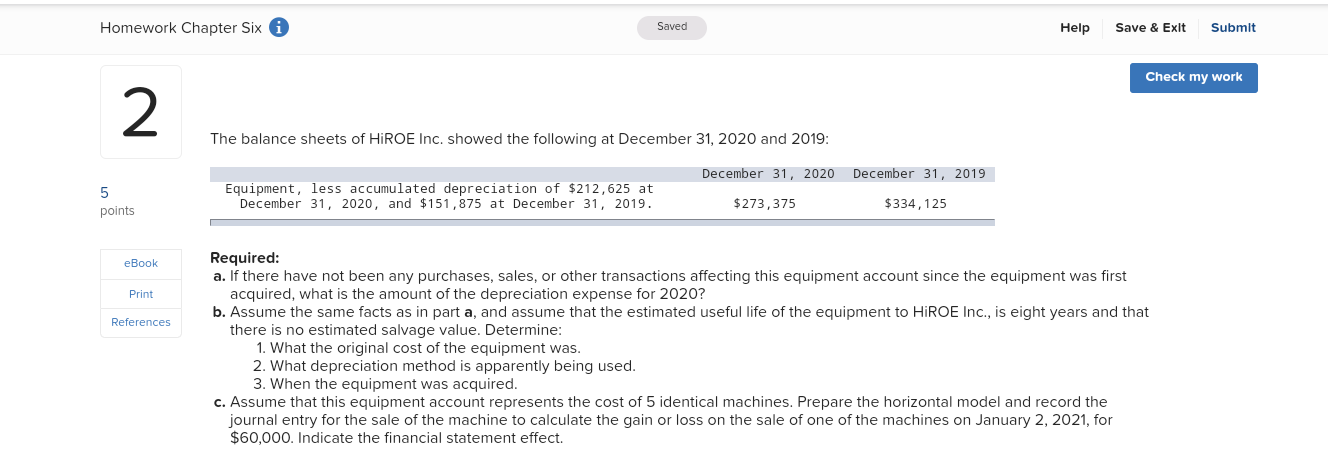

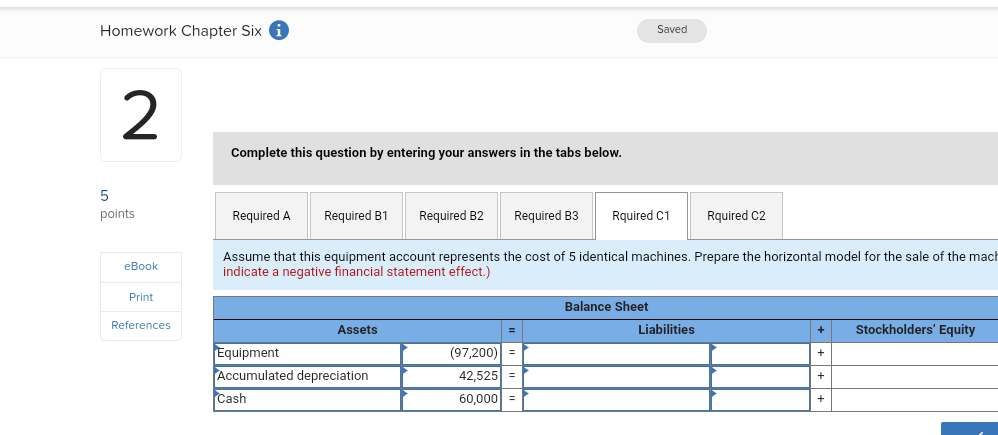

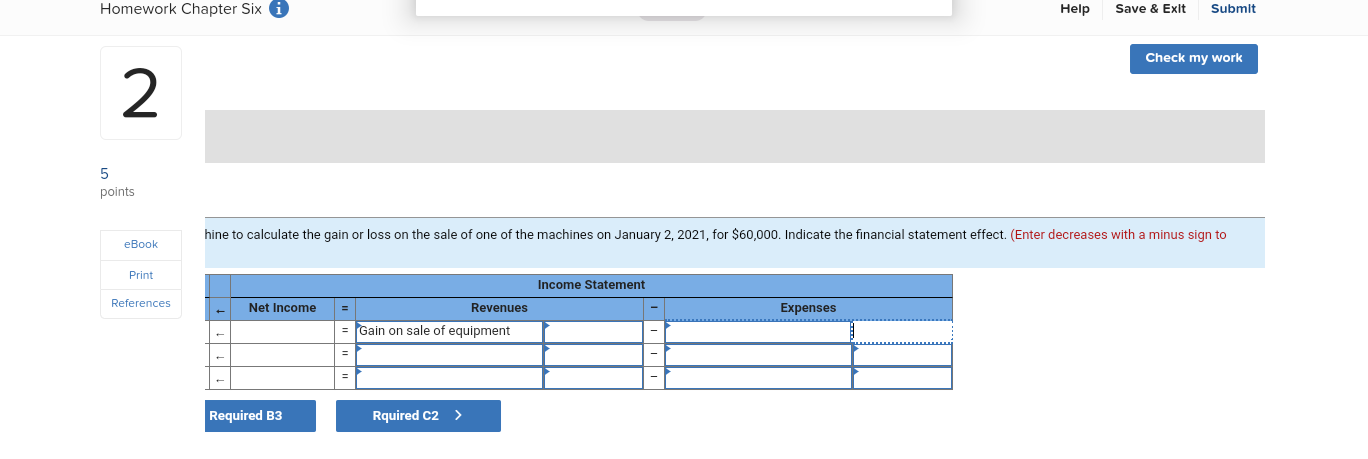

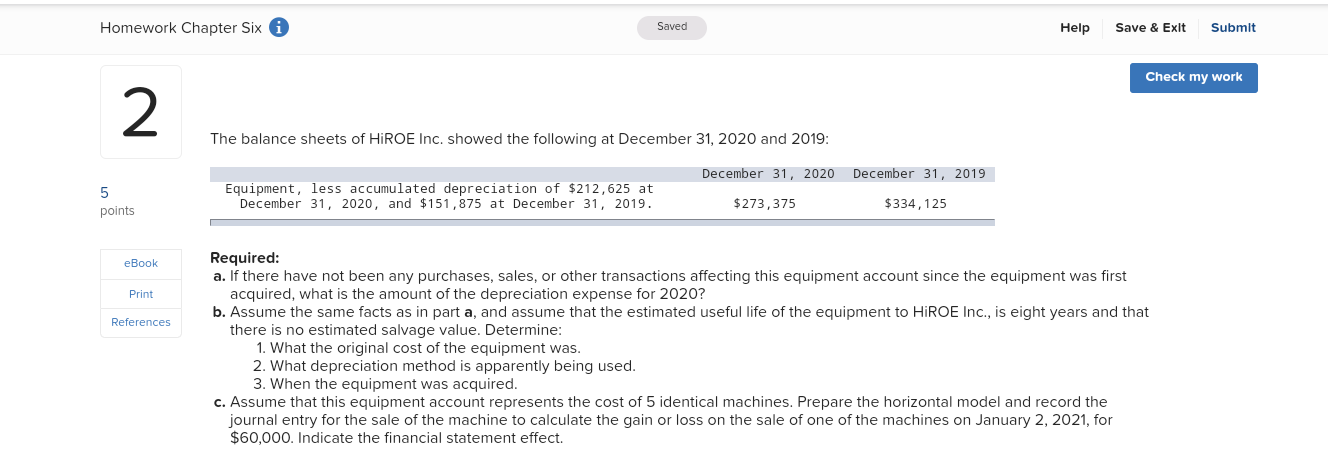

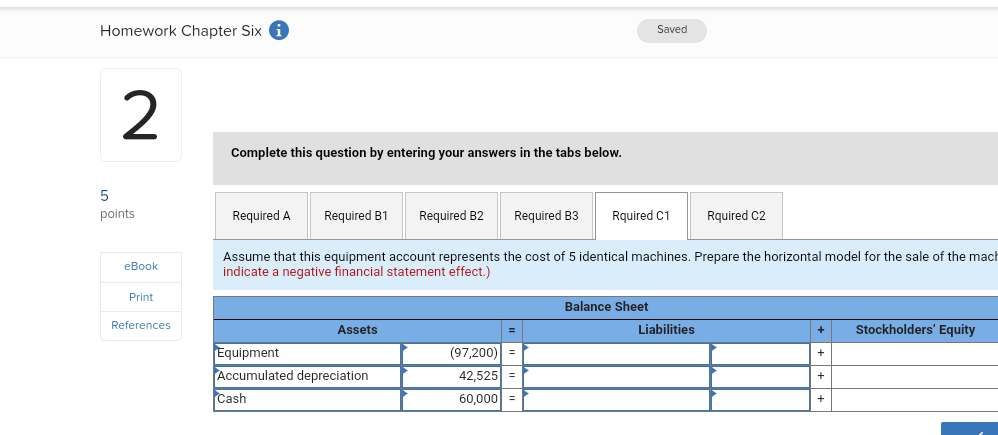

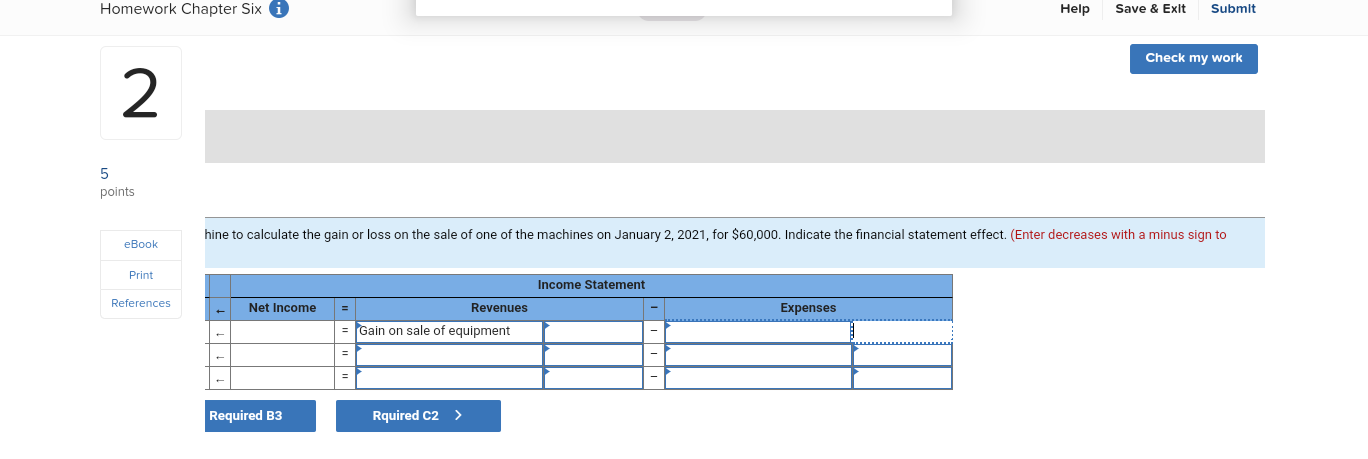

Homework Chapter Six i Saved Help Save & Exit Submit Check my work 2 The balance sheets of HIROE Inc. showed the following at December 31, 2020 and 2019: December 31, 2020 December 31, 2019 Equipment, less accumulated depreciation of $212,625 at December 31, 2020, and $151,875 at December 31, 2019. points $273, 375 $334,125 eBook Print References Required: a. If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amount of the depreciation expense for 2020? b. Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HiROE Inc., is eight years and that there is no estimated salvage value. Determine: 1. What the original cost of the equipment was. 2. What depreciation method is apparently being used. 3. When the equipment was acquired. c. Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model and record the journal entry for the sale of the machine to calculate the gain or loss on the sale of one of the machines on January 2, 2021, for $60,000. Indicate the financial statement effect. Homework Chapter Six Saved 2. Complete this question by entering your answers in the tabs below. 5 points Required A Required B1 Required B2 Required B3 Rquired C1 Rquired C2 eBook Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model for the sale of the mach indicate a negative financial statement effect.) Print References Balance Sheet Liabilities + Stockholders' Equity Assets Equipment Accumulated depreciation Cash (97,200) = 42,525 = 60,000/= Homework Chapter Six i Help Save & Exit Submit Check my work 2 5 points hine to calculate the gain or loss on the sale of one of the machines on January 2, 2021, for $60,000. Indicate the financial statement effect. (Enter decreases with a minus sign to eBook Print Income Statement References Net Income Expenses Revenues = Gain on sale of equipment Required B3 Rquired c2 >