help me with the discussion please

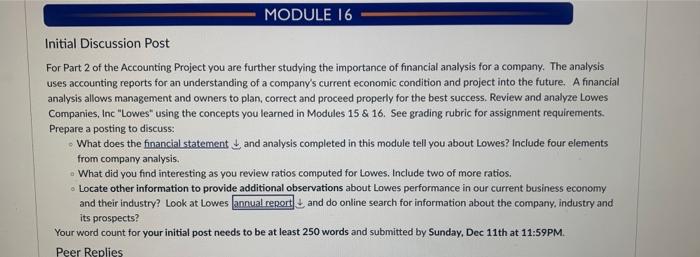

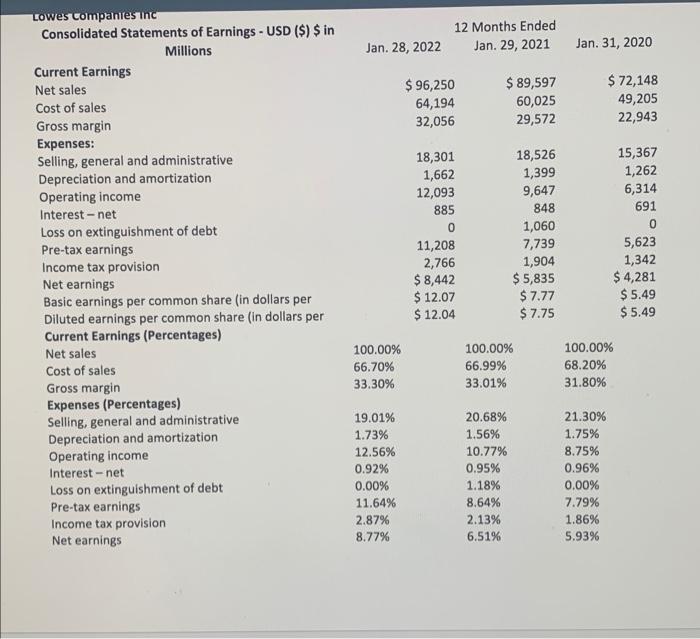

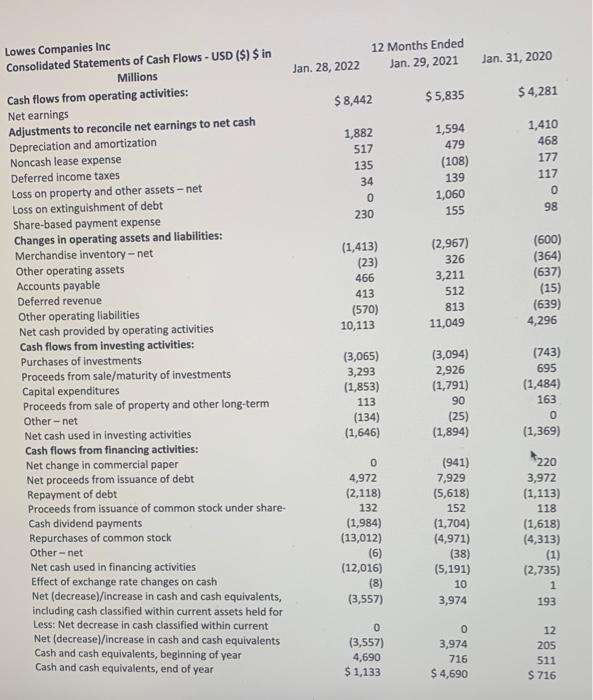

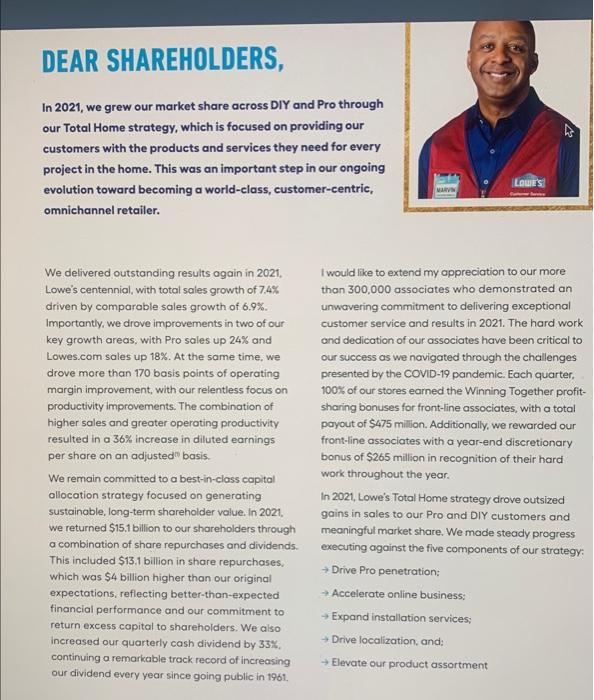

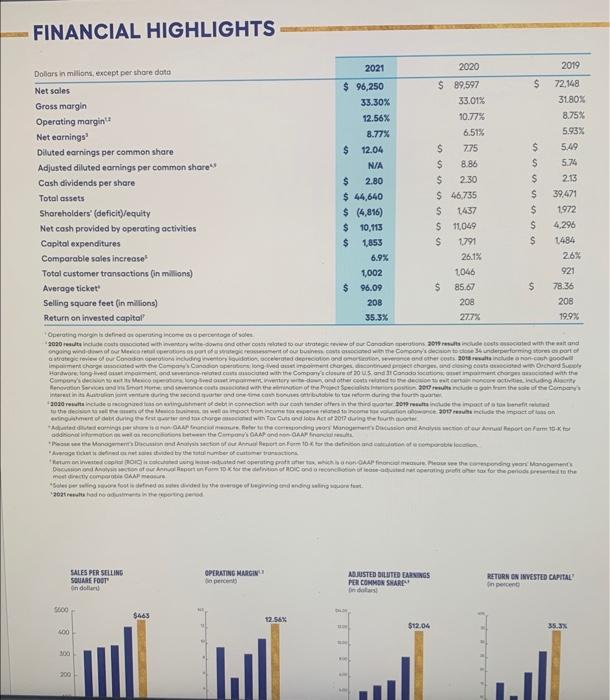

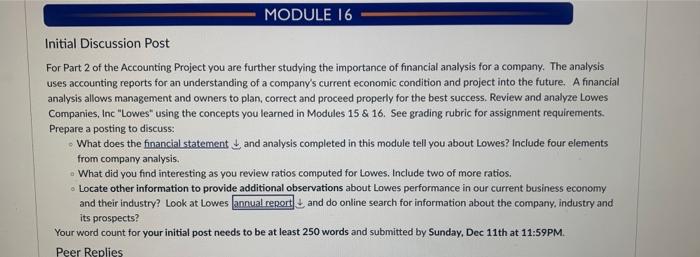

Initial Discussion Post For Part 2 of the Accounting Project you are further studying the importance of financial analysis for a company. The analysis uses accounting reports for an understanding of a company's current economic condition and project into the future. A financial analysis allows management and owners to plan, correct and proceed properly for the best success. Review and analyze Lowes Companies, Inc "Lowes" using the concepts you learned in Modules 15&16. See grading rubric for assignment requirements. Prepare a posting to discuss: - What does the financial statement and analysis completed in this module tell you about Lowes? Include four elements from company analysis. What did you find interesting as you review ratios computed for Lowes. Include two of more ratios. - Locate other information to provide additional observations about Lowes performance in our current business economy and their industry? Look at Lowes and do online search for information about the company, industry and its prospects? Your word count for your initial post needs to be at least 250 words and submitted by Sunday, Dec 11th at 11:59PM. Lowes companies inc Consolidated Statements of Earnings - USD (\$) \$ in Millions Jan. 28,2022 12 Months Ended Current Earnings Net sales Cost of sales Gross margin Jan. 29, 2021 Jan. 31,2020 Expenses: Selling, general and administrative Depreciation and amortization Operating income Interest-net Loss on extinguishment of debt Pre-tax earnings Income tax provision Net earnings Basic earnings per common share (in dollars per Diluted earnings per common share (in dollars per $96,25064,19432,056$89,59760,02529,572$72,14849,20522,943 Current Earnings (Percentages) Net sales Cost of sales Gross margin Expenses (Percentages) Selling, general and administrative Depreciation and amortization Operating income Interest - net Loss on extinguishment of debt Pre-tax earnings Income tax provision Net earnings 100.00%66.70%33.30%19.01%1.73%12.56%0.92%0.00%11.64%2.87%8.77%100.00%66.99%33.01%20.68%1.56%10.77%0.95%1.18%8.64%2.13%6.51%100.00%68.20%31.80%21.30%1.75%8.75%0.96%0.00%7.79%1.86%5.93% Lowes Companies Inc Consolidated Balance Sheets - USD (\$) \$ in Millions Jan. 28, 2022 Jan. 29, 2021 Current assets: Cash and cash equivalents Short-term investments Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes - net Other assets Total assets Current liabilities: Current maturities of long-term debt Current operating lease liabilities Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Noncurrent operating lease liabilities Deferred revenue - Lowe's protection plans Other liabilities Total liabilities Commitments and contingencies Shareholders' (deficit)/equity: Preferred stock $5 par value: Authorized 5.0 million shares; Issued Common stock - $0.50 par value: Authorized 5.6 billion shares; Issued and outstanding 670 million and 731 million, respectively Capital in excess of par value (Accumulated deficit)/retained earnings Accumulated other comprehensive loss Total shareholders' (deficit)/equity Total liabilities and shareholders' (deficit)/equity $1,13327117,6051,05120,06019,0714,1081991641,03844,640$4,69050616,19393722,32619,1553,83220034088246,735 Lowes Companies Inc Consolidated Statements of Cash Flows - USD (\$) $ in Millions Cash flows from operating activities: Net earning 5 Adjustments to reconcile net earnings to net cash Depreciation and amortization Noncash lease expense Deferred income taxes Loss on property and other assets - net Loss on extinguishment of debt Share-based payment expense Jan. 28, 2022 