Answered step by step

Verified Expert Solution

Question

1 Approved Answer

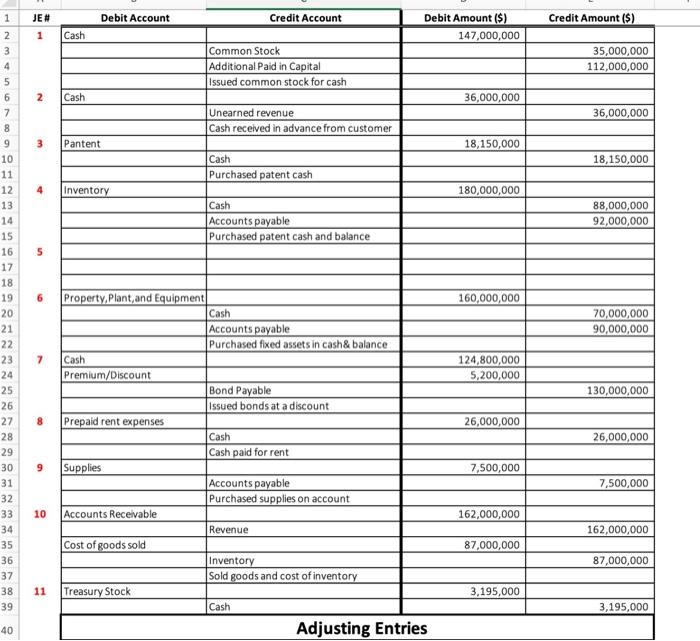

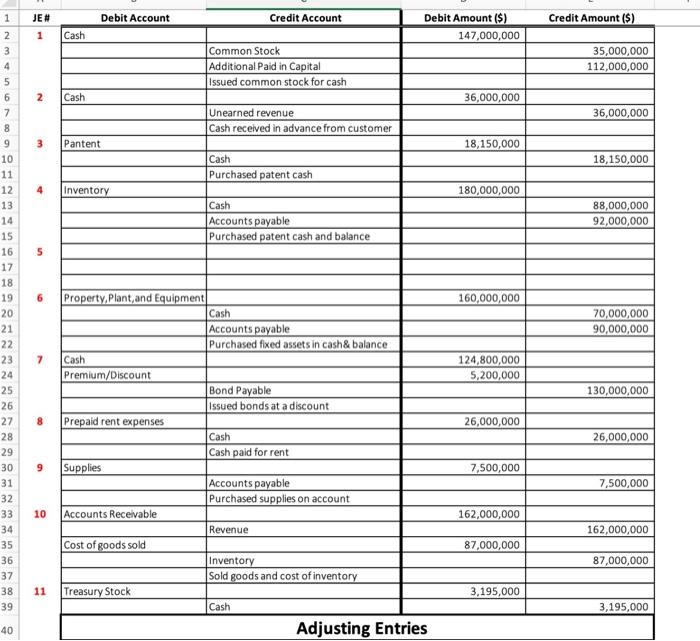

Help complete trial balance and Income statement witj journal entries given. begin{tabular}{|c|c|c|c|c|} hline JE# & Debit Account & Credit Account & Debit Amount ($) &

Help complete trial balance and Income statement witj journal entries given.

