help me pls

help me pls

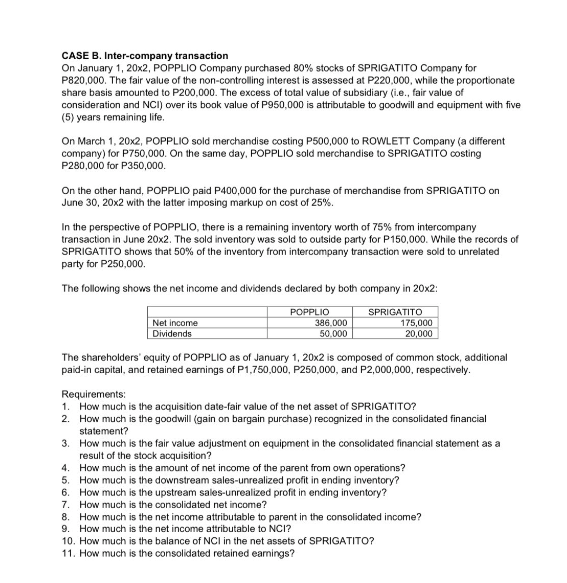

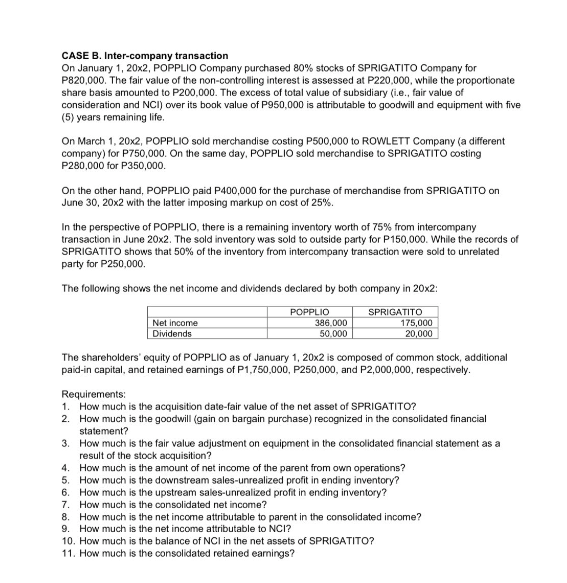

CASE B. Inter-company transaction On January 1, 20x2, POPPLIO Company purchased 80% stocks of SPRIGATITO Company for P820,000. The fair value of the non-controlling interest is assessed at P220,000, while the proportionate share basis amounted to P200,000. The excess of total value of subsidiary (i.e., fair value of consideration and NCl) over its book value of P950,000 is attributable to goodwill and equipment with five (5) years remaining life. On March 1, 20x2, POPPLIO sold merchandise costing P500,000 to ROWLETT Company (a different company) for P750,000. On the same day, POPPLIO sold merchandise to SPRIGATITO costing P280,000 for P350,000. On the other hand, POPPLIO paid P400,000 for the purchase of merchandise from SPRIGATITO on June 30,202 with the latter imposing markup on cost of 25%. In the perspective of POPPLIO, there is a remaining inventory worth of 75% from intercompany transaction in June 202. The sold inventory was sold to outside party for P150,000. While the records of SPRIGATITO shows that 50% of the inventory from intercompany transaction were sold to unrelated party for P250,000. The following shows the net income and dividends declared by both company in 202 : The shareholders' equity of POPPLIO as of January 1,202 is composed of common stock, additional paid-in capital, and retained earnings of P1,750,000,P250,000, and P2,000,000, respectively. Requirements: 1. How much is the acquisition date-fair value of the net asset of SPRIGATITO? 2. How much is the goodwill (gain on bargain purchase) recognized in the consolidated financial statement? 3. How much is the fair value adjustment on equipment in the consolidated financial statement as a result of the stock acquisition? 4. How much is the amount of net income of the parent from own operations? 5. How much is the downstream sales-unrealized profit in ending inventory? 6. How much is the upstream sales-unrealized profit in ending inventory? 7. How much is the consolidated net income? 8. How much is the net income attributable to parent in the consolidated income? 9. How much is the net income attributable to NCl ? 10. How much is the balance of NCI in the net assets of SPRIGATITO? 11. How much is the consolidated retained eamings

help me pls

help me pls