help me anwser these please along with the correct EXCEL formulas! thank you!

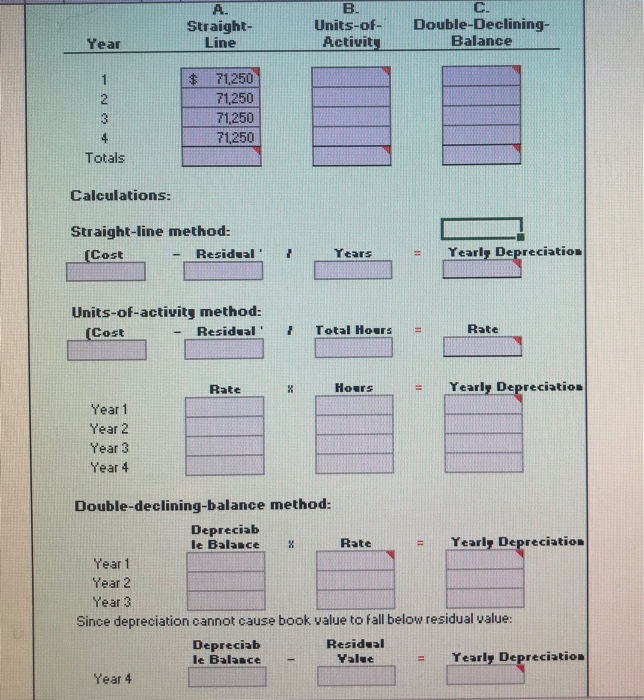

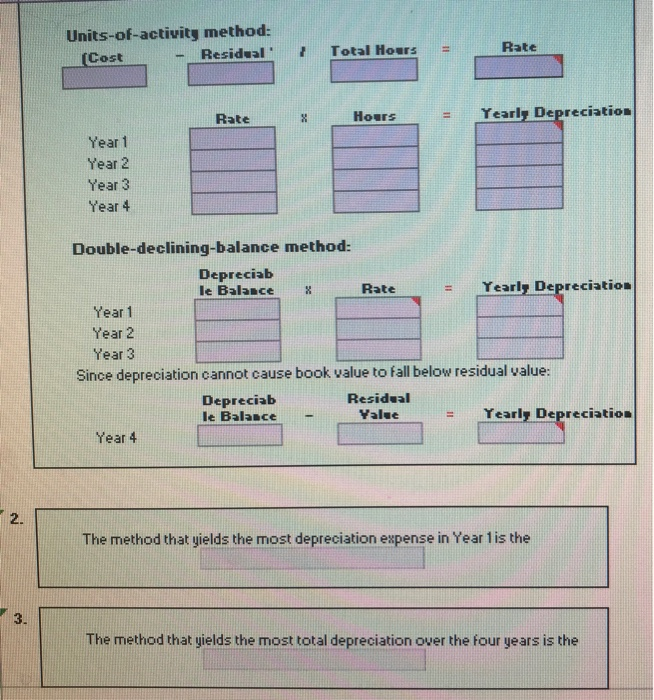

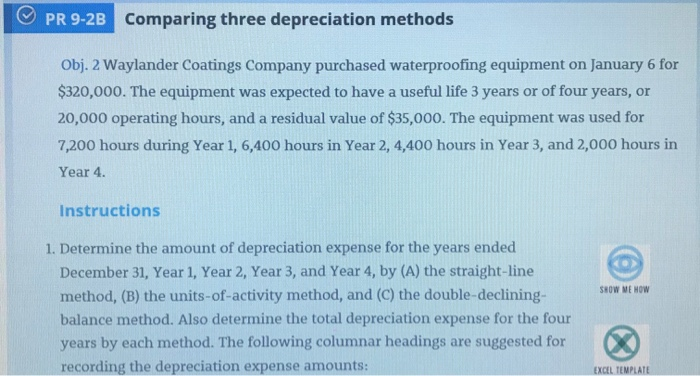

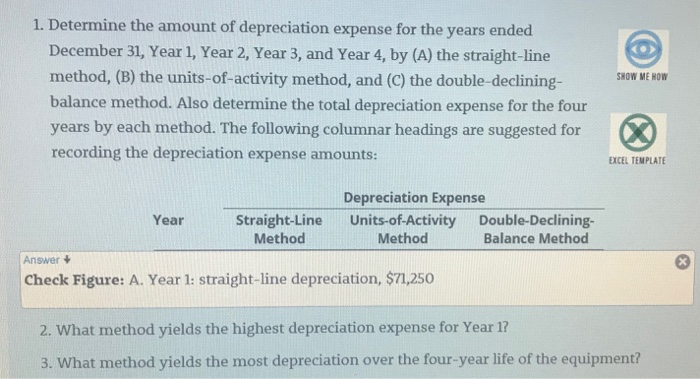

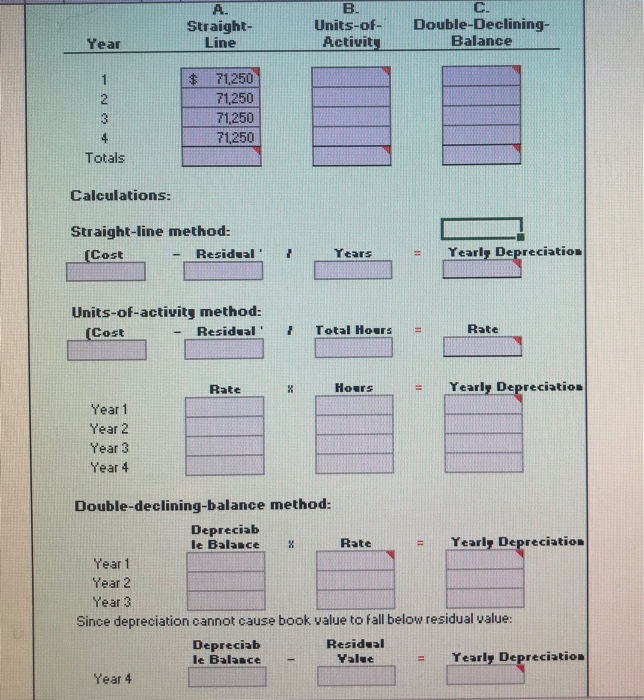

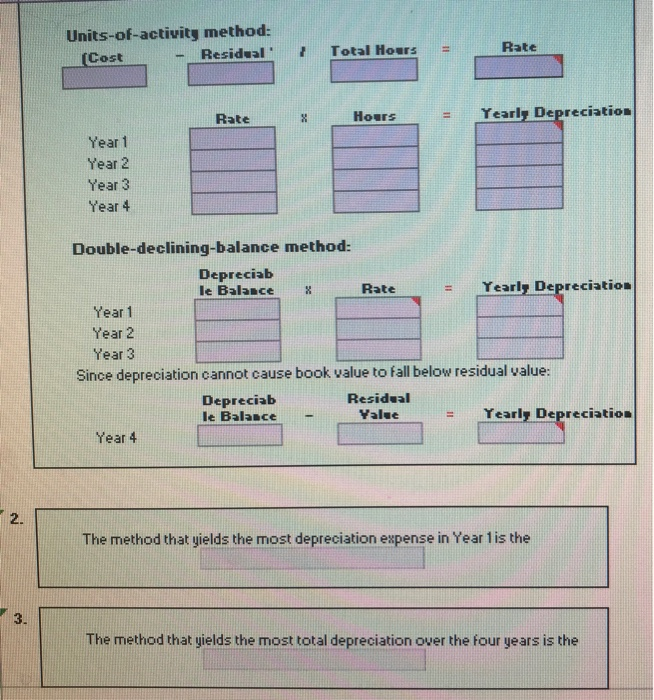

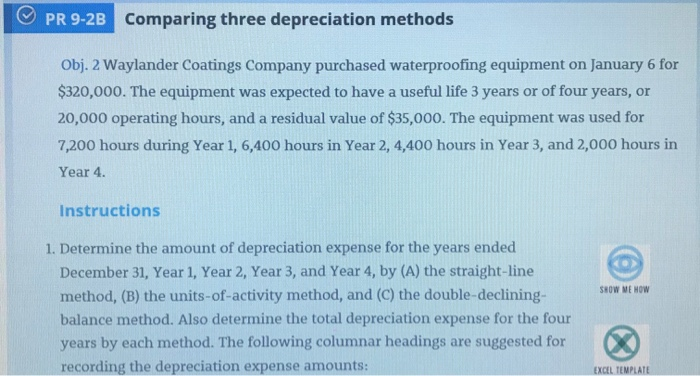

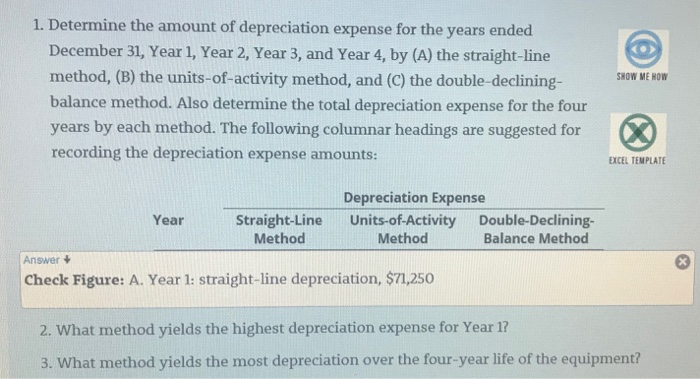

A. B. C. Straight- Units-of-Double-Declining Year Line Activit Balance $71,250 71,250 71,250 71,250 Totals Calculations: Straight-line method: Cost -ResidualYearsEY Yearly Depreciation Units-of-activity method: Cost - ResidcalTotal Hours Rate Rate Hours Yearl Depreciation Year 1 Year 2 Year 3 Year 4 Double-declining-balance method: Depreciab le Balance|||| Rate leBala.ce g Rate Yearly Depreciation = Year 1 Year 2 Year 3 Since depreciation cannot cause book value to fall below residual value: Residual Depreciab le BalanceYalue Yearly