Answered step by step

Verified Expert Solution

Question

1 Approved Answer

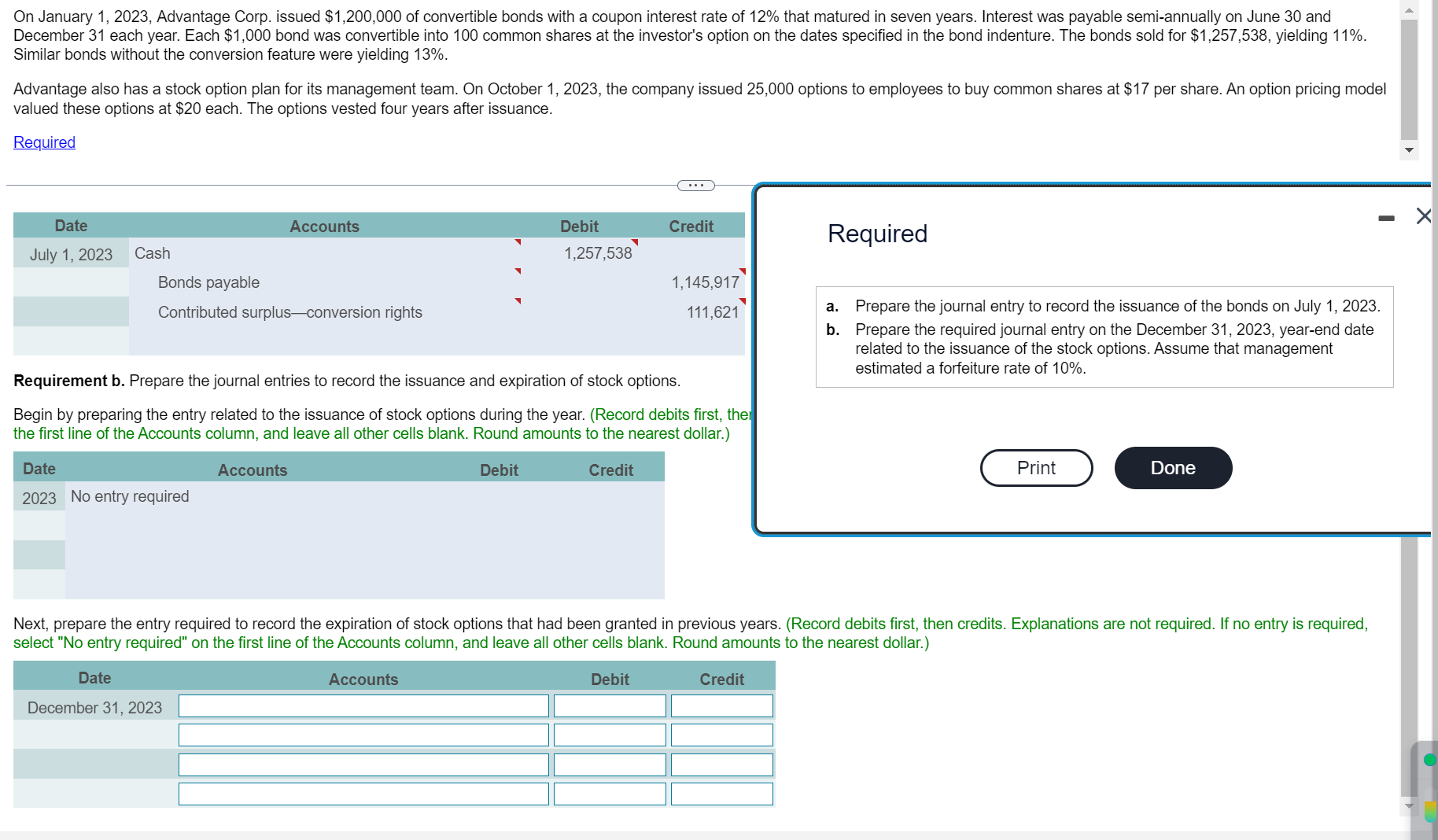

help me solve the third journal entry plz On January 1,2023 , Advantage Corp. issued $1,200,000 of convertible bonds with a coupon interest rate of

help me solve the third journal entry plz

On January 1,2023 , Advantage Corp. issued $1,200,000 of convertible bonds with a coupon interest rate of 12% that matured in seven years. Interest was payable semi-annually on June 30 and December 31 each year. Each $1,000 bond was convertible into 100 common shares at the investor's option on the dates specified in the bond indenture. The bonds sold for $1,257,538, yielding 11%. Similar bonds without the conversion feature were yielding 13%. Advantage also has a stock option plan for its management team. On October 1, 2023, the company issued 25,000 options to employees to buy common shares at $17 per share. An option pricing model valued these options at $20 each. The options vested four years after issuance. Required Requirement b. Prepare the journal entries to record the issuance and expiration of stock options. Begin by preparing the entry related to the issuance of stock options during the year. (Record debits first, ther the first line of the Accounts column, and leave all other cells blank. Round amounts to the nearest dollar.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started