Help me with this question

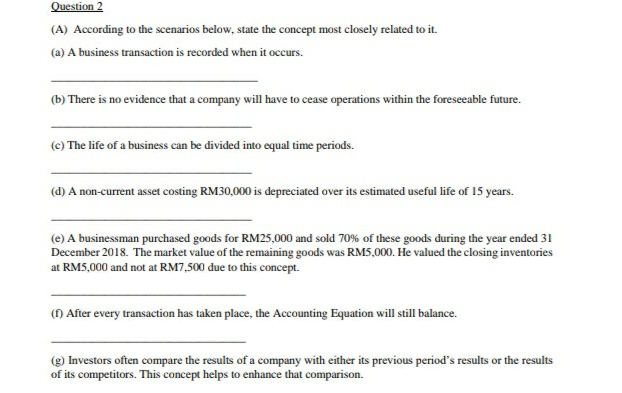

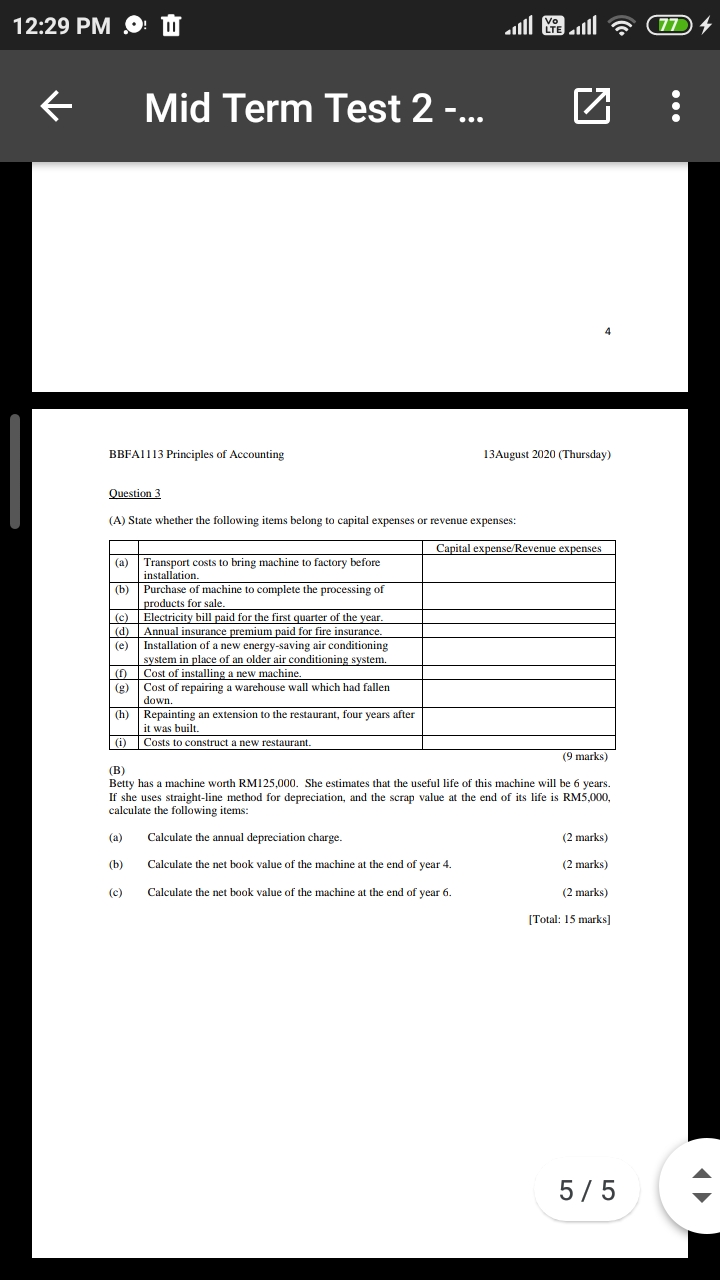

Question 2 (A) According to the scenarios below, state the concept most closely related to it. (a) A business transaction is recorded when it occurs. (b) There is no evidence that a company will have to cease operations within the foreseeable future. (c) The life of a business can be divided into equal time periods. (d) A non-current asset costing RM30,000 is depreciated over its estimated useful life of 15 years. (e) A businessman purchased goods for RM25,000 and sold 70% of these goods during the year ended 31 December 2018. The market value of the remaining goods was RM5,000. He valued the closing inventories at RM5,000 and not at RM7.500 due to this concept. (f) After every transaction has taken place, the Accounting Equation will still balance. (g) Investors often compare the results of a company with either its previous period's results or the results of its competitors. This concept helps to enhance that comparison.12:29 PM .O: W Mid Term Test 2 ... (7 : BBFAI 1 13 Principles of Accounting 13August 2020 (Thursday) Question 3 (A) State whether the following items belong to capital expenses or revenue expenses: Capital expense Revenue expenses (a) Transport costs to bring machine to factory before installation. (b) Purchase of machine to complete the processing of products for sale Electricity bill paid for the first quarter of the year Annual insurance premium paid for fire insurance. Installation of a new energy-saving air conditioning system in place of an older air conditioning system. (f) Cost of installing a new machine. (g) Cost of repairing a warehouse wall which had fallen down. (h) Repainting an extension to the restaurant, four years after it was built. (i) Costs to construct a new restaurant. (9 marks) B Betty has a machine worth RM125,000. She estimates that the useful life of this machine will be 6 years. If she uses straight-line method for depreciation, and the scrap value at the end of its life is RM5,000, calculate the following items: (a) Calculate the annual depreciation charge. (2 marks) (b) Calculate the net book value of the machine at the end of year 4. (2 marks) (c ) Calculate the net book value of the machine at the end of year 6. (2 marks) [Total: 15 marks] 5 /5