Jan. 29, 2021 Jan. 31, 2020 Changes in operating assets and liabilities: Merchandise inventory - net Other operating assets Accounts payable Deferred revenue Other operating liabilities Net cash provided by operating activities Cash flows from investing activities: Purchases of investments Proceeds from sale/maturity of investments Capital expenditures Proceeds from sale of property and other long-term Other-net Net cash used in investing activities Cash flows from financing activities: Net change in commercial paper Net proceeds from issuance of debt Repayment of debt Proceeds from issuance of common stock under share- Cash dividend payments Repurchases of common stock $8,442$5,835$4,281 Other - net 1,8825171353402301,594479(108)1391,0601551,410468177117098 Net cash used in financing activities Effect of exchange rate changes on cash Net (decrease)/increase in cash and cash equivalents, including cash classified within current assets held for Less: Net decrease in cash classified within current Net (decrease)/increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year (1,413)(23)466413(570)10,113(2,967)3263,21151281311,049(600)(364)(637)(15)(639)4,296 (3,065)3,293(1,853)113(134)(1,646)(3,094)2,926(1,791)90(25)(1,894)(743)695(1,484)1630(1,369) In 2021, we grew our market share across DIY and Pro through our Total Home strategy, which is focused on providing our customers with the products and services they need for every project in the home. This was an important step in our ongoing evolution toward becoming a world-class, customer-centric, omnichannel retailer. We delivered outstanding results again in 2021. I would like to extend my appreciation to our more Lowe's centennial, with total sales growth of 7.4% than 300,000 associates who demonstrated an driven by comparable sales growth of 6.9%. unwavering commitment to delivering exceptional Importantly, we drove improvements in two of our_ customer service and results in 2021. The hard work key growth areas, with Pro sales up 24% and and dedication of our associates have been critical to Lowes.com sales up 18\%. At the same time, we our success as we navigated through the challenges drove more than 170 basis points of operating presented by the COVID-19 pandemic. Each quarter, margin improvement, with our relentless focus on 100% of our stores earned the Winning Together profitproductivity improvements. The combination of sharing bonuses for front-line associates, with a total higher sales and greater operating productivity payout of $475 million. Additionally, we rewarded our resulted in a 36% increase in diluted earnings front-line associates with a year-end discretionary per share on an adjusted basis. bonus of $265 million in recognition of their hard We remain committed to a best-in-class capital_ work throughout the year. allocation strategy focused on generating In 2021, Lowe's Total Home strategy drove outsized sustainable, long-term shareholder value. In 2021, gains in sales to our Pro and DIY customers and we returned $15.1 billion to our shareholders through meaningful market share. We made steady progress a combination of share repurchases and dividends. executing against the five components of our strategy: This included $13.1 billion in share repurchases, Drive Pro penetration: which was $4 billion higher than our original expectations, reflecting better-than-expected Accelerate online business: financial performance and our commitment to Expand installation services; return excess capital to shareholders. We also increased our quarterly cash dividend by 33%. Drive localization, and: continuing a remarkable track record of increasing Elevate our product assortment our dividend every year since going public in 1961. With customer demand for integrated omnichannel lumber to capture better margins and reduce store shopping experiences