Help, Inc., a tax-exempt organization, incurs lobbying expenses of $225,000 during the tax year. Help is eligible for and makes the 501(h) lobbying expenditure election. During the year, Help spends $850,000 carrying out its exempt mission. A. Will the lobbying expenses result in Help, Inc. jeopardize its exempt status? Explain Calculate the amount of any tax that Help must pay associated with the lobbying expenses. (Show necessary computation). B. Assume same facts except that Help incurs lobbing expenses of $150,000. Will the lobbying expenses result in Help, Inc. jeopardize its exempt status? Explain. Calculate the amount of any tax that Help must pay associated with the lobbying expenses. (Show necessary computation)

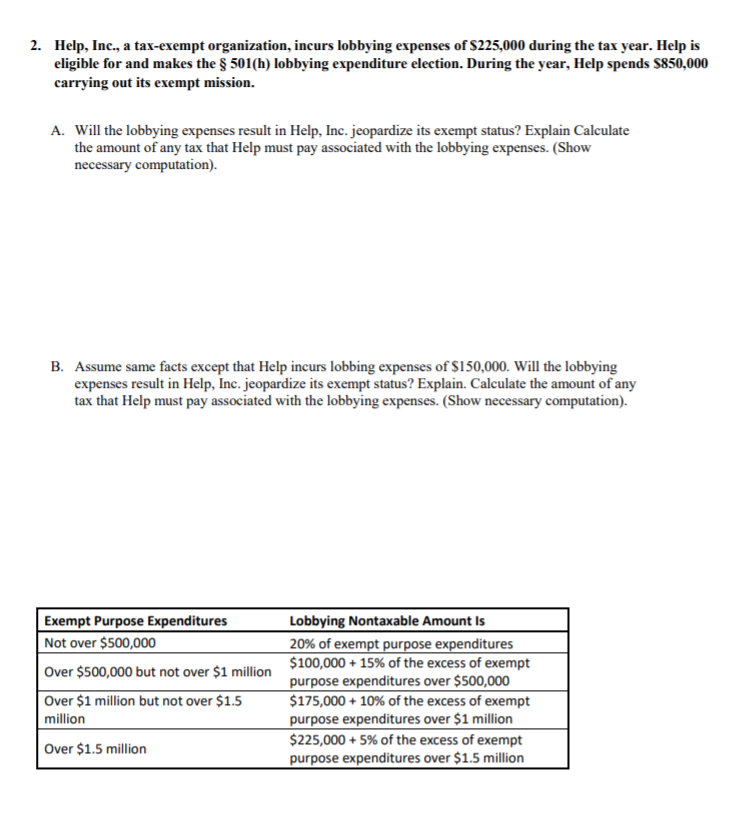

2. Help, Inc., a tax-exempt organization, incurs lobbying expenses of $225,000 during the tax year. Help is eligible for and makes the $ 501(h) lobbying expenditure election. During the year, Help spends $850,000 carrying out its exempt mission. A. Will the lobbying expenses result in Help, Inc. jeopardize its exempt status? Explain Calculate the amount of any tax that Help must pay associated with the lobbying expenses. (Show necessary computation). B. Assume same facts except that Help incurs lobbing expenses of $150,000. Will the lobbying expenses result in Help, Inc. jeopardize its exempt status? Explain. Calculate the amount of any tax that Help must pay associated with the lobbying expenses. (Show necessary computation). Exempt Purpose Expenditures Not over $500,000 Over $500,000 but not over $1 million Over $1 million but not over $1.5 million Lobbying Nontaxable Amount is 20% of exempt purpose expenditures $100,000+ 15% of the excess of exempt purpose expenditures over $500,000 $175,000 + 10% of the excess of exempt purpose expenditures over $1 million $225,000 + 5% of the excess of exempt purpose expenditures over $1.5 million Over $1.5 million 2. Help, Inc., a tax-exempt organization, incurs lobbying expenses of $225,000 during the tax year. Help is eligible for and makes the $ 501(h) lobbying expenditure election. During the year, Help spends $850,000 carrying out its exempt mission. A. Will the lobbying expenses result in Help, Inc. jeopardize its exempt status? Explain Calculate the amount of any tax that Help must pay associated with the lobbying expenses. (Show necessary computation). B. Assume same facts except that Help incurs lobbing expenses of $150,000. Will the lobbying expenses result in Help, Inc. jeopardize its exempt status? Explain. Calculate the amount of any tax that Help must pay associated with the lobbying expenses. (Show necessary computation). Exempt Purpose Expenditures Not over $500,000 Over $500,000 but not over $1 million Over $1 million but not over $1.5 million Lobbying Nontaxable Amount is 20% of exempt purpose expenditures $100,000+ 15% of the excess of exempt purpose expenditures over $500,000 $175,000 + 10% of the excess of exempt purpose expenditures over $1 million $225,000 + 5% of the excess of exempt purpose expenditures over $1.5 million Over $1.5 million