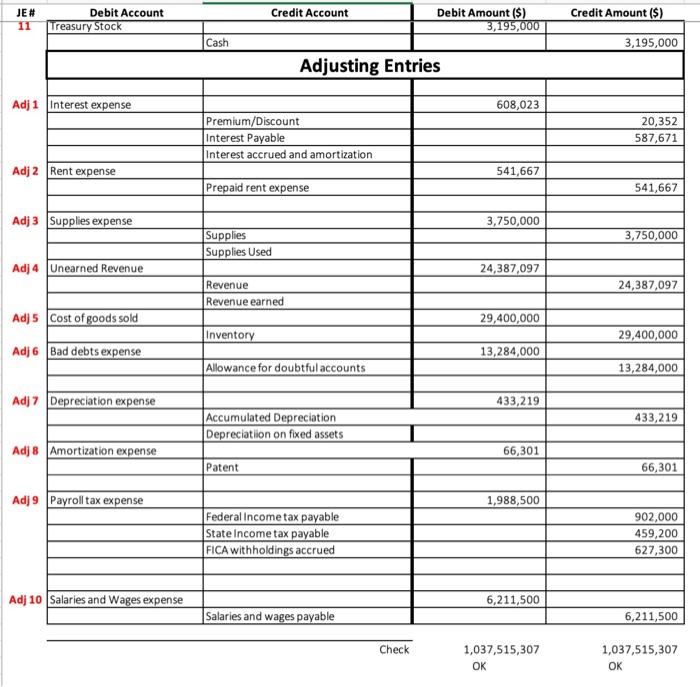

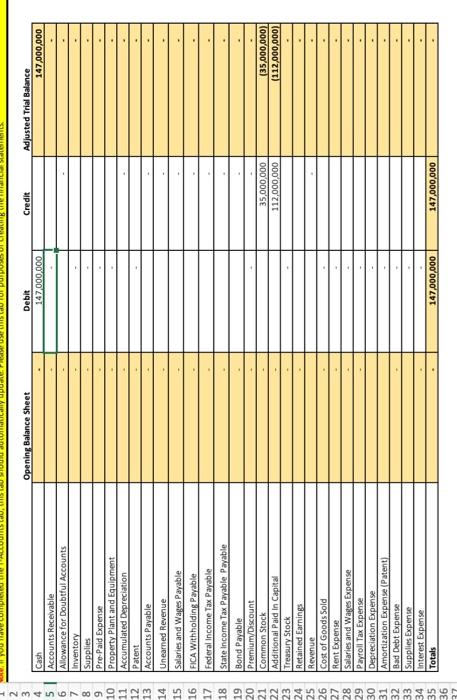

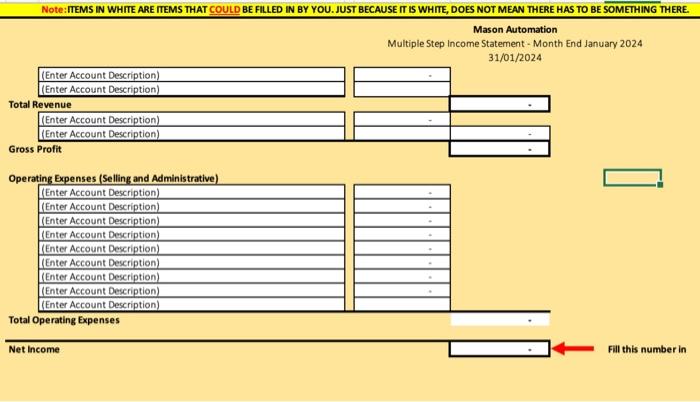

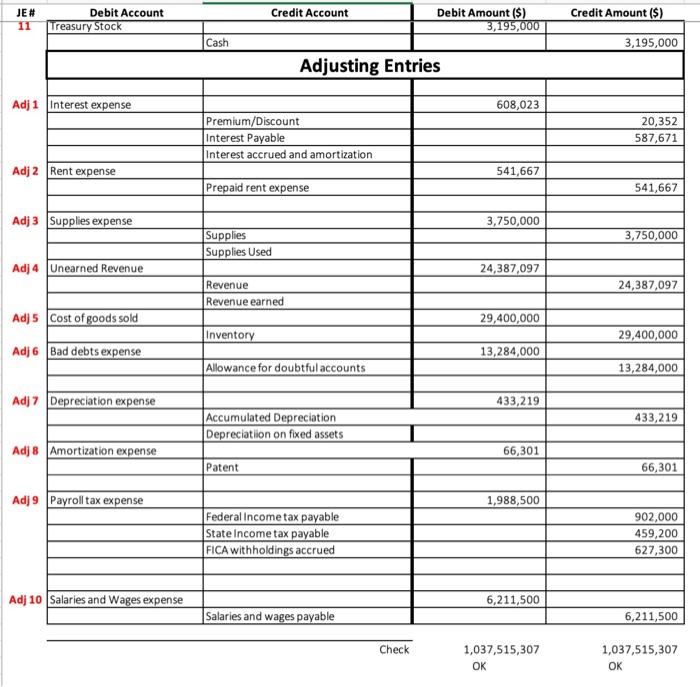

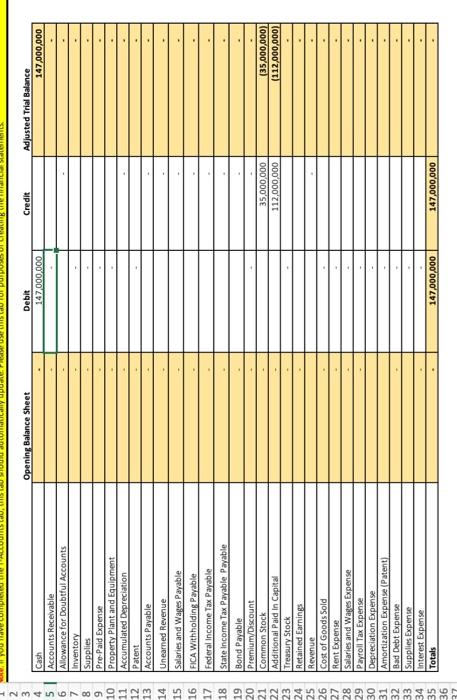

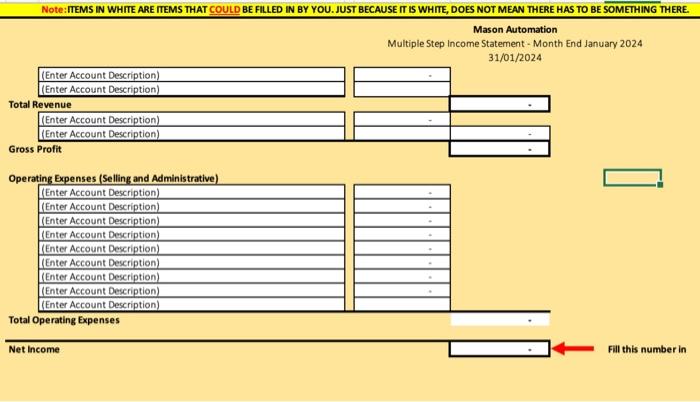

\begin{tabular}{|c|c|c|c|c|} \hline JE\# & Debit Account & Credit Account & Debit Amount (\$) & Credit Amount (\$) \\ \hline \multirow[t]{4}{*}{1} & Cash & & 147,000,000 & \\ \hline & & Common Stock & & 35,000,000 \\ \hline & & Additional Paid in Capital & & 112,000,000 \\ \hline & & Issued common stock for cash & & \\ \hline \multirow[t]{3}{*}{2} & Cash & & 36,000,000 & \\ \hline & & Unearned revenue & & 36,000,000 \\ \hline & & Cash received in advance from customer & & \\ \hline \multirow[t]{3}{*}{3} & Pantent & & 18,150,000 & \\ \hline & & Cash & & 18,150,000 \\ \hline & & Purchased patent cash & & \\ \hline \multirow[t]{4}{*}{4} & Inventory & & 180,000,000 & \\ \hline & & Cash & & 88,000,000 \\ \hline & & Accounts payable & & 92,000,000 \\ \hline & & Purchased patent cash and balance & & \\ \hline \multicolumn{5}{|l|}{5} \\ \hline & & & & \\ \hline \multirow[t]{4}{*}{6} & Property, Plant, and Equipment & & 160,000,000 & \\ \hline & & Cash & & 70,000,000 \\ \hline & & Accounts payable & & 90,000,000 \\ \hline & & Purchased fixed assets in cash\& balance & & \\ \hline \multirow[t]{4}{*}{7} & Cash & & 124,800,000 & \\ \hline & Premium/Discount & & 5,200,000 & \\ \hline & & Bond Payable & & 130,000,000 \\ \hline & & Issued bonds at a discount & & \\ \hline \multirow[t]{3}{*}{8} & Prepaid rent expenses & & 26,000,000 & \\ \hline & & Cash & & 26,000,000 \\ \hline & & Cash paid for rent & & \\ \hline \multirow[t]{3}{*}{9} & Supplies & & 7,500,000 & \\ \hline & & Accounts payable & & 7,500,000 \\ \hline & & Purchased supplies on account & & \\ \hline \multirow[t]{5}{*}{10} & Accounts Receivable & & 162,000,000 & \\ \hline & & Revenue & & 162,000,000 \\ \hline & Cost of goods sold & & 87,000,000 & \\ \hline & & Inventory & & 87,000,000 \\ \hline & & Sold