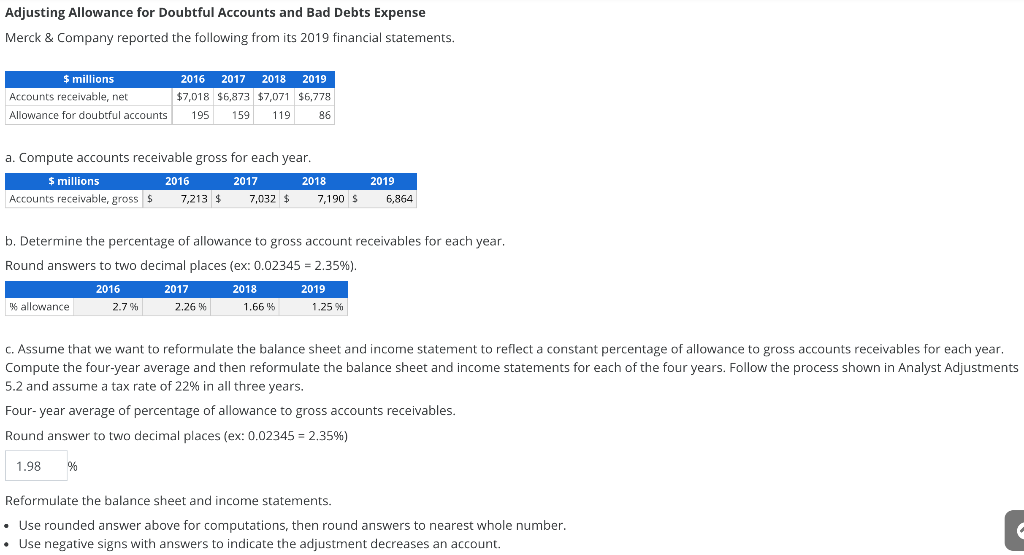

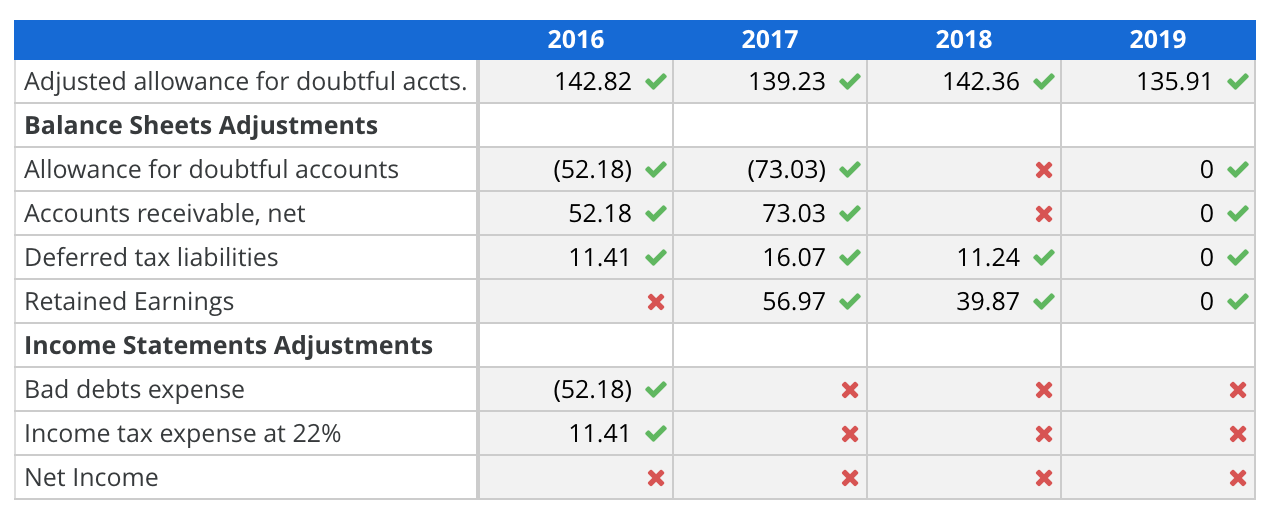

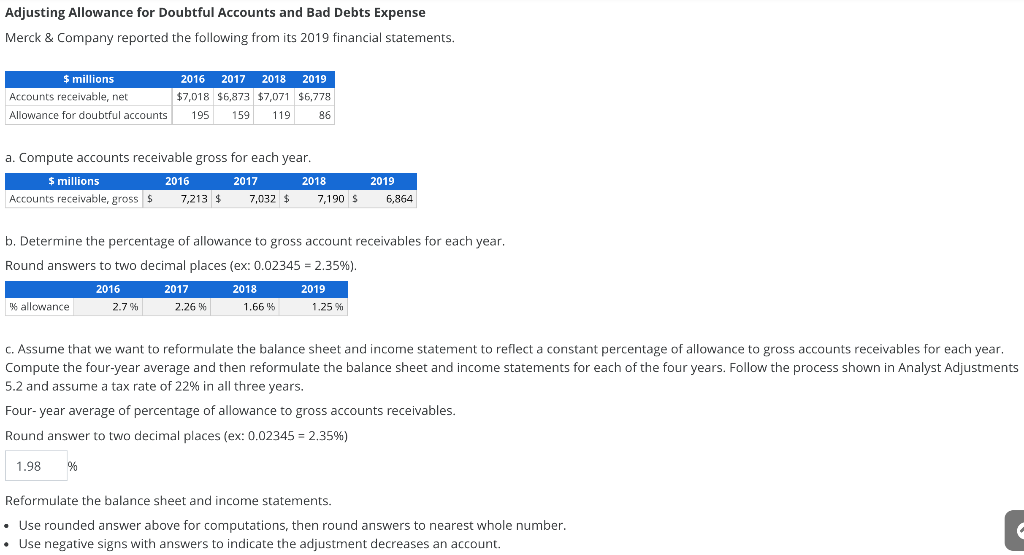

