Answered step by step

Verified Expert Solution

Question

1 Approved Answer

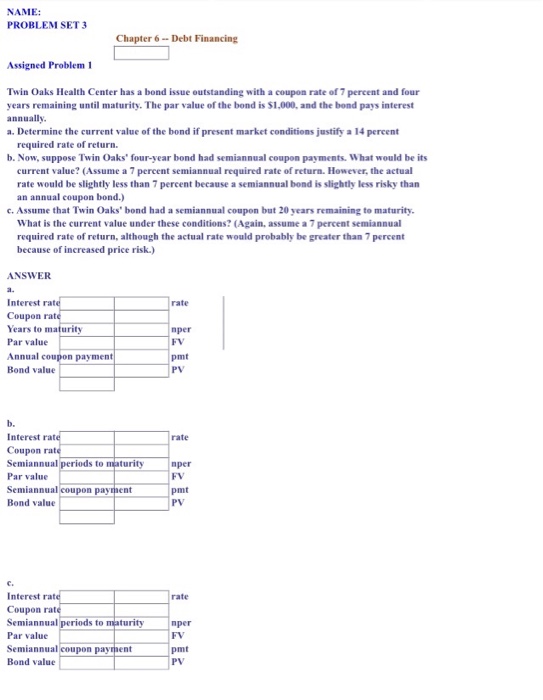

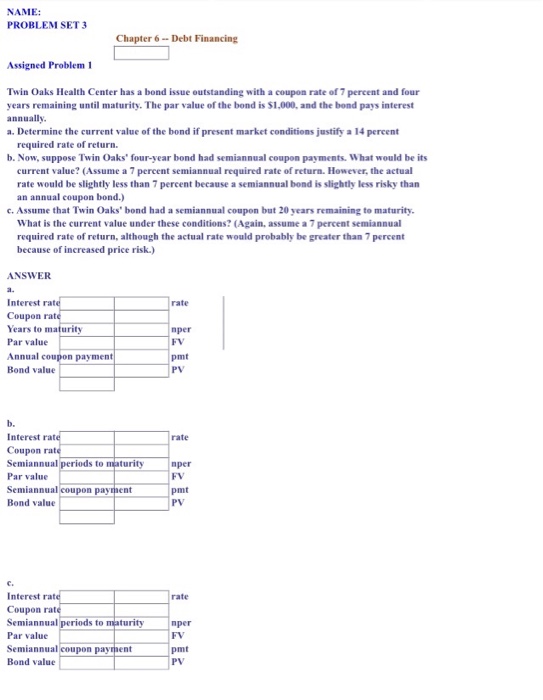

Help! From the Understanding Fundamentals of Healthcare Management, Gapenski NAME: PROBLEM SET 3 Chapter 6 Debt Financing Assigned Problem Twin Oaks Health Center has a

Help! From the Understanding Fundamentals of Healthcare Management, Gapenski

NAME: PROBLEM SET 3 Chapter 6 Debt Financing Assigned Problem Twin Oaks Health Center has a bond issue outstanding with a coupon rate of7percent and four years remaining until maturity. The par value of the bond is S1 000, and the bond pays interest annually a. Determine the current value of the bond if present market conditions justify a l4 percent required rate of return. b. Now, suppose Twin Oaks' four-year bond had semiannual coupon payments. What would be its current value? (Assume a 7 percent semiannual required rate of return. However, the actual rate would be slightly less than 7 percent because a semiannual bond is slightly less risky than an annual coupon bond.) c Assume that Twin Oaks' bond had a semiannual coupon but 20 years remaining to maturity. What is the current value under these conditions? (Again, assume a 7 percent semiannual required rate of return. although the actual rate would probably be greater than 7percent because of increased price risk.) ANSWER Interest rat rate Coupon rate Years to maturity nper Par value FV Annual coupon payment pmt Bond value PV Interest ra rate Coupon rate Semiannual periods to maturity nper Par value FV Semiannual coupon payment Bond value PV Interest ra rate Coupon rate Semiannual periods to maturity nper Par value Semiannual coupon pay ent t Bond value PV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started