increasing. we continue to labor. In-store fulfiliment was expanded through the invest in our supply chain and omnichannel rollout of touchless lockers across all of our U.S. capabilities. During the year, we converted three stores, which quickly became our customers' fovorite markets to a market-based delivery model for big pickup option. and bulky products such as appliances and grills. Under the new model, these products flow from bulk In 2021, we celebrated our centennial with a $10 milion distribution centers directly to customer homes, investment across 100 Hometowns throughout the bypassing stores altogether. The new market-based country with community impoct projects ranging delivery model is driving higher appliance sales, from renovating food pantries and homeless improved profitability, improved inventory turns, shelters to updating youth centers. This was our woy better on-time delivery rates and customer of expressing gratitude to our loyal customers while satisfaction. We will continue converting our U.S. honoring the company's long-standing markets to the new model through 2023. commitment to community service. We drove operational efficiency across our stores and We are also supporting the health of our planet corporate spend through our Perpetual Productivity by investing in sustainability in our operations. Initiatives ("PPi"). This series of initiatives not only increasing responsible product sourcing and unlocked operating leverage during the year but reducing our environmental impact. Looking will scale over time. We implemented significant ahead, we plan to intensify our efforts to protect changes to improve store labor productivity by the climate by establishing a science based net-zero using technology to reduce tasking hours, improve target in 2022. The new target will include both customer service, and increase sales productivity. near and long-term greenhouse gas emissions We also installed digital signs in appliances and reduction goals for Lowe's full value chain, including 5 copes 1, 2 and 3 . FINANCIAL HIGHLIGHTS Initial Discussion Post For Part 2 of the Accounting Project you are further studying the importance of financial analysis for a company. The analysis uses accounting reports for an understanding of a company's current economic condition and project into the future. A financial analysis allows management and owners to plan, correct and proceed properly for the best success. Review and analyze Lowes Companies, Inc "Lowes" using the concepts you learned in Modules 15&16. See grading rubric for assignment requirements. Prepare a posting to discuss: - What does the financial statement and analysis completed in this module tell you about Lowes? Include four elements from company analysis. What did you find interesting as you review ratios computed for Lowes. Include two of more ratios. - Locate other information to provide additional observations about Lowes performance in our current business economy and their industry? Look at Lowes and do online search for information about the company, industry and its prospects? Your word count for your initial post needs to be at least 250 words and submitted by Sunday, Dec 11th at 11:59PM. Lowes companies inc Consolidated Statements of Earnings - USD (\$) \$ in Millions Jan. 28,2022 12 Months Ended Current Earnings Net sales Cost of sales Gross margin Jan. 29, 2021 Jan. 31,2020 Expenses: Selling, general and administrative Depreciation and amortization Operating income Interest-net Loss on extinguishment of debt Pre-tax earnings Income tax provision Net earnings Basic earnings per common share (in dollars per Diluted earnings per common share (in dollars per $96,25064,19432,056$89,59760,02529,572$72,14849,20522,943 Current Earnings (Percentages) Net sales Cost of sales Gross margin Expenses (Percentages) Selling, general and