Answered step by step

Verified Expert Solution

Question

1 Approved Answer

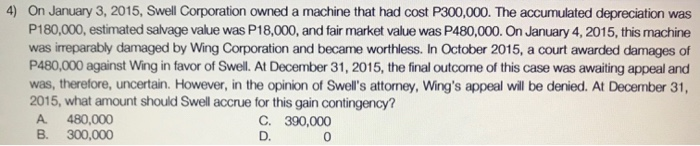

help me please thank you 4) On January 3, 2015, Swell Corporation owned a machine that had cost P300,000. The accumulated depreciation was P180,000, estimated

help me please thank you

4) On January 3, 2015, Swell Corporation owned a machine that had cost P300,000. The accumulated depreciation was P180,000, estimated salvage value was P18,000, and fair market value was P480,000. On January 4, 2015, this machine was irreparably damaged by Wing Corporation and became worthless. In October 2015, a court awarded damages of P480,000 against Wing in favor of Swell. At December 31, 2015, the final outcome of this case was awaiting appeal and was, therefore, uncertain. However, in the opinion of Swell's attorney, Wing's appeal will be denied. At December 31, 2015, what amount should Swell accrue for this gain contingency? A 480,000 C. 390,000 300,000 D. B. 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started