Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me doing part A This is all informantion that was provided Damon Corporation, a ports equpment manufacturer, har a machine currently in wae that

Help me doing part A

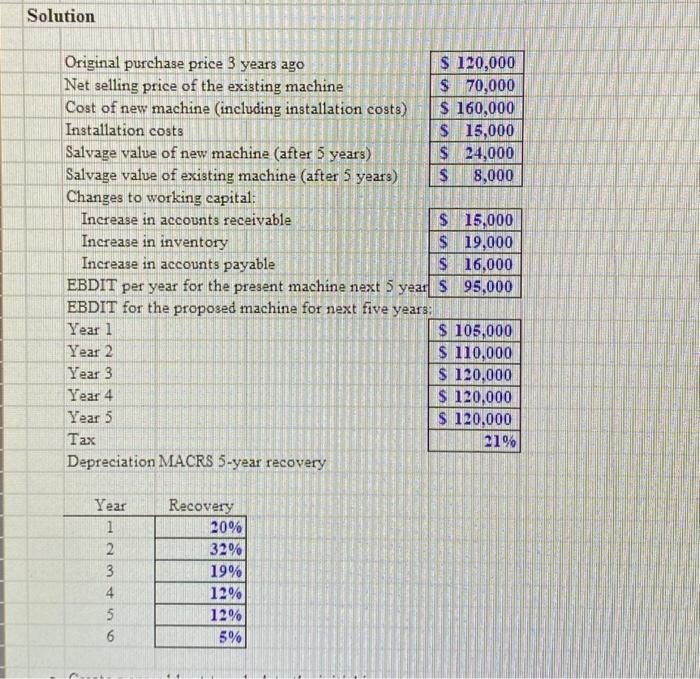

This is all informantion that was provided

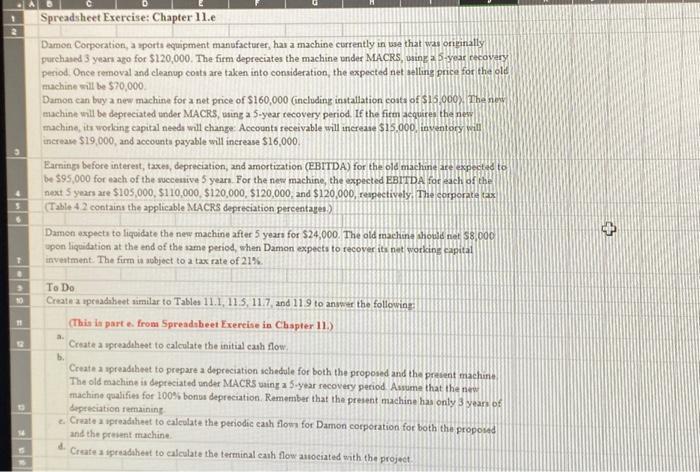

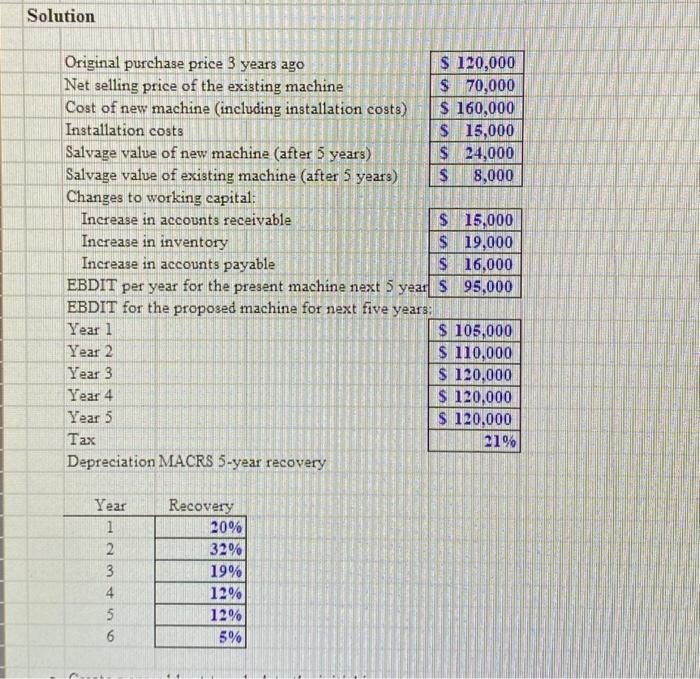

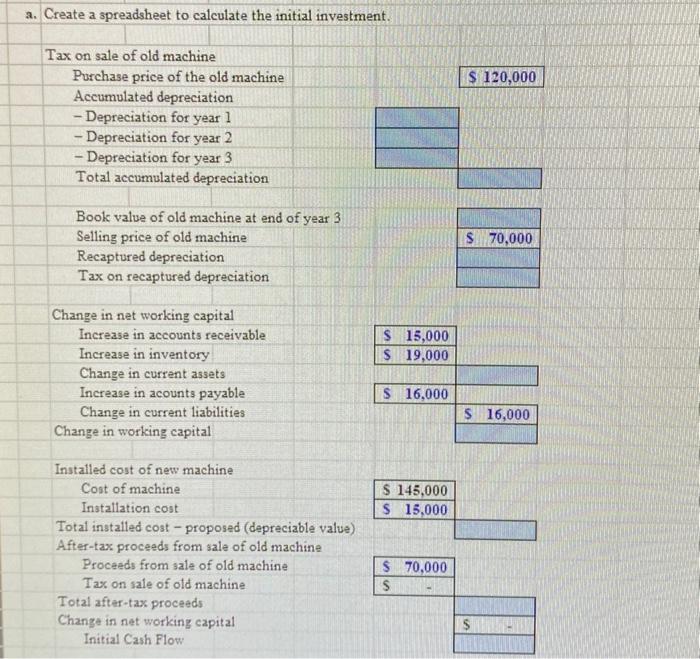

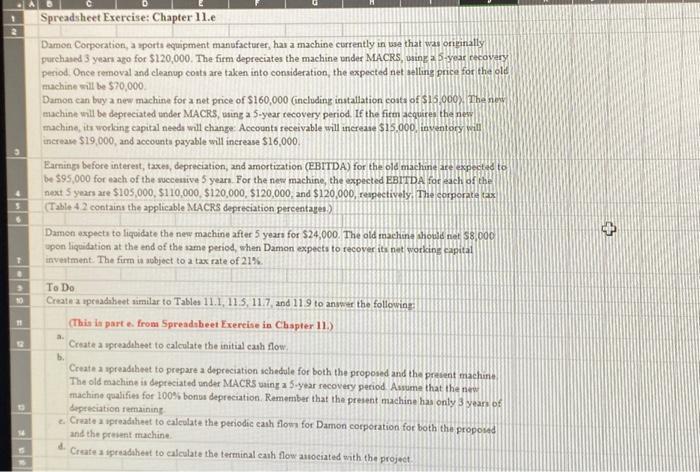

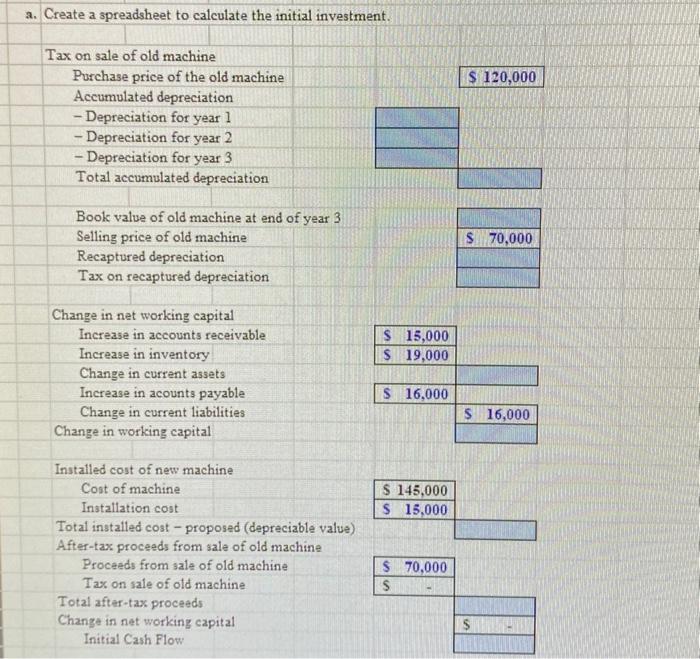

Damon Corporation, a ports equpment manufacturer, har a machine currently in wae that was originally purchased 3 years ago for $120,000. The firm depreciates the machine under MACRS, using a 5. year recovery period. Once removal and cleanup conts are taken into consideration, the expected net aelling price for the old machine sill be $70,000. Damon can buy a new machine for a net price of $160,000 (including instatlation costs of 515,000 . 7 . 16 net machine will be depreciated under MACFS, wing a 5 -year recovery period. If the firm acquires the newy machine, its working capital needs will change: Accounts receivable will ancrease 515,000, inventory ght? increase $19,000, and account payable will increase $16,000. Earning before interent, taxen, depreciation, and amortization (EBITDA) for the old machane are expected to be 595,000 for each of the succestive 5 years. For the nes machine, the expected EBIIDA for ach of the next 5 years are $105,000,$110,000,5120,000,5120,000, and $120,000, respectively, The corporate tax (Table 4.2 contains the applicable MACR3 depreciation percentaget) Damon expects to liquidate the new machine after 5 years for 524,000 . The old machane ahowd net 58,000 upon liquidation at the end of the ame period, when Damon expects to fecover ita net working capitaf inveatment. The firm is abbject to 2 tax rate of 21%. To