Answered step by step

Verified Expert Solution

Question

1 Approved Answer

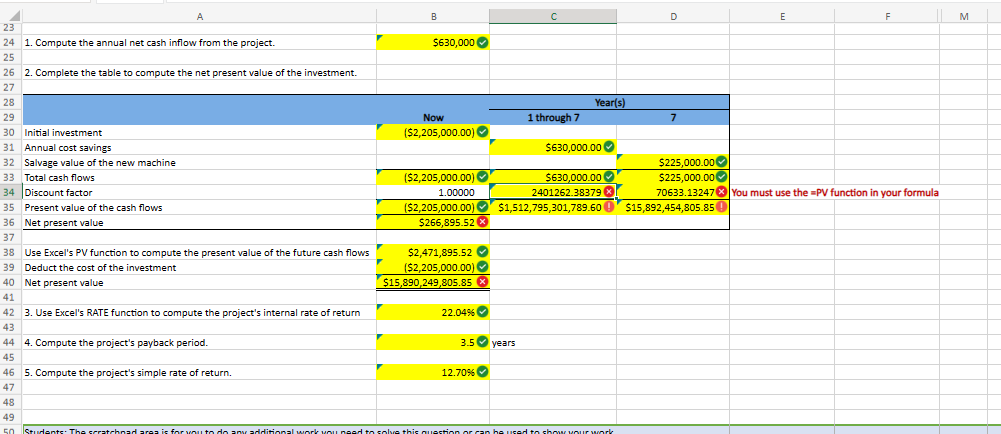

HELP! I'M GETTING THE WRONG ANSWER BECAUSE I DON'T KNOW HOW TO USE THE PV FUNCTION IN EXCEL. PLEASE GIVE FORMULA AND EXPLAIN HOW TO

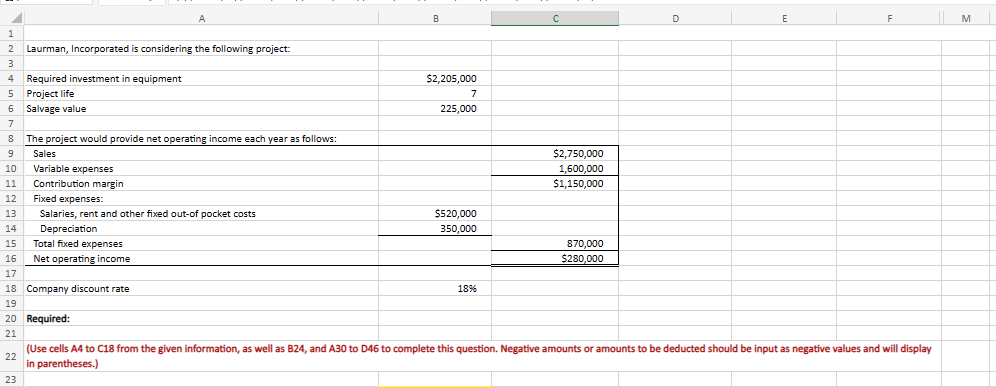

HELP! I'M GETTING THE WRONG ANSWER BECAUSE I DON'T KNOW HOW TO USE THE PV FUNCTION IN EXCEL. PLEASE GIVE FORMULA AND EXPLAIN HOW TO USE THE PV FUNCTION IN EXCEL FOR CELLS C34 AND D34 THE DISCOUNT FACTOR. PEASE DONT ANSWER UNLESS YOU PUT SPECIFIC DETAILS ON HOW TO USE PV FUNCTION IN EXCEL. PLEASE ONLY HELP ME CORRECT WRONG ANSWERS MARKED IN RED. THANK YOU!!!

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & M \\ \hline \multicolumn{8}{|l|}{1} \\ \hline 2 & Laurman, Incorporated is considering the following project: & & & & & & \\ \hline \multicolumn{8}{|l|}{3} \\ \hline 4 & Required investment in equipment & $2,205,000 & & & & & \\ \hline 5 & Project life & 7 & & & & & \\ \hline 6 & Salvage value & 225,000 & & & & & \\ \hline \multicolumn{8}{|l|}{7} \\ \hline 8 & The project would provide net operating income each year as follows: & & & & & & \\ \hline 9 & Sales & & $2,750,000 & & & & \\ \hline 10 & Variable expenses & & 1,600,000 & & & & \\ \hline 11 & Contribution margin & & $1,150,000 & & & & \\ \hline 12 & Fixed expenses: & & & & & & \\ \hline 13 & Salaries, rent and other fixed out-of pocket costs & $520,000 & & & & & \\ \hline 14 & Depreciation & 350,000 & & & & & \\ \hline 15 & Total fixed expenses & & 870,000 & & & & \\ \hline 16 & Net operating income & & $280,000 & & & & \\ \hline \multicolumn{8}{|l|}{17} \\ \hline 18 & Company discount rate & 18% & & & & & \\ \hline \multicolumn{8}{|l|}{19} \\ \hline 20 & Required: & & & & & & \\ \hline \multicolumn{8}{|l|}{21} \\ \hline 22 & \begin{tabular}{l} (Use cells A4 to C18 from the given information, as well as B24, and A3 \\ in parentheses.) \end{tabular} & this que & & & & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & M \\ \hline \multicolumn{8}{|l|}{1} \\ \hline 2 & Laurman, Incorporated is considering the following project: & & & & & & \\ \hline \multicolumn{8}{|l|}{3} \\ \hline 4 & Required investment in equipment & $2,205,000 & & & & & \\ \hline 5 & Project life & 7 & & & & & \\ \hline 6 & Salvage value & 225,000 & & & & & \\ \hline \multicolumn{8}{|l|}{7} \\ \hline 8 & The project would provide net operating income each year as follows: & & & & & & \\ \hline 9 & Sales & & $2,750,000 & & & & \\ \hline 10 & Variable expenses & & 1,600,000 & & & & \\ \hline 11 & Contribution margin & & $1,150,000 & & & & \\ \hline 12 & Fixed expenses: & & & & & & \\ \hline 13 & Salaries, rent and other fixed out-of pocket costs & $520,000 & & & & & \\ \hline 14 & Depreciation & 350,000 & & & & & \\ \hline 15 & Total fixed expenses & & 870,000 & & & & \\ \hline 16 & Net operating income & & $280,000 & & & & \\ \hline \multicolumn{8}{|l|}{17} \\ \hline 18 & Company discount rate & 18% & & & & & \\ \hline \multicolumn{8}{|l|}{19} \\ \hline 20 & Required: & & & & & & \\ \hline \multicolumn{8}{|l|}{21} \\ \hline 22 & \begin{tabular}{l} (Use cells A4 to C18 from the given information, as well as B24, and A3 \\ in parentheses.) \end{tabular} & this que & & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started