undefined

undefined

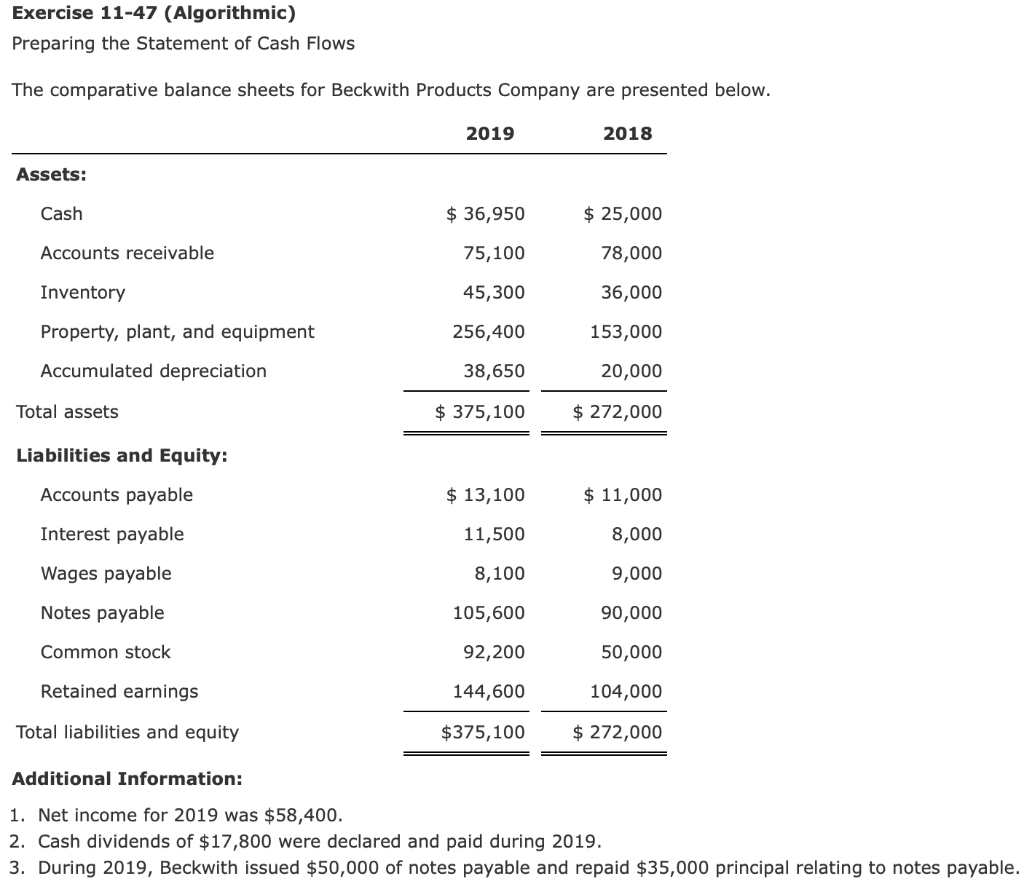

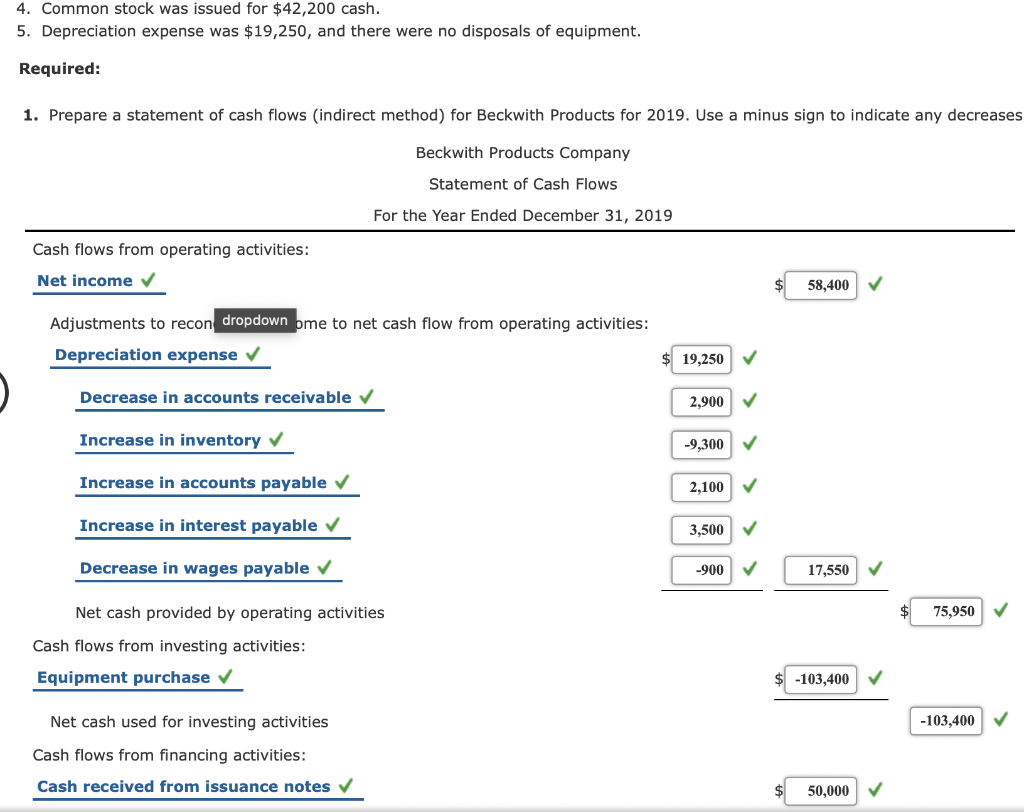

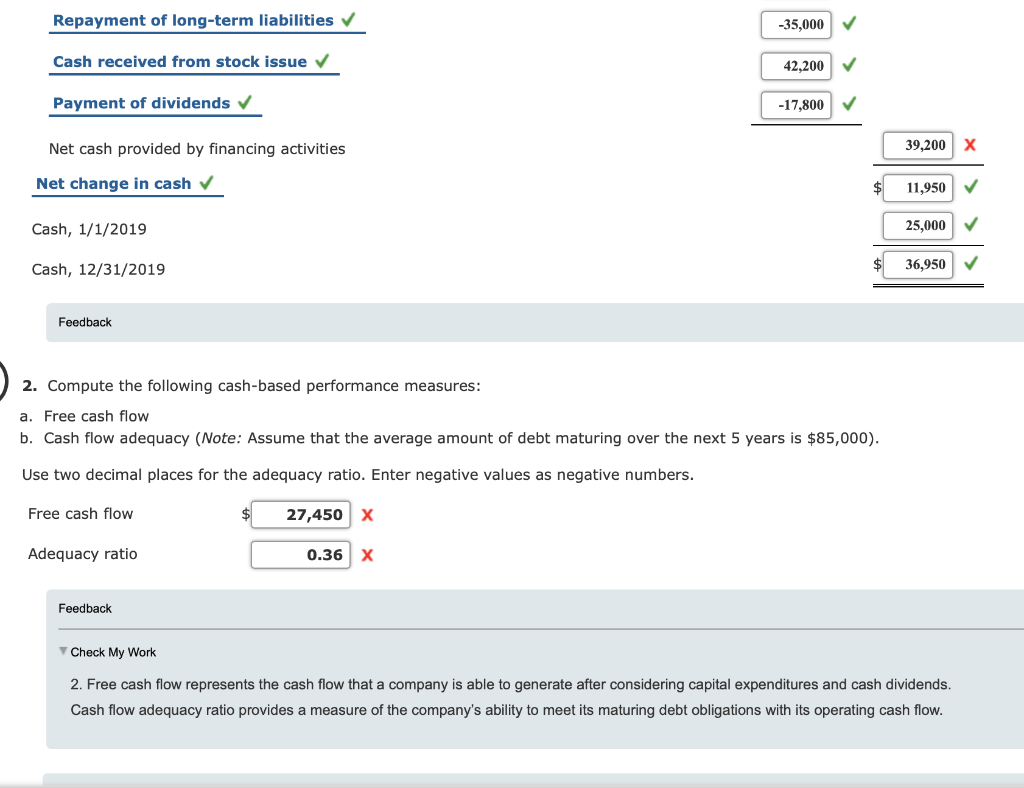

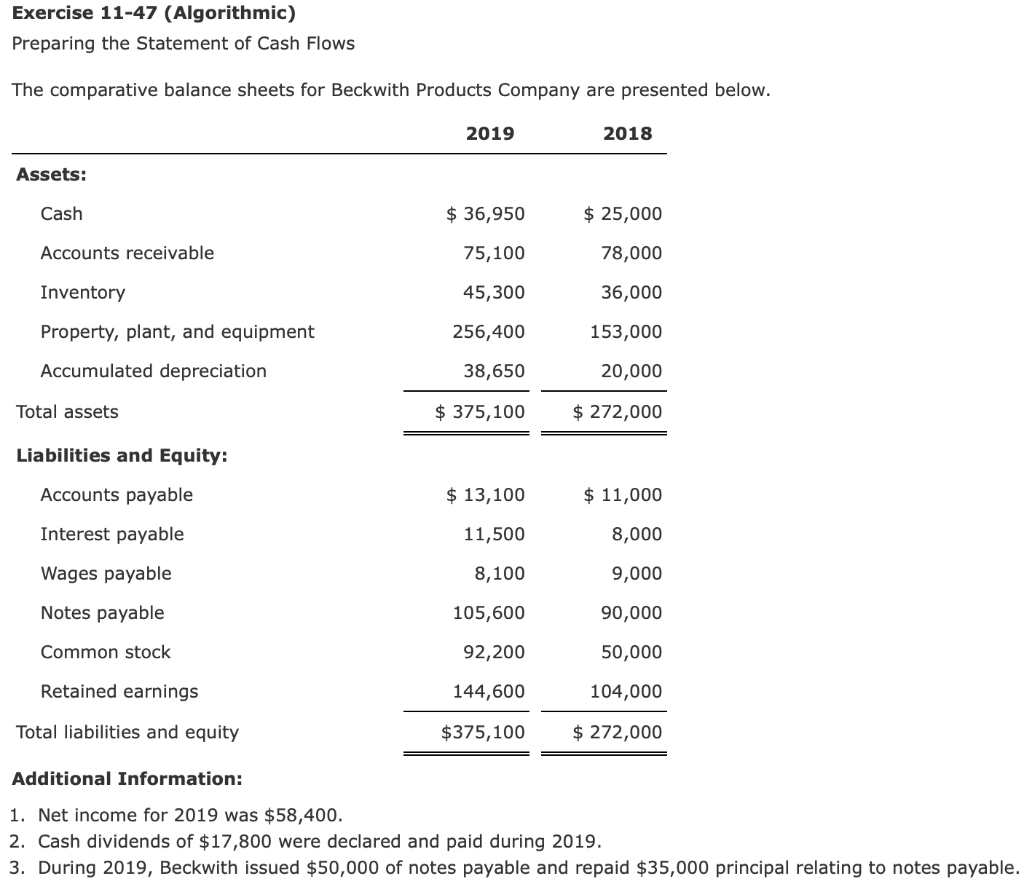

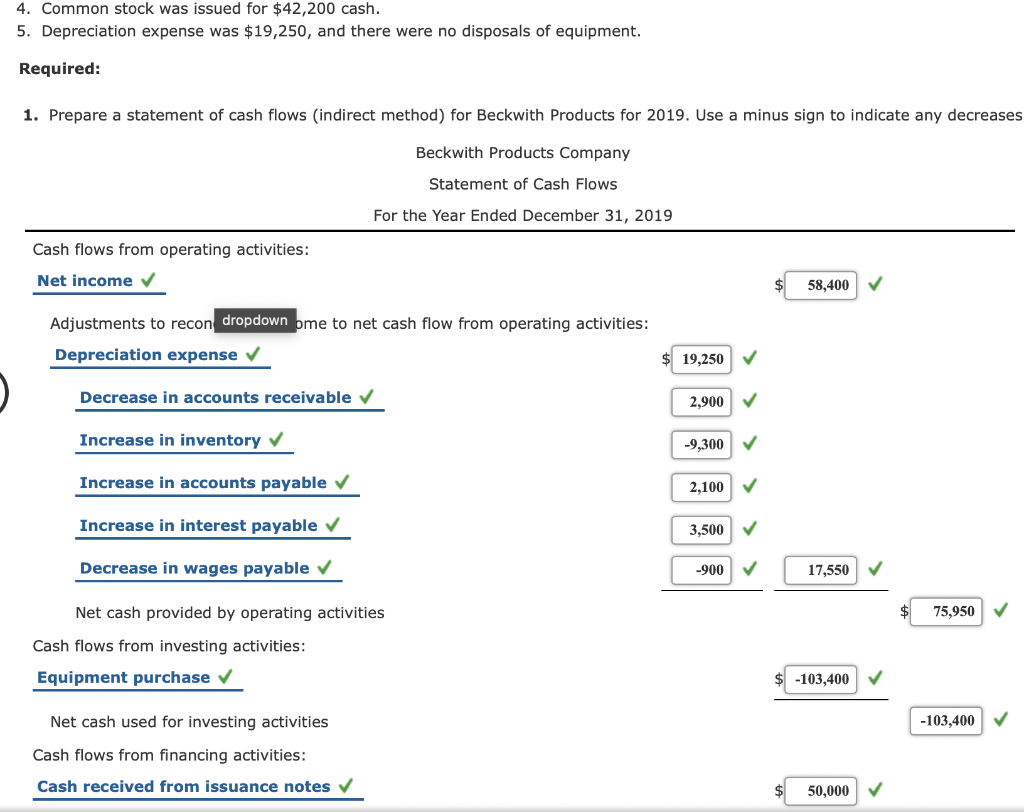

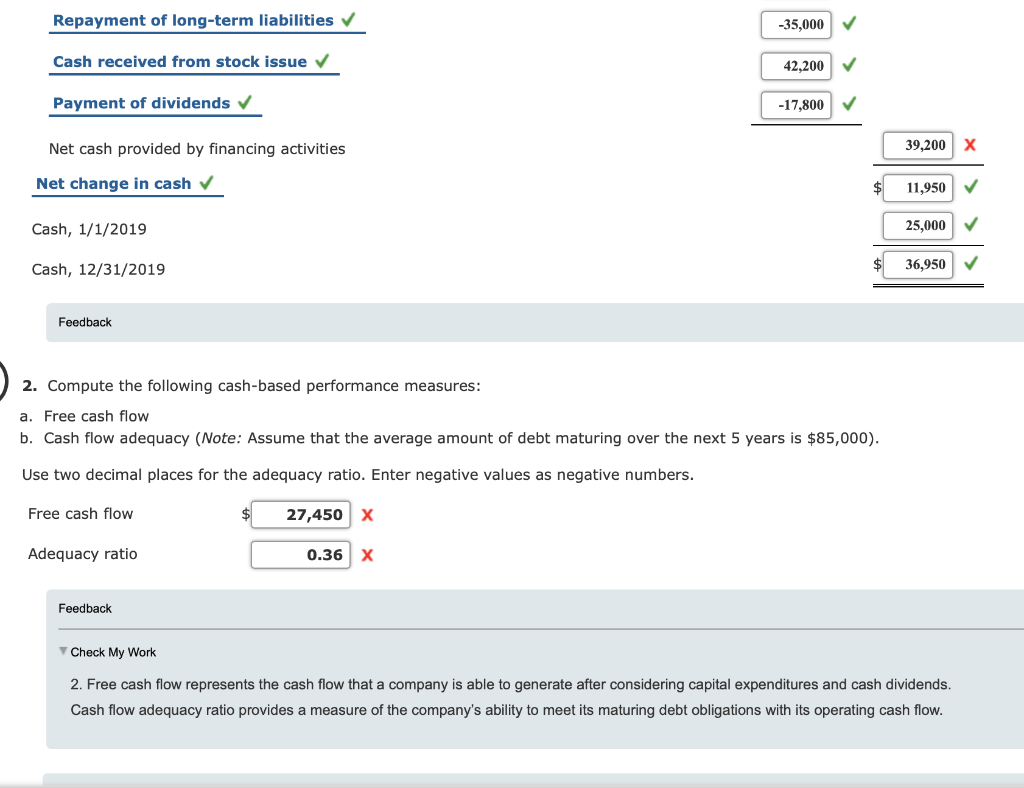

Exercise 11-47 (Algorithmic) Preparing the Statement of Cash Flows The comparative balance sheets for Beckwith Products Company are presented below. 2019 2018 Assets: Cash $ 36,950 $ 25,000 Accounts receivable 75,100 78,000 Inventory 45,300 36,000 Property, plant, and equipment 256,400 153,000 Accumulated