administrative Depreciation and amortization Operating income Interest - net Loss on extinguishment of debt Pre-tax earnings Income tax provision Net earnings 100.00%66.70%33.30%19.01%1.73%12.56%0.92%0.00%11.64%2.87%8.77%100.00%66.99%33.01%20.68%1.56%10.77%0.95%1.18%8.64%2.13%6.51%100.00%68.20%31.80%21.30%1.75%8.75%0.96%0.00%7.79%1.86%5.93% Lowes Companies Inc Consolidated Balance Sheets - USD (\$) \$ in Millions Jan. 28, 2022 Jan. 29, 2021 Current assets: Cash and cash equivalents Short-term investments Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes - net Other assets Total assets Current liabilities: Current maturities of long-term debt Current operating lease liabilities Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Noncurrent operating lease liabilities Deferred revenue - Lowe's protection plans Other liabilities Total liabilities Commitments and contingencies Shareholders' (deficit)/equity: Preferred stock $5 par value: Authorized 5.0 million shares; Issued Common stock - $0.50 par value: Authorized 5.6 billion shares; Issued and outstanding 670 million and 731 million, respectively Capital in excess of par value (Accumulated deficit)/retained earnings Accumulated other comprehensive loss Total shareholders' (deficit)/equity Total liabilities and shareholders' (deficit)/equity $1,13327117,6051,05120,06019,0714,1081991641,03844,640$4,69050616,19393722,32619,1553,83220034088246,735 Lowes Companies Inc Consolidated Statements of Cash Flows - USD (\$) $ in Millions Cash flows from operating activities: Net earning 5 Adjustments to reconcile net earnings to net cash Depreciation and amortization Noncash lease expense Deferred income taxes Loss on property and other assets - net Loss on extinguishment of debt Share-based payment expense Jan. 28, 2022 Jan. 29, 2021 Jan. 31, 2020 Changes in operating assets and liabilities: Merchandise inventory - net Other operating assets Accounts payable Deferred revenue Other operating liabilities Net cash provided by operating activities Cash flows from investing activities: Purchases of investments Proceeds from sale/maturity of investments Capital expenditures Proceeds from sale of property and other long-term Other-net Net cash used in investing activities Cash flows from financing activities: Net change in commercial paper Net proceeds from issuance of debt Repayment of debt Proceeds from issuance of common stock under share- Cash dividend payments Repurchases of common stock $8,442$5,835$4,281 Other - net 1,8825171353402301,594479(108)1391,0601551,410468177117098 Net cash used in financing activities Effect of exchange rate changes on cash Net (decrease)/increase in cash and cash equivalents, including cash classified within current assets held for Less: Net decrease in cash classified within current Net (decrease)/increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year (1,413)(23)466413(570)10,113(2,967)3263,21151281311,049(600)(364)(637)(15)(639)4,296 (3,065)3,293(1,853)113(134)(1,646)(3,094)2,926(1,791)90(25)(1,894)(743)695(1,484)1630(1,369) In 2021, we grew our market share across DIY and Pro through our Total Home strategy, which is focused on providing our customers with the products and services they need for every project in the home. This was an important step in our ongoing evolution toward becoming a world-class, customer-centric, omnichannel retailer. We delivered outstanding results again in 2021. I would like to extend my appreciation to our more Lowe's centennial, with total sales growth of 7.4% than 300,000 associates who demonstrated an driven by comparable sales growth of 6.9%. unwavering commitment to delivering exceptional Importantly, we drove improvements in two of our_ customer service and results in 2021. The hard work key growth areas, with Pro sales up 24% and and dedication of our associates have been critical to