goods and cost of inventory & & \\ \hline \multirow[t]{3}{*}{11} & \begin{tabular}{|l|l|} Treasury Stock \\ \end{tabular} & & 3,195,000 & \\ \hline & & Cash & & 3,195,000 \\ \hline & \multicolumn{4}{|c|}{ Adjusting Entries } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline JE\# & Debit Account & Credit Account & Debit Amount (\$) & Credit Amount (\$) \\ \hline \multirow[t]{3}{*}{11} & Treasury Stock & & 3,195,000 & \\ \hline & & Cash & & 3,195,000 \\ \hline & \multicolumn{4}{|c|}{ Adjusting Entries } \\ \hline & & & & \\ \hline \multirow[t]{4}{*}{ Adj 1} & \begin{tabular}{|l|l|} Interest expense \\ \end{tabular} & & 608,023 & \\ \hline & & Premium/Discount & & 20,352 \\ \hline & & Interest Payable & & 587,671 \\ \hline & & Interest accrued and amortization & & \\ \hline \multirow[t]{2}{*}{ Adj 2} & \begin{tabular}{|l|} Rent expense \\ \end{tabular} & & 541,667 & \\ \hline & & Prepaid rent expense & & 541,667 \\ \hline \multirow{3}{*}{ Adj 3} & Supplies expense & & 3,750,000 & \\ \hline & & Supplies & & 3,750,000 \\ \hline & & Supplies Used & & \\ \hline \multirow[t]{3}{*}{ Adj 4} & Unearned Revenue & & 24,387,097 & \\ \hline & & Revenue & & 24,387,097 \\ \hline & & Revenue earned & & \\ \hline \multirow[t]{2}{*}{ Adj 5} & Cost of goods sold & & 29,400,000 & \\ \hline & & Inventory & & 29,400,000 \\ \hline \multirow[t]{3}{*}{ Adj 6} & Bad debts expense & & 13,284,000 & \\ \hline & & Allowance for doubtful accounts & & 13,284,000 \\ \hline & & & & \\ \hline \multirow[t]{3}{*}{ Adj 7} & Depreciation expense & & 433,219 & \\ \hline & & Accumulated Depreciation & & 433,219 \\ \hline & & Depreciatilion on fixed assets & & \\ \hline \multirow[t]{2}{*}{ Adj 8} & Amortization expense & & 66,301 & \\ \hline & & Patent & & 66,301 \\ \hline \multirow{6}{*}{ Adj 9} & Payrolltax expense & & 1988.500 & \\ \hline & & Federal Income tax payable & & 902,000 \\ \hline & & State Income tax payable & & 459,200 \\ \hline & & FICA withholdings accrued & & 627,300 \\ \hline & & & & \\ \hline & & & & \\ \hline \multirow{2}{*}{ Adj 10} & Salaries and Wages expense & Salaries and wages payable & 6,211,500 & 6,211,500 \\ \hline & & Check & \begin{tabular}{l} 1,037,515,307 \\ OK \end{tabular} & \begin{tabular}{l} 1,037,515,307 \\ OK \end{tabular} \\ \hline \end{tabular} Opening Balance Sheet \begin{tabular}{|c|c|c|c|c|} \hline & Opening Balance Sheet & Debit & Credit & Adjusted Trial Balance \\ \hline Cash & & 147,000,000 & & 147,000,000 \\ \hline Accounts Receivable & + & + & & + \\ \hline Allowance for Doubtful Accounts & - & & - & + \\ \hline \begin{tabular}{|l|l|} Inventory \\ \end{tabular} & & + & & + \\ \hline Supplies & - & & & . \\ \hline Pre-Paid Expense & & & & \\ \hline Property Plant and Equipment & - & & & . \\ \hline Accumulated Depreciation & - & & & . \\ \hline Patent & & - & & + \\ \hline Accounts Payable & - & & & + \\ \hline Unearned Revenue & . & & - & - \\ \hline Salaries and Wages Payable & & & - & - \\ \hline FICA Withholding Payable & . & & = & - \\ \hline Federal Income Tax Payable & = & & = & . \\ \hline State income Tax Payable Payable & - & &. &. \\ \hline Bond Payable. & & & - &. \\ \hline Premium/Discount & + & - & - & \\ \hline Common Stock & - & & 35,000,000 & (35,000,000) \\ \hline Additional Paid in Capital & + & & 112,000,000 & (112,000,000) \\ \hline Treasury Stock & & + & & + \\ \hline Retained Earnings & = & & & \\ \hline Revenue & & & + &. \\ \hline Cost of Goods Sold & = & = & & + \\ \hline Rent Expense & - & -. & & \\ \hline Salaries and Wages Expense. & - & - & & \\ \hline Payroll Tax Expense & - & - & & \\ \hline Depreciation Expense & & - & & + \\ \hline Amortization Expense (Patent) & & + & & \\ \hline Bad Debt Expense & + & + & & \\ \hline Supplies Expense & & & & \\ \hline Interest Expense & . & = & & . \\ \hline Totals & . & 147,000,000 & 147,000,000 &. \\ \hline \end{tabular} NOTE:ITEMS IN WHITE ARE ITEMS THAT COULD BE FILLED IN BY YOU. JUST BECAUSE IT IS WHITE, DOES NOT MEAN THERE HAS TO BE SOMETHING THERE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started