Answered step by step

Verified Expert Solution

Question

1 Approved Answer

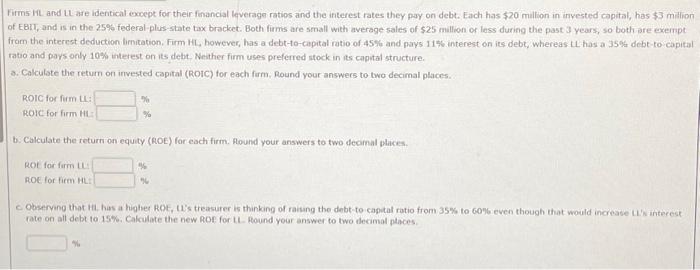

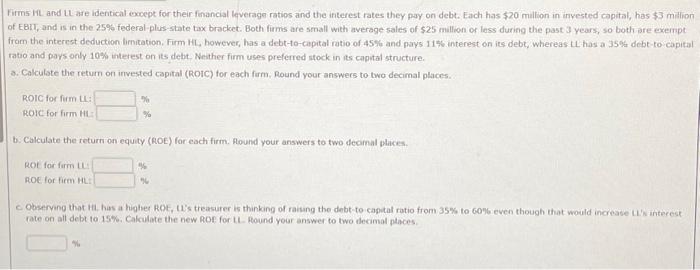

Help is appreciated, will leave upvote for correct answers Firms HL and LL are identical exoept for their financial leverage ratios and the interest rates

Help is appreciated, will leave upvote for correct answers

Firms HL and LL are identical exoept for their financial leverage ratios and the interest rates they pay on debt. Each has $20 mullion in invested capital, has $3 million of EBI, and is in the 25% federal-plus -state tax bracket. Both firms are small with average sales of $25 million or less during the past 3 years, so both are exempt from the interest deduction limitation. Firm HL, however, has a debt-to-capital ratio of 45% and pays 11%6 interest on its debt, whereas 4L has a 35% debt-to capital ratio and pays only 10% interest on its debt. Neither firm uses preferred stock in its capital structure. a. Calculate the retum on invested capital (ROIC) for each firm, Round your answers to two decimal places. ROIC for firm U: Roic for firm HL: b. Calculate the return on equity (AOE) for each firm. Plound your answers to two decamal places. ROE for farm te: ROE for fiem HL: rate on all debt to 15%. Cakculate the new ROE for L. Plound your answer to two decimal ptaces

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started