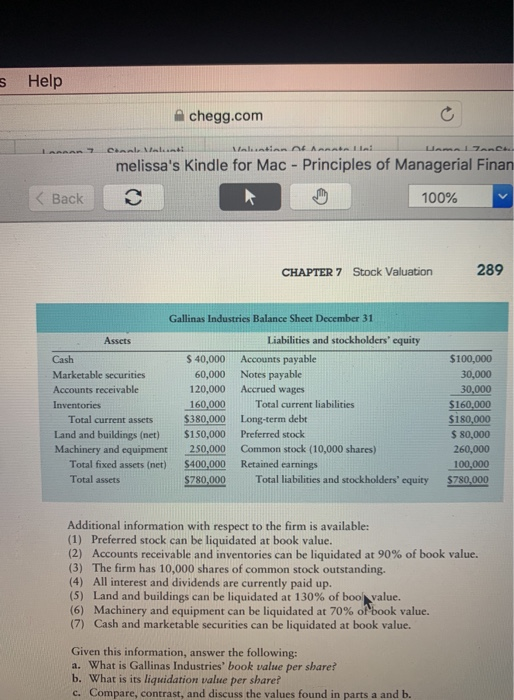

Help chegg.com Canle alamat Walentin Annabella melissa's Kindle for Mac - Principles of Managerial Finan Back 100% CHAPTER 7 Stock Valuation 289 Gallinas Industries Balance Sheet December 31 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Land and buildings (net) Machinery and equipment Total fixed assets (net) Total assets $ 40,000 60,000 120,000 160,000 $380,000 $150,000 250,000 $400,000 $780,000 Liabilities and stockholders' equity Accounts payable Notes payable Accrued wages Total current liabilities Long-term debt Preferred stock Common stock (10,000 shares) Retained earnings Total liabilities and stockholders' equity $100,000 30,000 30,000 $160,000 $180,000 $ 80,000 260,000 100,000 $780,000 Additional information with respect to the firm is available: (1) Preferred stock can be liquidated at book value. (2) Accounts receivable and inventories can be liquidated at 90% of book value. (3) The firm has 10,000 shares of common stock outstanding. (4) All interest and dividends are currently paid up. (5) Land and buildings can be liquidated at 130% of bool value. (6) Machinery and equipment can be liquidated at 70% of book value. (7) Cash and marketable securities can be liquidated at book value. Given this information, answer the following: a. What is Gallinas Industries' book value b. What is its liquidation value per share? c. Compare, contrast, and discuss the values found in parts a and b. per share? Help chegg.com Canle alamat Walentin Annabella melissa's Kindle for Mac - Principles of Managerial Finan Back 100% CHAPTER 7 Stock Valuation 289 Gallinas Industries Balance Sheet December 31 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Land and buildings (net) Machinery and equipment Total fixed assets (net) Total assets $ 40,000 60,000 120,000 160,000 $380,000 $150,000 250,000 $400,000 $780,000 Liabilities and stockholders' equity Accounts payable Notes payable Accrued wages Total current liabilities Long-term debt Preferred stock Common stock (10,000 shares) Retained earnings Total liabilities and stockholders' equity $100,000 30,000 30,000 $160,000 $180,000 $ 80,000 260,000 100,000 $780,000 Additional information with respect to the firm is available: (1) Preferred stock can be liquidated at book value. (2) Accounts receivable and inventories can be liquidated at 90% of book value. (3) The firm has 10,000 shares of common stock outstanding. (4) All interest and dividends are currently paid up. (5) Land and buildings can be liquidated at 130% of bool value. (6) Machinery and equipment can be liquidated at 70% of book value. (7) Cash and marketable securities can be liquidated at book value. Given this information, answer the following: a. What is Gallinas Industries' book value b. What is its liquidation value per share? c. Compare, contrast, and discuss the values found in parts a and b. per share