Help me in answering the following questions

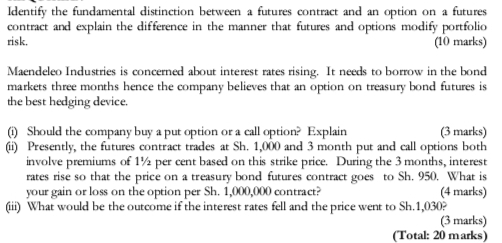

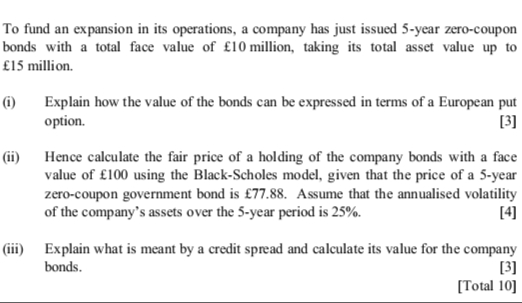

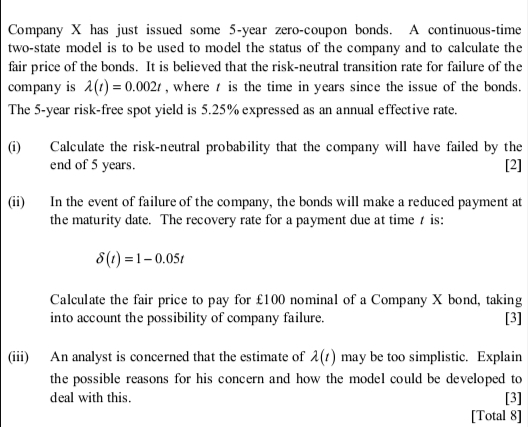

Identify the fundamental distinction between a futures contract and an option on a futures contract and explain the difference in the manner that futures and options modify portfolio risk. (10 marks) Maendeleo Industries is concerned about interest rates rising. It needs to borrow in the bond markets three months hence the company believes that an option on treasury bond futures is the best hedging device. Should the company buy a put option or a call option? Explain (3 marks) Presently, the futures contract trades at Sh. 1,000 and 3 month put and call options both involve premiums of 1/2 per cent based on this strike price. During the 3 months, interest rates rise so that the price on a treasury bond futures contract goes to Sh. 950. What is your gain or loss on the option per Sh. 1,000,000 contract? (4 marks) (ill) What would be the outcome if the interest rates fell and the price went to Sh.1,030? (3 marks) (Total: 20 marks)To fund an expansion in its operations, a company has just issued 5-year zero-coupon bonds with a total face value of E10 million, taking its total asset value up to $15 million. (i) Explain how the value of the bonds can be expressed in terms of a European put option. [3] (ii) Hence calculate the fair price of a holding of the company bonds with a face value of $100 using the Black-Scholes model, given that the price of a 5-year zero-coupon government bond is $77.88. Assume that the annualised volatility of the company's assets over the 5-year period is 25%. [4] (Hii) Explain what is meant by a credit spread and calculate its value for the company bonds. [3] [Total 10]Company X has just issued some 5-year zero-coupon bonds. A continuous-time two-state model is to be used to model the status of the company and to calculate the fair price of the bonds. It is believed that the risk-neutral transition rate for failure of the company is A() =0.002/, where / is the time in years since the issue of the bonds. The 5-year risk-free spot yield is 5.25% expressed as an annual effective rate. (i) Calculate the risk-neutral probability that the company will have failed by the end of 5 years. [2] (ii) In the event of failure of the company, the bonds will make a reduced payment at the maturity date. The recovery rate for a payment due at time / is: 6(1) =1-0.05/ Calculate the fair price to pay for f100 nominal of a Company X bond, taking into account the possibility of company failure. [3] (iii) An analyst is concerned that the estimate of 1() may be too simplistic. Explain the possible reasons for his concern and how the model could be developed to deal with this. [3] [Total 8]