Depreciation Year 4 Units-of-activity method: Rate - Residual Total Hours Cost Rate Hours Yearly Depreciat Year 1 Year 2 Year 3 Year 4 Double-declining-balance method: Depreciab le Balance Rate-- Yearl Depreciation Year 1 Year 2 Year 3 Since depreciation cannot cause book value to fall below residual value: Depreciab le BalaaCC Residual Yalse Yearly Depreciation Year 4 2. The method that yields the most depreciation expense in Year 1is the 3. The method that yields the most total depreciation over the four years is the Comparing three depreciation methods Obj. 2 Waylander Coatings Company purchased waterproofing equipment on January 6 for $320,000. The equipment was expected to have a useful life 3 years or of four years, or 20,000 operating hours, and a residual value of $35,000. The equipment was used for 7,200 hours during Year 1, 6,400 hours in Year 2, 4,400 hours in Year 3 and 2,000 hours in Year 4. Instructions 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (A) the straight-line method, (B) the units-of-activity method, and (C) the double-declining- balance method. Also determine the total depreciation expense for the four years by each method. The following columnar headings are suggested for recording the depreciation expense amounts: SHOW ME HOW EXCEL TEMPLATE 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (A) the straight-line method, (B) the units-of-activity method, and (C) the double-declining- balance method. Also determine the total depreciation expense for the four years by each method. The following columnar headings are suggested for recording the depreciation expense amounts: S80W ME ROW EXCEL TEMPLATE Depreciation Expense Straight-Line Units-of-Activity Double-Declining- Year Method Method Balance Method Answer i Check Figure: A. Year 1: straight-line depreciation, $71,250 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the four-year life of the equipment