Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me correct answers. Show explanation Required information Problem 6-54 (LO 6-3) (Static) [The following information applies to the questions displayed below.] Jackson is 18

Help me correct answers. Show explanation

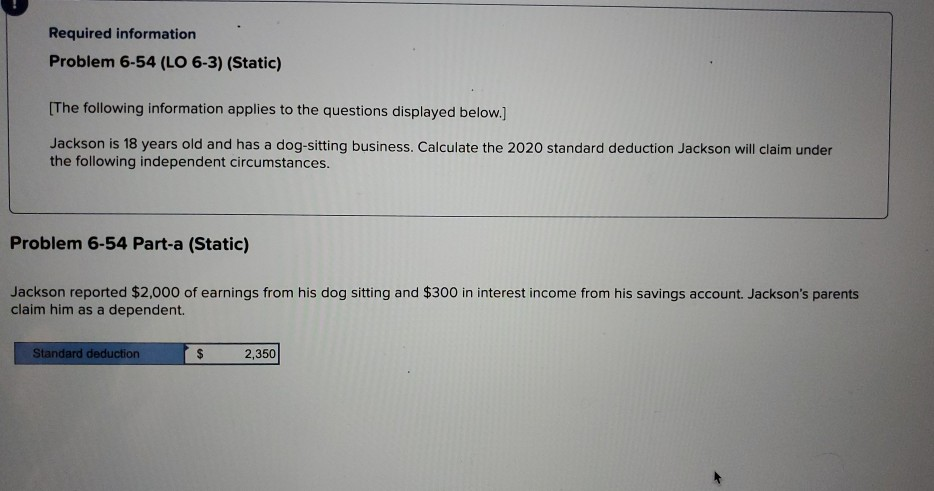

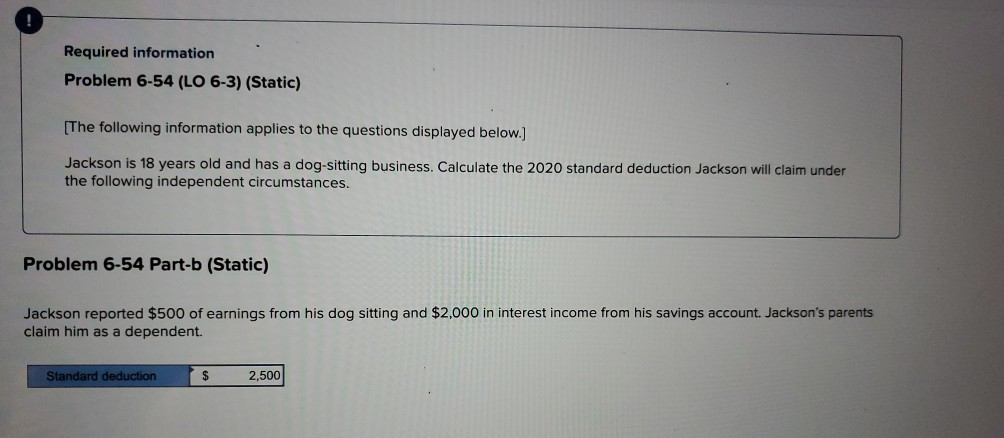

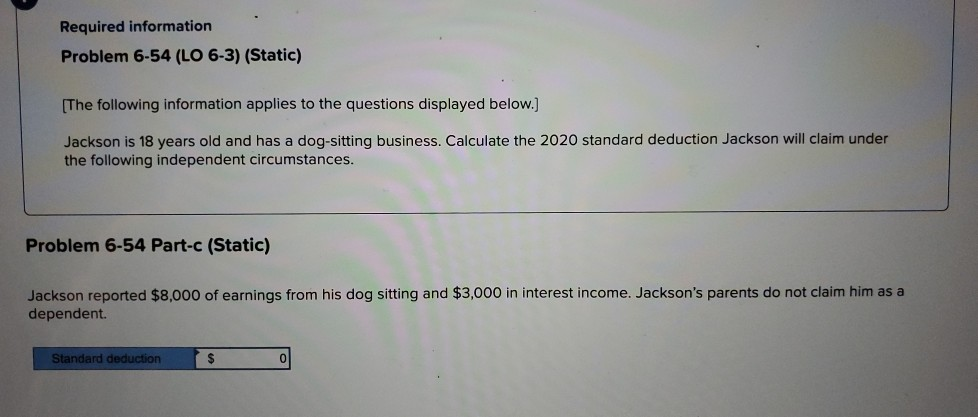

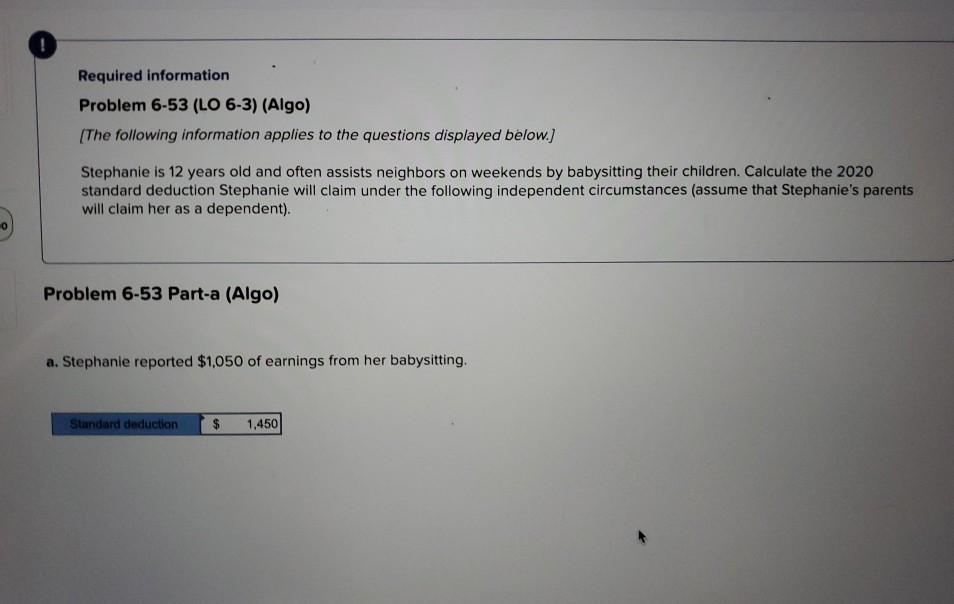

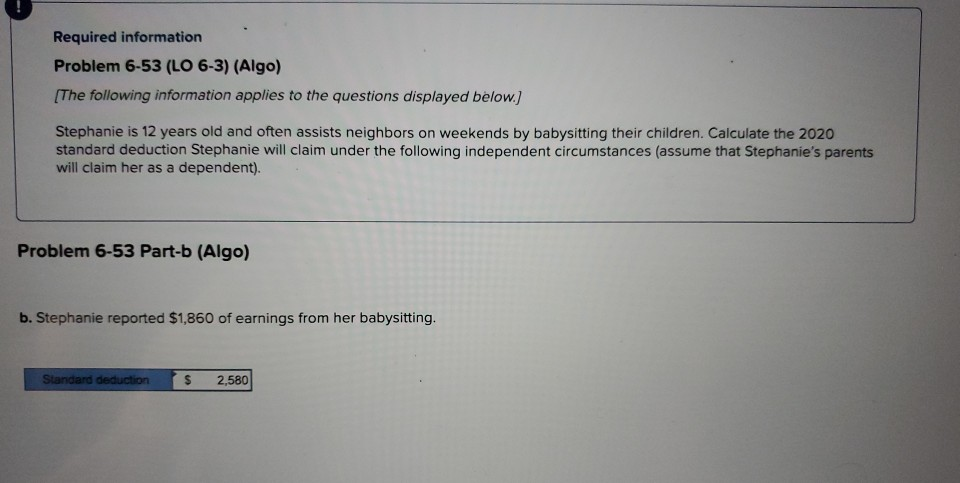

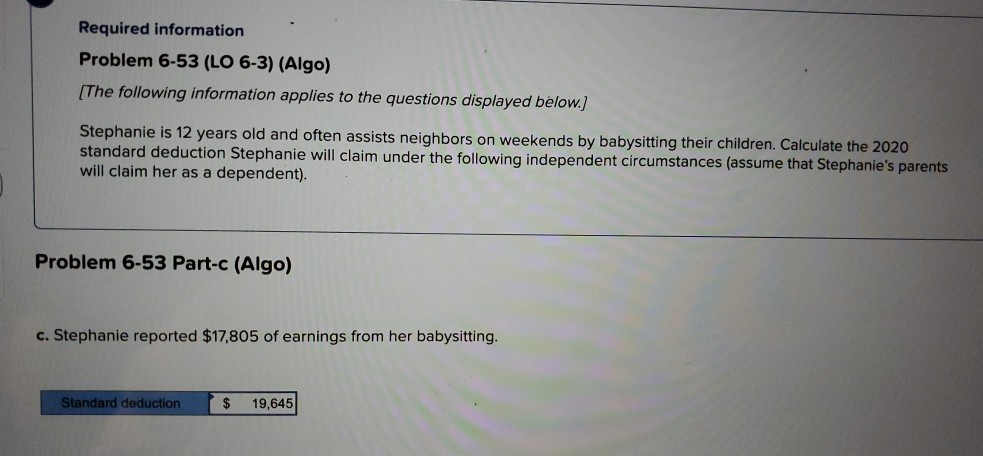

Required information Problem 6-54 (LO 6-3) (Static) [The following information applies to the questions displayed below.] Jackson is 18 years old and has a dog-sitting business. Calculate the 2020 standard deduction Jackson will claim under the following independent circumstances. Problem 6-54 Part-a (Static) Jackson reported $2,000 of earnings from his dog sitting and $300 in interest income from his savings account. Jackson's parents claim him as a dependent. Standard deduction $ 2,350 Required information Problem 6-54 (LO 6-3) (Static) [The following information applies to the questions displayed below.] Jackson is 18 years old and has a dog-sitting