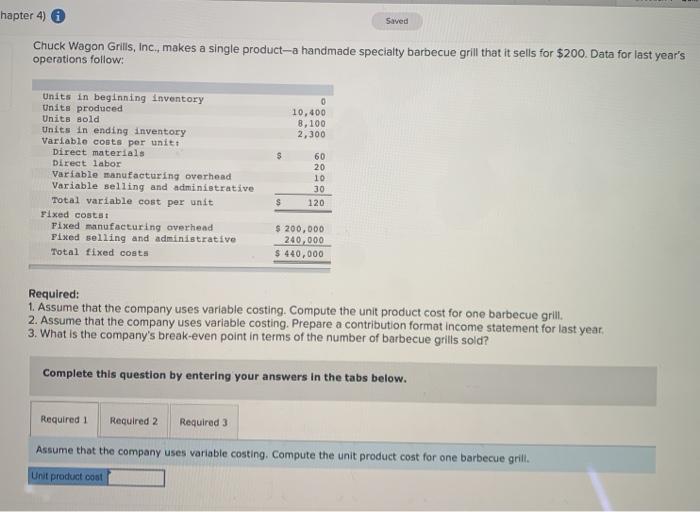

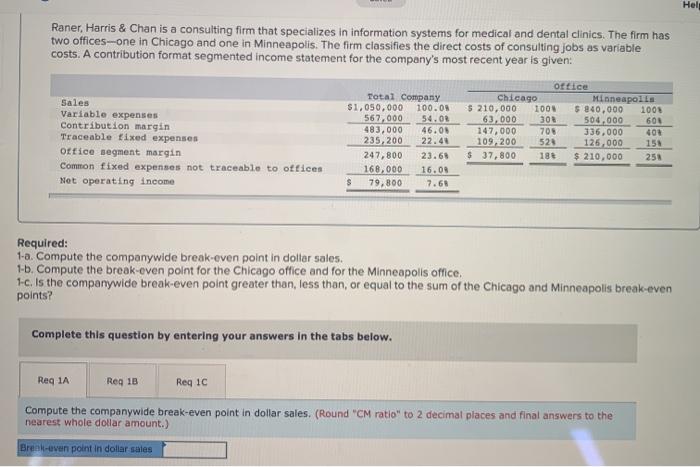

Saved hapter 4) Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $200. Data for last year's operations follow: 10,400 8,100 2,300 $ Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unitt Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs Fixed manufacturing overhead Fixed selling and administrative Total fixed costs 60 20 10 30 120 $ $ 200,000 240.000 $ 440,000 Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year, 3. What is the company's break-even point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. Unit productos Hel Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Not operating income Total Company $1,050,000 100.0% 567,000 54.00 483,000 46.00 235,200 22.40 247,800 23.68 168,000 16.08 $ 79,800 7.68 Ottice Chicago Minneapolis $ 210,000 1000 $ 240,000 1008 63,000 308 504.000 600 147,000 708 336,000 408 109,200 523 125.000 158 $ 37,800 180 $ 210,000 258 Required: 1-a. Compute the companywide break-even point in dollar sales. 1-b. Compute the break-even point for the Chicago office and for the Minneapolis office. 1-c. Is the companywide break-even point greater than less than or equal to the sum of the Chicago and Minneapolis break-even points? Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Req 1C Compute the companywide break-even point in dollar sales. (Round "CM ratio" to 2 decimal places and final answers to the nearest whole dollar amount.) Break-even point in dollar sales