Answered step by step

Verified Expert Solution

Question

1 Approved Answer

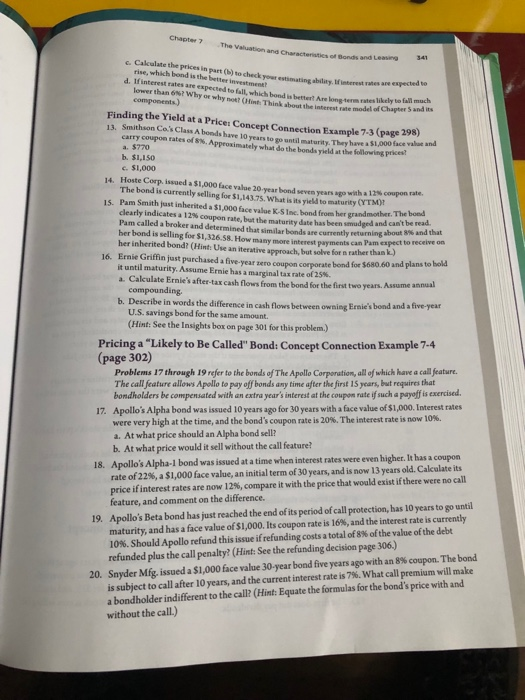

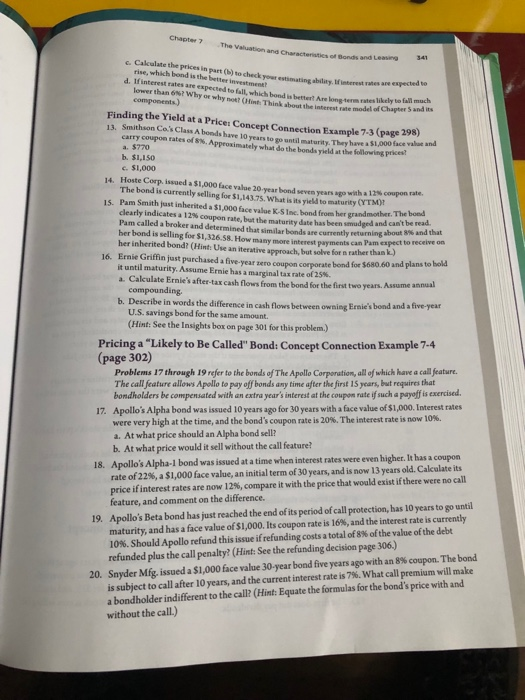

Help! I need shown how to do #17! Chapter 7 The Valuation and of Bonds and Leasing 341 c. Cakculate the prices in part (b)

Help! I need shown how to do #17!

Chapter 7 The Valuation and of Bonds and Leasing 341 c. Cakculate the prices in part (b) to check yoer estimating abdlity.If inberest ranes rise, which bond is the d. If interest rates are expected to fall, which bond is better? Are long term lower than 6%? Why or why not? (Hint Thin.bout the inter estrate modelof Chape rates likely to fall much Finding the Yield at a Price: Co 13. Smithson Cos Class A bonds have 10 ncept Connection Example 7-3 (page 298) years to go until maturity.They have a $1,000 face value and carry coupon fates of 8%. Approximately what do the bonds yield at the ng Pos b. $1,150 c. $1,000 14. Hoste Corp. issued a s1,000 face value 20-year bond seven years ago with a 12% coupon rate. 15. Pam Smith jast inherited a $1,000face value K-S Inc. bond fromm her grandmother. The bond The bond is currently selling for $1,143.75. What is its yield to maturity (YTM) clearly indicates a 12% coupon rate, but the maturity date has been smudged and can't be read Pam called a broker and determined that similar bonds are currently returning about her bond is selling for $1,326.58. How many more interest payments can Pam espect to re her inherited bond? (Hint: Use an iterative approach, but solve for n rather than k) 8% and that 16. Ernie Griffin just parchased a five-year sero coupon corporate bond for $680.60 and plans to it until maturity. Assume Ernie has a marginal tax rate of 25%. a. Calculate Ernie's after-tax cash flows from the bond for the first two years b. Describe in words the difference in cash flows between owning Ernie's bond and a five-year U.S. savings bond for the same amount (Hint: See the Insights box on page 301 for this problem.) Pricing a "Likely to Be Called" Bond: Concept Connection Example 7-4 (page 302) Problems 17 through 19 refer to the bonds of The Apollo Corporation, all of which have a call jeature. The call feature allows Apollo to pay off bonds any time after the first 15 years, but requires that bondholders be compensated with an extra year's interest at the coupon rate if such a payoffis exercised. Apollo's Alpha bond was issued 10 years ago for 30 years with a face value of $1,000. Interest rates were very high at the time, and the bond's coupon rate is 20%. The interest rate is now 10%. a. At what price should an Alpha bond sell? b. At what price would it sell without the call feature? Apollo's Alpha-1 bond was issued at a time when interest rates were even higher. It has a coupon rate of22%, a $1,000 face value, an initial term of 30 years, and is now i3 years old. Calculate its price if interest rates are now i2%, compare it with the price that would exist if there were no call feature, and comment on the difference. 17. 18. Apollo's Beta bond has just reached the end of its period of call protection, has 10 years to go until maturity, and has a face value of $1,000. Its coupon rate is 16%, and the interest rate is currently 10%. Should Apollo refund this issue ifrefunding costs a total of 8% of the value of the debt refunded plus the call penalty? (Hint: See the refunding decision page 306.) 19. 20. Snyder Mfg issued a $1,000 face value 30-year bond five years ago with an 8% coupon. The bond a bondholder indifferent to the call (Hint: Equate the formulas for the bond's price with and without the call.) is subject to call after 10 years, and the current interest rate is 7%, what call premium will make

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started