help. me with columns 5 on the starting questions and help me with the dates and post. Ref. on the journal please

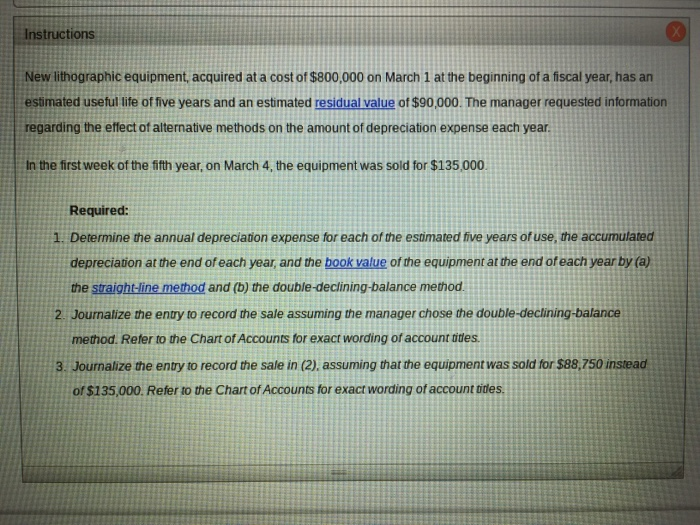

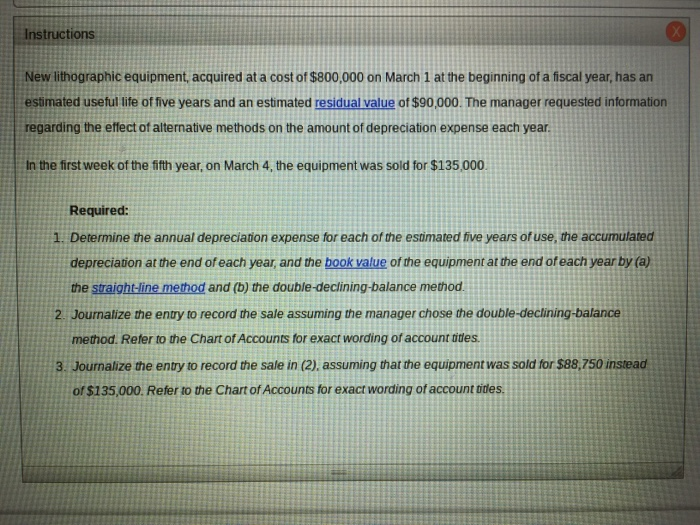

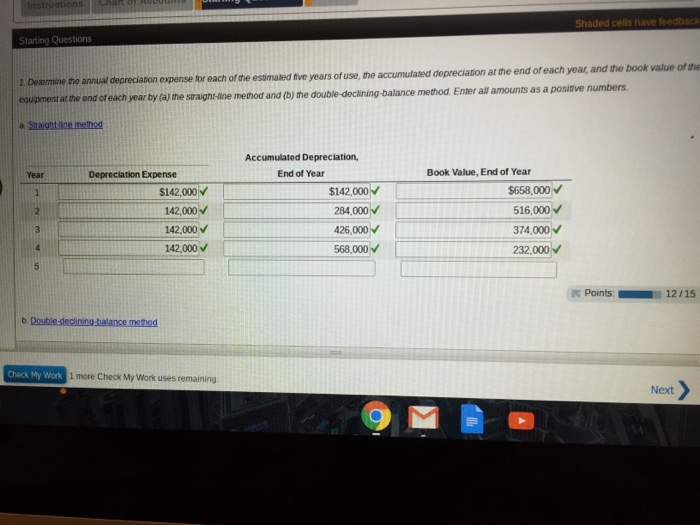

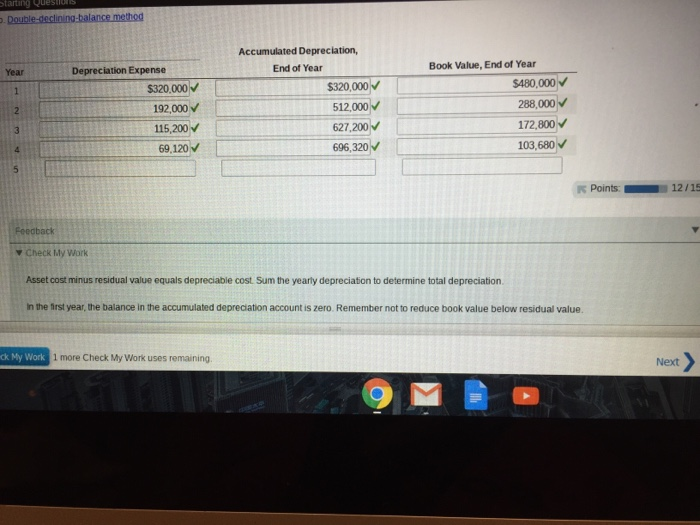

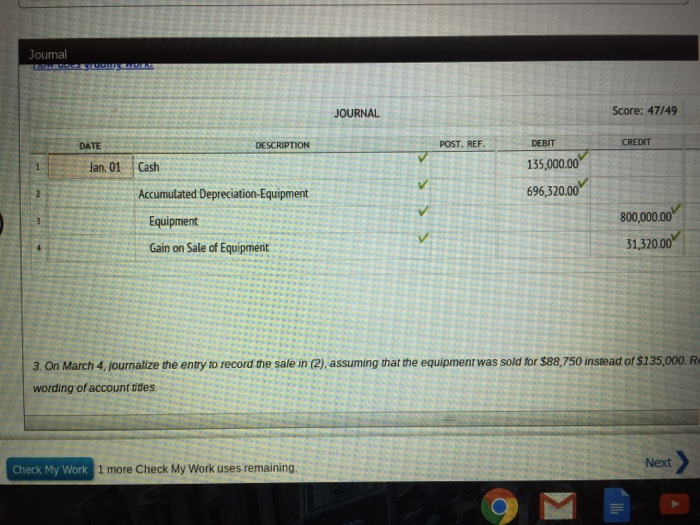

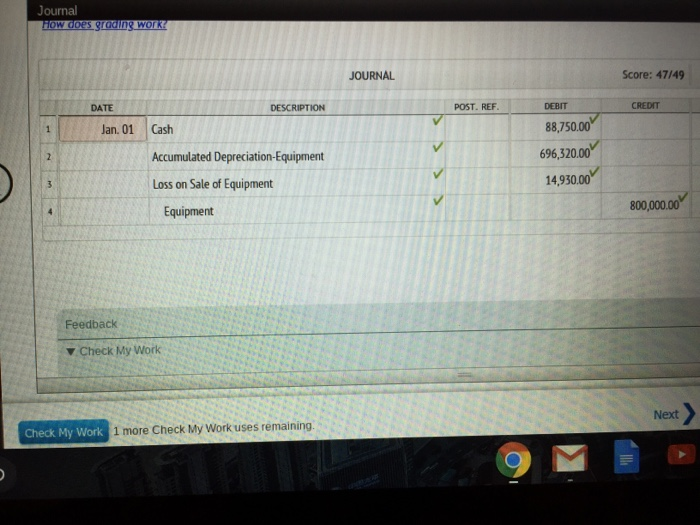

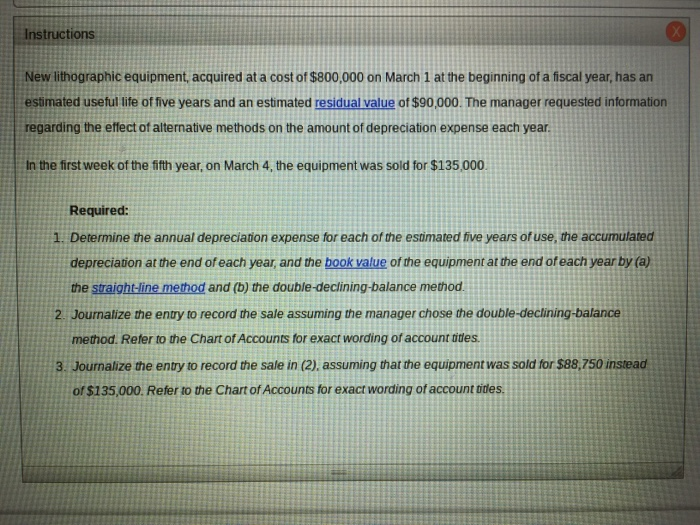

Instructions New lithographic equipment, acquired at a cost of $800,000 on March 1 at the beginning of a fiscal year, has an estimated useful life of five years and an estimated residual value of $90,000. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. In the first week of the fifth year, on March 4, the equipment was sold for $135,000. Required: 1. Determine the annual depreciation expense for each of the estimated five years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. Journalize the entry to record the sale assuming the manager chose the double-declining-balance method. Refer to the Chart of Accounts for exact wording of account titles. 3. Journalize the entry to record the sale in (2), assuming that the equipment was sold for $88,750 instead of $135,000. Refer to the Chart of Accounts for exact wording of account titles. Instructions Chart I ACUUM Shaded cells have feedback Starting Questions Dermine the annual depreciation expense for each of the estimated five years of use, the accumulated depreciation at the end of each year, and the book value of the equpment at the end of each year by (a) the straight-line method and (b) the double-declining balance method. Enter all amounts