business. Calculate the 2020 standard deduction Jackson will claim under the following independent circumstances. Problem 6-54 Part-b (Static) Jackson reported $500 of earnings from his dog sitting and $2,000 in interest income from his savings account. Jackson's parents claim him as a dependent. Standard deduction $ 2,500 Required information Problem 6-54 (LO 6-3) (Static) [The following information applies to the questions displayed below.) Jackson is 18 years old and has a dog-sitting business. Calculate the 2020 standard deduction Jackson will claim under the following independent circumstances. Problem 6-54 Part-c (Static) Jackson reported $8,000 of earnings from his dog sitting and $3,000 in interest income. Jackson's parents do not claim him as a dependent. Standard deduction $ Required information Problem 6-53 (LO 6-3) (Algo) [The following information applies to the questions displayed below.) Stephanie is 12 years old and often assists neighbors on weekends by babysitting their children. Calculate the 2020 standard deduction Stephanie will claim under the following independent circumstances (assume that Stephanie's parents will claim her as a dependent). 0 Problem 6-53 Part-a (Algo) a. Stephanie reported $1,050 of earnings from her babysitting, Standard deduction $ 1,450 Required information Problem 6-53 (LO 6-3) (Algo) [The following information applies to the questions displayed below.) Stephanie is 12 years old and often assists neighbors on weekends by babysitting their children. Calculate the 2020 standard deduction Stephanie will claim under the following independent circumstances (assume that Stephanie's parents will claim her as a dependent). Problem 6-53 Part-b (Algo) b. Stephanie reported $1,860 of earnings from her babysitting. Standard deduction $ 2,580 Required information Problem 6-53 (LO 6-3) (Algo) (The following information applies to the questions displayed below.) Stephanie is 12 years old and often assists neighbors on weekends by babysitting their children. Calculate the 2020 standard deduction Stephanie will claim under the following independent circumstances (assume that Stephanie's parents will claim her as a dependent). Problem 6-53 Part-c (Algo) c. Stephanie reported $17,805 of earnings from her babysitting. Standard deduction $ 19,645Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started