Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me complete my mc 19. Which statement is false about the Liquidity Premium Theory of the term structure of interest rates: a. It is

help me complete my mc

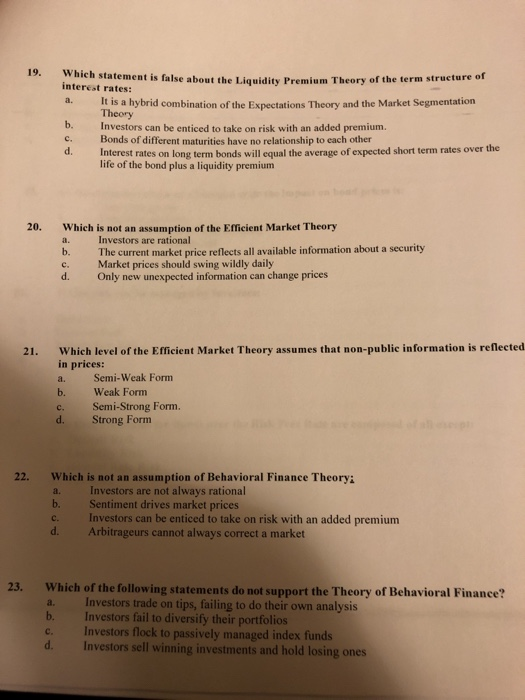

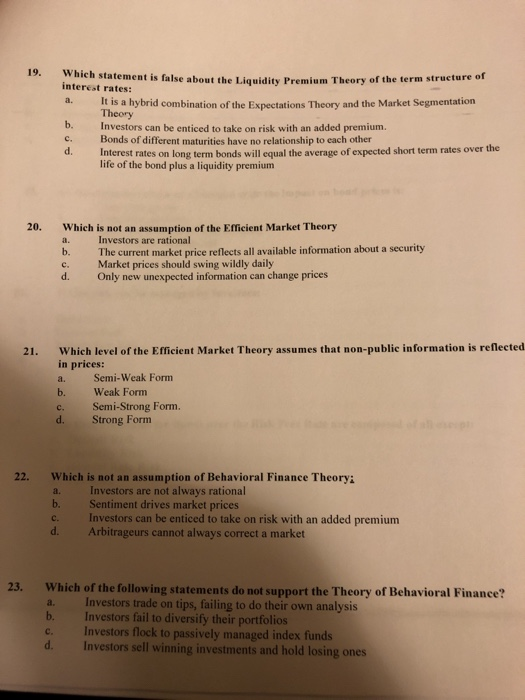

19. Which statement is false about the Liquidity Premium Theory of the term structure of interest rates: a. It is a hybrid combination of the Expectations Theory and the Market Segmentation Theory b. Investors can be enticed to take on risk with an added premium. c. Bonds of different maturities have no relationship to each other d.Interest rates on long term bonds will equal the average of expected short term rates over the life of the bond plus a liquidity premiunm 20. Which is not an assumption of the Efficient Market Theory a. Investors are rational b. The current market price reflects all available information about a security d. Only new unexpected information can change prices c. Market prices should swing wildly daily 21. Which level of the Efficient Market Theory assumes that non-public information is reflected in prices a. Semi-Weak Form b. Weak Form c. Semi-Strong Form. d. Strong Form 22. Which is not an assumption of Behavioral Finance Theory a. b. c. Investors are not always rational Sentiment drives market prices Investors can be enticed to take on risk with an added premium Arbitrageurs cannot always correct a market d. Which of the following statements do not support the Theory of Behavioral Finance? a. Investors trade on tips, failing to do their own analysis b. Investors fail to diversify their portfolios c. Investors flock to passively managed index funds d. Investors sell winning investments and hold losing ones 23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started