Lowes.com sales up 18\%. At the same time, we our success as we navigated through the challenges drove more than 170 basis points of operating presented by the COVID-19 pandemic. Each quarter, margin improvement, with our relentless focus on 100% of our stores earned the Winning Together profitproductivity improvements. The combination of sharing bonuses for front-line associates, with a total higher sales and greater operating productivity payout of $475 million. Additionally, we rewarded our resulted in a 36% increase in diluted earnings front-line associates with a year-end discretionary per share on an adjusted basis. bonus of $265 million in recognition of their hard We remain committed to a best-in-class capital_ work throughout the year. allocation strategy focused on generating In 2021, Lowe's Total Home strategy drove outsized sustainable, long-term shareholder value. In 2021, gains in sales to our Pro and DIY customers and we returned $15.1 billion to our shareholders through meaningful market share. We made steady progress a combination of share repurchases and dividends. executing against the five components of our strategy: This included $13.1 billion in share repurchases, Drive Pro penetration: which was $4 billion higher than our original expectations, reflecting better-than-expected Accelerate online business: financial performance and our commitment to Expand installation services; return excess capital to shareholders. We also increased our quarterly cash dividend by 33%. Drive localization, and: continuing a remarkable track record of increasing Elevate our product assortment our dividend every year since going public in 1961. With customer demand for integrated omnichannel lumber to capture better margins and reduce store shopping experiences increasing. we continue to labor. In-store fulfiliment was expanded through the invest in our supply chain and omnichannel rollout of touchless lockers across all of our U.S. capabilities. During the year, we converted three stores, which quickly became our customers' fovorite markets to a market-based delivery model for big pickup option. and bulky products such as appliances and grills. Under the new model, these products flow from bulk In 2021, we celebrated our centennial with a $10 milion distribution centers directly to customer homes, investment across 100 Hometowns throughout the bypassing stores altogether. The new market-based country with community impoct projects ranging delivery model is driving higher appliance sales, from renovating food pantries and homeless improved profitability, improved inventory turns, shelters to updating youth centers. This was our woy better on-time delivery rates and customer of expressing gratitude to our loyal customers while satisfaction. We will continue converting our U.S. honoring the company's long-standing markets to the new model through 2023. commitment to community service. We drove operational efficiency across our stores and We are also supporting the health of our planet corporate spend through our Perpetual Productivity by investing in sustainability in our operations. Initiatives ("PPi"). This series of initiatives not only increasing responsible product sourcing and unlocked operating leverage during the year but reducing our environmental impact. Looking will scale over time. We implemented significant ahead, we plan to intensify our efforts to protect changes to improve store labor productivity by the climate by establishing a science based net-zero using technology to reduce tasking hours, improve target in 2022. The new target will include both customer service, and increase sales productivity. near and long-term greenhouse gas emissions We also installed digital signs in appliances and reduction goals for Lowe's full value chain, including 5 copes 1, 2 and 3 . FINANCIAL HIGHLIGHTS