Do Creatna ipreadiheet aimilar to Tables 11.1,11.5,11.7, and 119 to ansuer the following (This is part e. from Spreadabeet Exereise in Chapter 11) a. Croate a upreadihet to calculate the initial cash flow: b. Creat a apreadtheet to prepare a depreciation wchedule for both the proposed and tha preient machitie The old machine is depreciated under MACRS uaing a 5 -year recovery period Asume that ihe neve machine qualifies for 100% bons depreciation. Remember that the present machine has only 3 years of depreciation remaining c. Crate a ipreadathet to ealeulate the peciodic eash flow for Damon corporation for both the proposfd and the preient machine. d. Creafe a ipreadihent to calculate the terminal canh flow aivociated with the project Depreciation MACRS 5-year recovery a. Create a spreadsheet to calculate the initial investment. Tax on sale of old machine Purchase price of the old machine $120,000 Accumulated depreciation - Depreciation for year 1 - Depreciation for year 2 - Depreciation for year 3 Total accumulated depreciation Book value of old machine at end of year 3 Selling price of old machine Recaptured depreciation Tax on recaptured depreciation Change in net working capital Increase in accounts receivable Increase in inventory Change in current assets Increase in acounts payable Change in current liabilities Change in working capital Installed cost of new machine Cost of machine Installation cost \begin{tabular}{|lr|} \hline$ & 145,000 \\ \hline 5 & 15,000 \\ \hline \end{tabular} Total installed cost - proposed (depreciable value) After-tax proceeds from sale of old machine Proceeds from sale of old machine Tax on sale of old machine Total after-tax proceeds Change in net working capital Initial Cash Flow \begin{tabular}{|lr|} \hline 5 & 70,000 \\ \hline 5 & \\ \hline & \\ \hline & 5 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started