depreciation 38,650 20,000 Total assets $ 375,100 $ 272,000 Liabilities and Equity: Accounts payable $ 13,100 $ 11,000 Interest payable 11,500 8,000 Wages payable 8,100 9,000 Notes payable 105,600 90,000 Common stock 92,200 50,000 Retained earnings 144,600 104,000 Total liabilities and equity $375,100 $ 272,000 Additional Information: 1. Net income for 2019 was $58,400. 2. Cash dividends of $17,800 were declared and paid during 2019. 3. During 2019, Beckwith issued $50,000 of notes payable and repaid $35,000 principal relating to notes payable. 4. Common stock was issued for $42,200 cash. 5. Depreciation expense was $19,250, and there were no disposals of equipment. Required: 1. Prepare a statement of cash flows (indirect method) for Beckwith Products for 2019. Use a minus sign to indicate any decreases Beckwith Products Company Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating activities: Net income 58,400 Adjustments to recon dropdown ome to net cash flow from operating activities: Depreciation expense 19,250 Decrease in accounts receivable 2,900 Increase in inventory -9,300 Increase in accounts payable 2,100 Increase in interest payable 3,500 Decrease in wages payable -900 17,550 75,950 Net cash provided by operating activities Cash flows from investing activities: Equipment purchase -103,400 -103,400 Net cash used for investing activities Cash flows from financing activities: Cash received from issuance notes 50,000 Repayment of long-term liabilities -35,000 Cash received from stock issue 42,200 Payment of dividends -17,800 39,200 Net cash provided by financing activities Net change in cash 11,950 Cash, 1/1/2019 25,000 Cash, 12/31/2019 36,950 Feedback 2. Compute the following cash-based performance measures: a. Free cash flow b. Cash flow adequacy (Note: Assume that the average amount of debt maturing over the next 5 years is $85,000). Use two decimal places for the adequacy ratio. Enter negative values as negative numbers. Free cash flow 27,450 X Adequacy ratio 0.36X Feedback Check My Work 2. Free cash flow represents the cash flow that a company is able to generate after considering capital expenditures and cash dividends. Cash flow adequacy ratio provides a measure of the company's ability to meet its maturing debt obligations with its operating cash flow

undefined

undefined