Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me please A Canada-based investor buys shares of Toronto-Dominion Bank (TD.TO) for C$90.00 on October 15,2007 with the intent of holding them for a

help me please

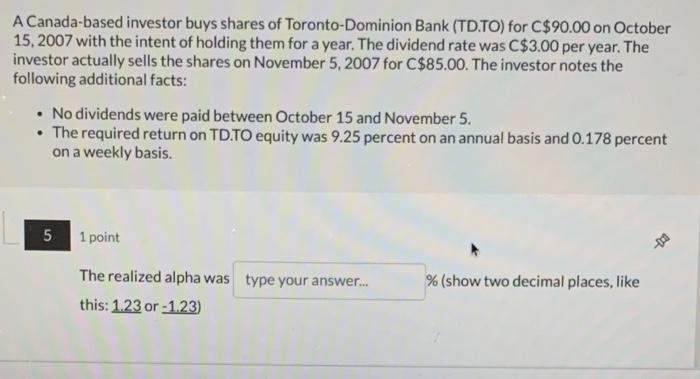

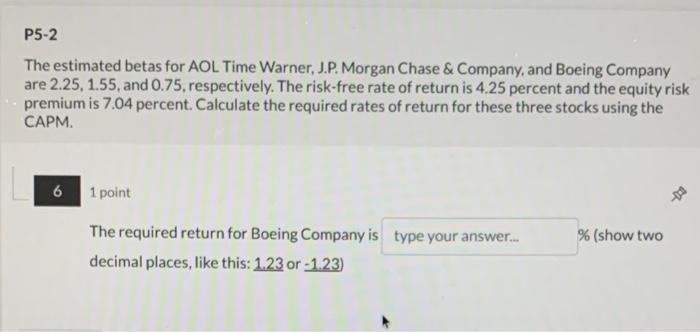

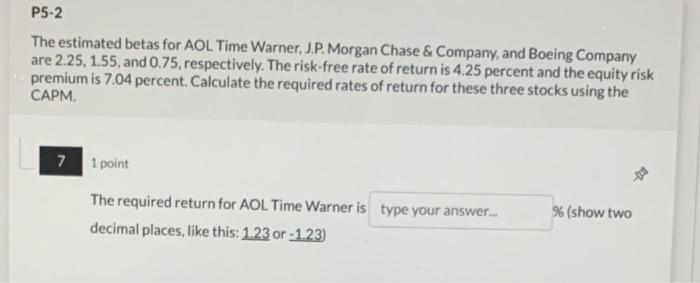

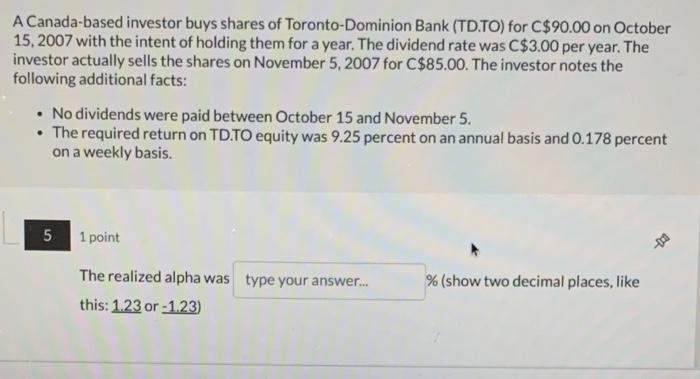

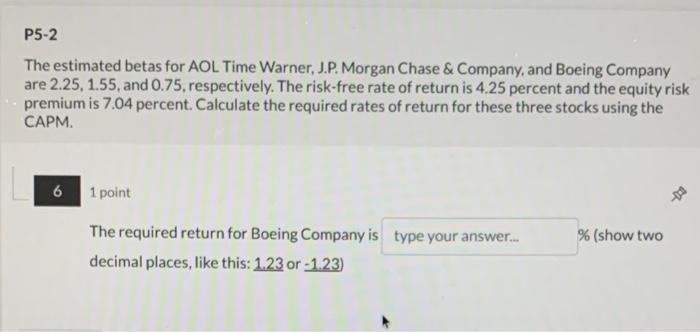

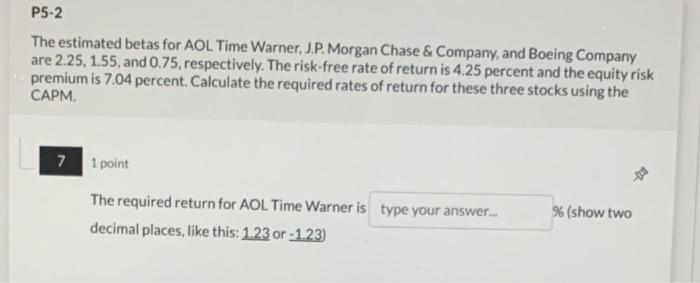

A Canada-based investor buys shares of Toronto-Dominion Bank (TD.TO) for C$90.00 on October 15,2007 with the intent of holding them for a year. The dividend rate was C$3.00 per year. The investor actually sells the shares on November 5,2007 for C$85.00. The investor notes the following additional facts: - No dividends were paid between October 15 and November 5. - The required return on TD.TO equity was 9.25 percent on an annual basis and 0.178 percent on a weekly basis. 1 point The realized alpha was \% (show two decimal places, like this: 1.23 or 1.23 ) The estimated betas for AOL Time Warner, J.P. Morgan Chase \& Company, and Boeing Company are 2.25,1.55, and 0.75, respectively. The risk-free rate of return is 4.25 percent and the equity risk premium is 7.04 percent. Calculate the required rates of return for these three stocks using the CAPM. 6 point The required return for Boeing Company is \% (show two decimal places, like this: 1.23 or 1.23 ) The estimated betas for AOL Time Warner, J.P. Morgan Chase \& Company, and Boeing Company are 2.25,1.55, and 0.75, respectively. The risk-free rate of return is 4.25 percent and the equity risk premium is 7.04 percent. Calculate the required rates of return for these three stocks using the CAPM. 7 1 point The required return for AOL Time Warner is \% (show two decimal places, like this: 1.23 or 1.23 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started