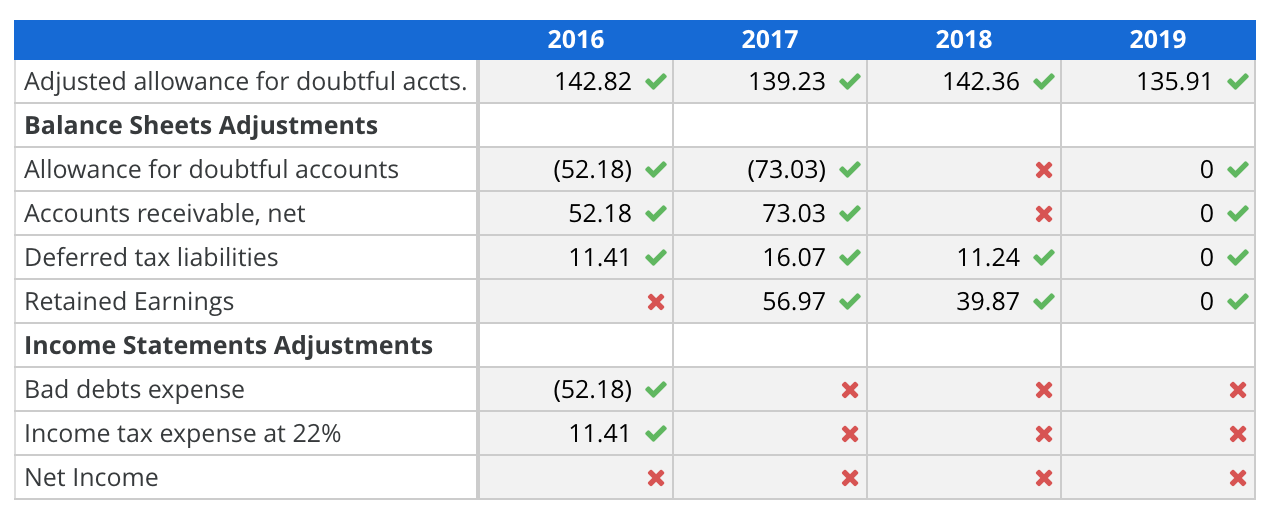

Help me figure this out please. One the ones with the red X's.

Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck & Company reported the following from its 2019 financial statements. $ millions Accounts receivable, net Allowance for doubtful accounts 2016 2017 2018 2019 $7,018 $6,873 $7,071 $6,778 195 159 119 86 a. Compute accounts receivable gross for each year. $ millions 2016 2017 2018 Accounts receivable, gross $ 7,213 $ 7,032 $ 7,190 $ 2019 6,864 b. Determine the percentage of allowance to gross account receivables for each year, Round answers to two decimal places (ex: 0.02345 = 2.35%). 2016 2017 2018 2019 % allowance 2.7% 2.26% 1,66% 1.25% C. Assume that we want to reformulate the balance sheet and income statement to reflect a constant percentage of allowance to gross accounts receivables for each year, Compute the four-year average and then reformulate the balance sheet and income statements for each of the four years. Follow the process shown in Analyst Adjustments 5.2 and assume a tax rate of 22% in all three years. Four-year average of percentage of allowance to gross accounts receivables. Round answer to two decimal places (ex: 0.02345 = 2.35%) 1.98 % Reformulate the balance sheet and income statements. Use rounded answer above for computations, then round answers to nearest whole number. Use negative signs with answers to indicate the adjustment decreases an account. 2016 2017 2018 2019 142.82 139.23 142.36 135.91 (52.18) (73.03) X O 52.18 73.03 x 0 11.41 16.07 11.24 0 Adjusted allowance for doubtful accts. Balance Sheets Adjustments Allowance for doubtful accounts Accounts receivable, net Deferred tax liabilities Retained Earnings Income Statements Adjustments Bad debts expense Income tax expense at 22% Net Income X 56.97 39.87 o (52.18) X X X 11.41 ~ X X x x x x x Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck & Company reported the following from its 2019 financial statements. $ millions Accounts receivable, net Allowance for doubtful accounts 2016 2017 2018 2019 $7,018 $6,873 $7,071 $6,778 195 159 119 86 a. Compute accounts receivable gross for each year. $ millions 2016 2017 2018 Accounts receivable, gross $ 7,213 $ 7,032 $ 7,190 $ 2019 6,864 b. Determine the percentage of allowance to gross account receivables for each year, Round answers to two decimal places (ex: 0.02345 = 2.35%). 2016 2017 2018 2019 % allowance 2.7% 2.26% 1,66% 1.25% C. Assume that we want to reformulate the balance sheet and income statement to reflect a constant percentage of allowance to gross accounts receivables for each year, Compute the four-year average and then reformulate the balance sheet and income statements for each of the four years. Follow the process shown in Analyst Adjustments 5.2 and assume a tax rate of 22% in all three years. Four-year average of percentage of allowance to gross accounts receivables. Round answer to two decimal places (ex: 0.02345 = 2.35%) 1.98 % Reformulate the balance sheet and income statements. Use rounded answer above for computations, then round answers to nearest whole number. Use negative signs with answers to indicate the adjustment decreases an account. 2016 2017 2018 2019 142.82 139.23 142.36 135.91 (52.18) (73.03) X O 52.18 73.03 x 0 11.41 16.07 11.24 0 Adjusted allowance for doubtful accts. Balance Sheets Adjustments Allowance for doubtful accounts Accounts receivable, net Deferred tax liabilities Retained Earnings Income Statements Adjustments Bad debts expense Income tax expense at 22% Net Income X 56.97 39.87 o (52.18) X X X 11.41 ~ X X x x x x x