as a positive numbers & Straight line method Depreciation Expense S142.000 142,000 142,000 142,000 Accumulated Depreciation, End of Year $142,000 284,000 426,000 568,000 Book Value, End of Year $658,000 516,000 374,000 232,000 Points: 12/15 Double-declining-balance method Check My Work 1 more Check My Work uses remaining Next > Starting questi - Double-declining balance method Depreciation Expense $320,000 192,000 115,200 69,120 Accumulated Depreciation, End of Year $320,000 512,000 627,200 696,320 V Book Value, End of Year $480,000 288,000 172,800 103,680 V Points: 12/15 Feedbac Check My Work Asset cost minus residual value equals depreciable cost. Sum the yearly depreciation to determine total depreciation in the first year, the balance in the accumulated depreciation account is zero. Remember not to reduce book value below residual value ck My Work 1 more Check My Work uses remaining, Next > Joumal ESTROSTACEIT JOURNAL Score: 47/49 DESCRIPTION POST. REF. DEBIT CREDIT DATE Jan. 01 135,000.00 696,320.00 Cash Accumulated Depreciation Equipment Equipment Gain on Sale of Equipment 800,000.00 31,320.00 3. On March 4. journalize the entry to record the sale in (2), assuming that the equipment was sold for $88,750 instead of $135,000. R wording of account tides. Check My Work 1 more Check My Work uses remaining Next > Journal HOW does grgang WOTE JOURNAL Score: 47/49 DESCRIPTION POST. REF DEBIT CREDIT Jan. 01 Cash Accumulated Depreciation-Equipment Loss on Sale of Equipment 88,750.00 696,320.00 14,930.00 Equipment 800,000.00 Feedback Check My Work Next Check My Work 1 more Check My Work uses remaining