Help me calculate price to earning ratio and also market to book ratio. Thank you

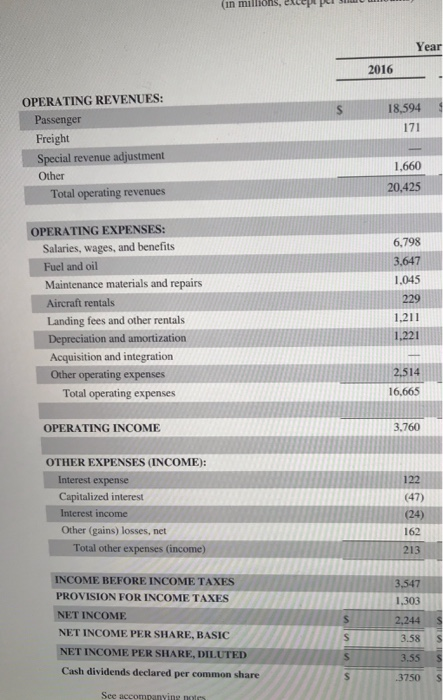

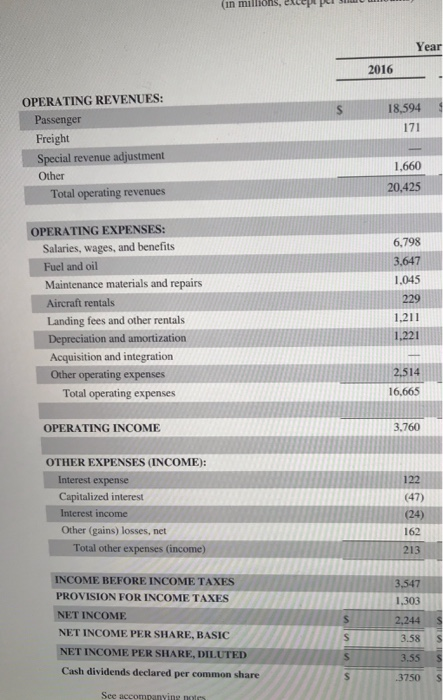

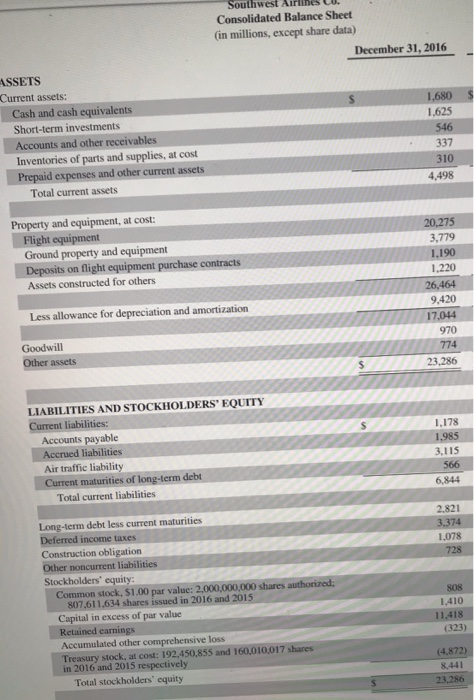

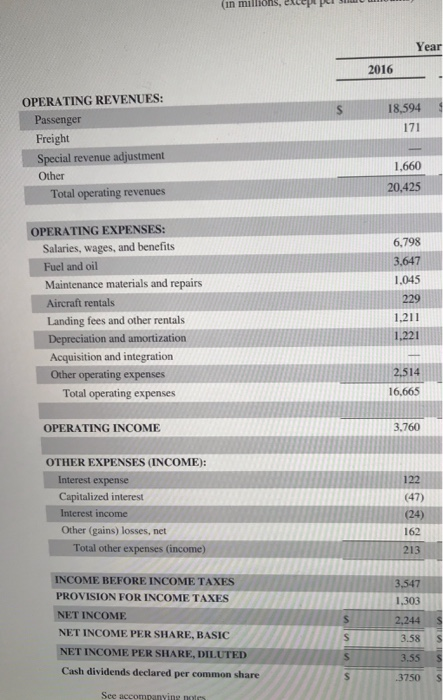

(in millions, except per Year 2016 18,594 171 OPERATING REVENUES: Passenger Freight Special revenue adjustment Other Total operating revenues 1,660 20,425 6,798 3,647 1.045 229 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees and other rentals Depreciation and amortization Acquisition and integration Other operating expenses Total operating expenses 1.211 2,514 16,665 OPERATING INCOME 3.760 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 3,547 1303 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED Cash dividends declared per common share 3.58 See accompanying als Southwest Airlines C. Consolidated Balance Sheet (in millions, except share data) December 31, 2016 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, al cost Prepaid expenses and other current assets Total current assets 1,680 1.625 546 337 310 4,498 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 20,275 3,779 1.190 1.220 26,464 9.420 17.044 970 774 23.286 Less allowance for depreciation and amortization Goodwill Other assets $ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,178 1.985 3.115 566 6,844 2.821 3.374 1,078 728 Long-term debt less current maturities Deferred income taxes Construction obligation Other noncurrent liabilities Stockholders' equity: Common stock. $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2016 and 2015 Capital in excess of par value Retained earnings Accumulated other comprehensive loss Treasury stock, al cost: 192.450,855 and 160,010,017 shares in 2016 and 2015 respectively Total stockholders' equity SOS 1.410 11.418 (323) (4.872) 8.441 23.286 (in millions, except per Year 2016 18,594 171 OPERATING REVENUES: Passenger Freight Special revenue adjustment Other Total operating revenues 1,660 20,425 6,798 3,647 1.045 229 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees and other rentals Depreciation and amortization Acquisition and integration Other operating expenses Total operating expenses 1.211 2,514 16,665 OPERATING INCOME 3.760 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 3,547 1303 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED Cash dividends declared per common share 3.58 See accompanying als Southwest Airlines C. Consolidated Balance Sheet (in millions, except share data) December 31, 2016 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, al cost Prepaid expenses and other current assets Total current assets 1,680 1.625 546 337 310 4,498 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 20,275 3,779 1.190 1.220 26,464 9.420 17.044 970 774 23.286 Less allowance for depreciation and amortization Goodwill Other assets $ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,178 1.985 3.115 566 6,844 2.821 3.374 1,078 728 Long-term debt less current maturities Deferred income taxes Construction obligation Other noncurrent liabilities Stockholders' equity: Common stock. $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2016 and 2015 Capital in excess of par value Retained earnings Accumulated other comprehensive loss Treasury stock, al cost: 192.450,855 and 160,010,017 shares in 2016 and 2015 respectively Total stockholders' equity SOS 1.410 11.418 (323) (4.872) 8.441 23.286