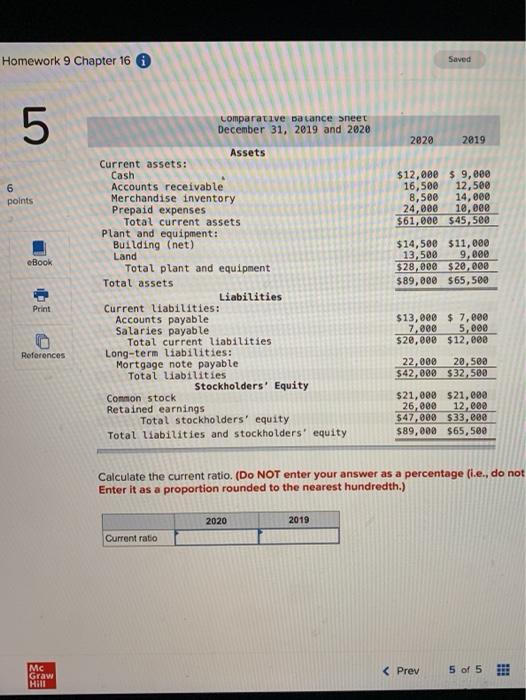

help find the current ratio

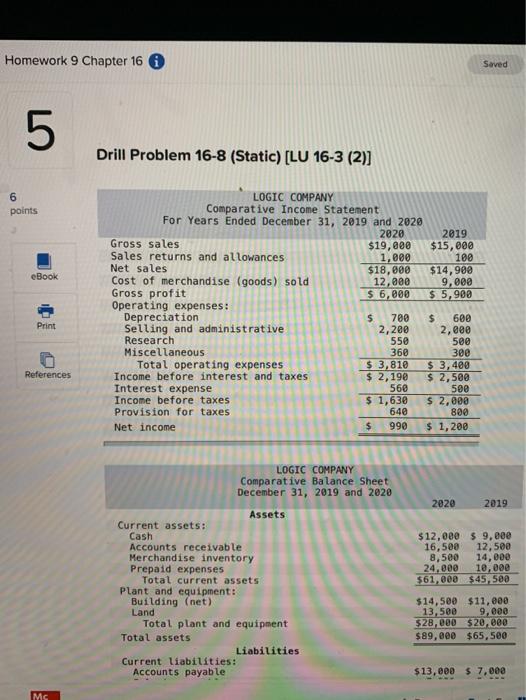

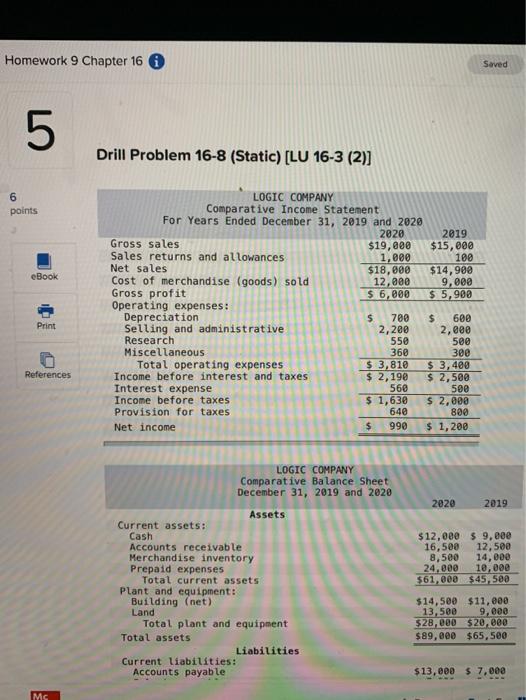

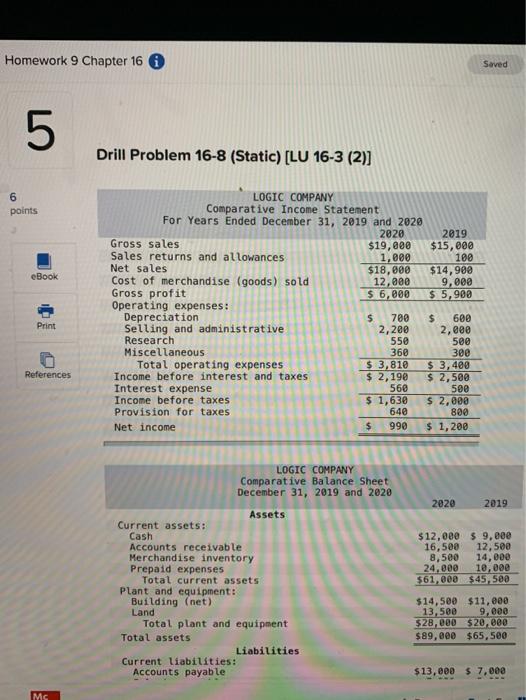

Homework 9 Chapter 16 Saved 5 Drill Problem 16-8 (Static) [LU 16-3 (2)] 6 points eBook LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2019 and 2028 2028 2019 Gross sales $19,000 $15,000 Sales returns and allowances 1,000 100 Net sales $18,000 $14,900 Cost of merchandise (goods) sold 12,000 9,000 Gross profit $ 6,000 $ 5,900 Operating expenses: Depreciation $ 700 $ 600 Selling and administrative 2,280 2,000 Research 550 500 Miscellaneous 360 300 Total operating expenses $ 3,810 $ 3,400 Income before interest and taxes $ 2,190 $ 2,500 Interest expense 560 500 Income before taxes $ 1,630 $ 2,000 Provision for taxes 640 800 Net income $ 990 $ 1,200 Print References 2020 2019 LOGIC COMPANY Comparative Balance Sheet December 31, 2019 and 2020 Assets Current assets! Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) Land Total plant and equipment Total assets Liabilities Current liabilities: Accounts payable $12,000 $9,000 16,500 12,500 8,500 14,000 24,000 10,000 $61,000 $45,500 $14,500 $11,000 13,500 9,000 $28,000 $20,000 $89,000 $65,500 $13,000 $7,000 Mc Homework 9 Chapter 16 Saved 5 2020 2019 6 points $12,000 $9,000 16,500 12,500 8,500 14,000 24,000 10,000 $61,000 $45,500 eBook comparative balance sheet December 31, 2019 and 2020 Assets Current assets: Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) Land Total plant and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term liabilities: Mortgage note payable Total liabilities Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $14,500 $11,000 13,500 9,000 $28,000 $20,000 $89,000 565,500 Print sourcen $13,000 $ 7,000 7,000 5,000 $20,000 $12,008 References 22,000 20.500 $42,000 $32,500 $21,000 $21,000 26,000 12,000 $47,000 $33,000 $89,000 $65,500 Calculate the current ratio. (Do NOT enter your answer as a percentage (i.e., do not Enter it as a proportion rounded to the nearest hundredth.) 2020 2019 Current ratio Mc Graw Hill