Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Needed ASAP. Current Attempt in Progress Monty Inc. had the following statement of financial position at the end of operations for 2022: During 2023,

Help Needed ASAP.

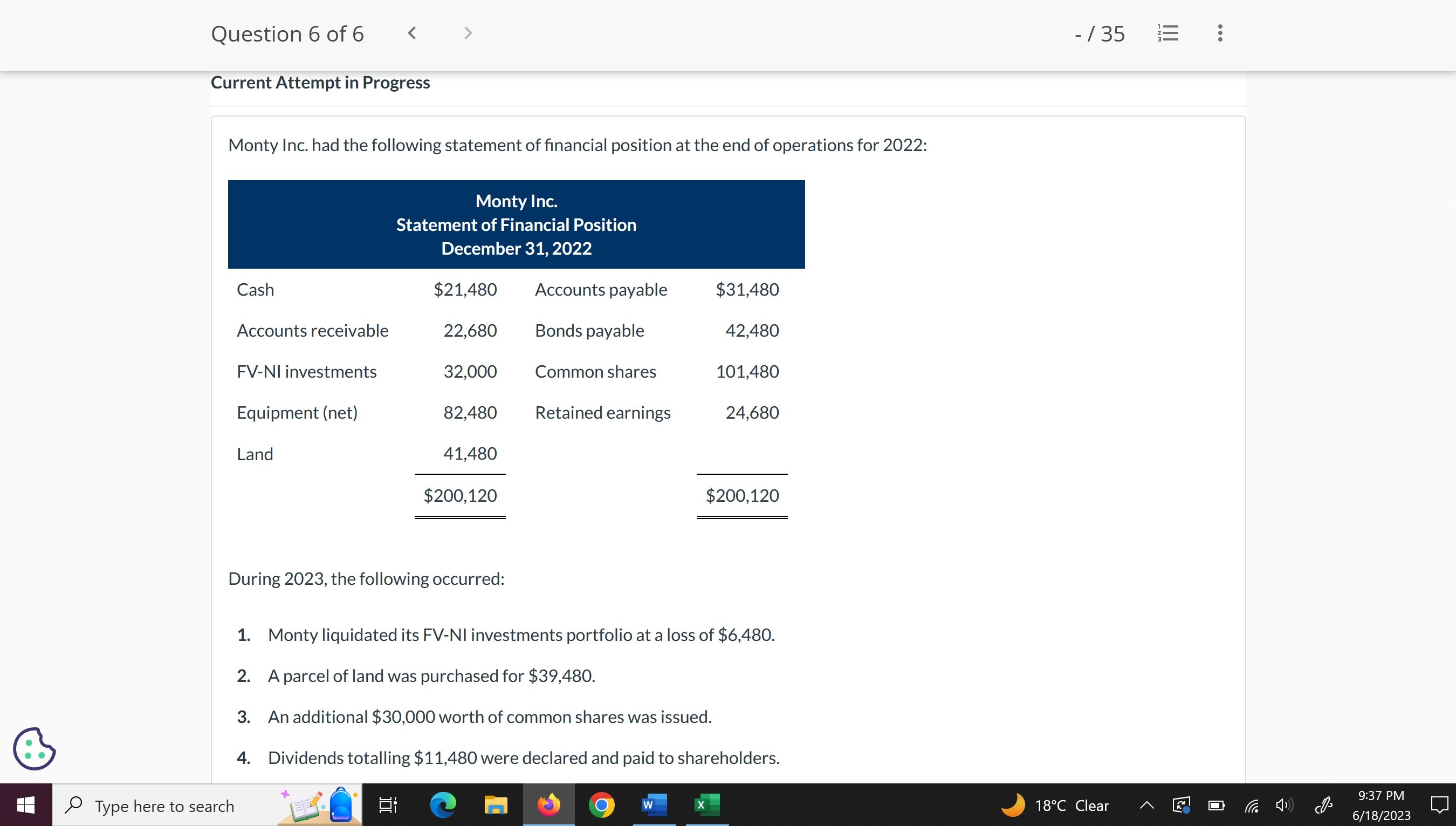

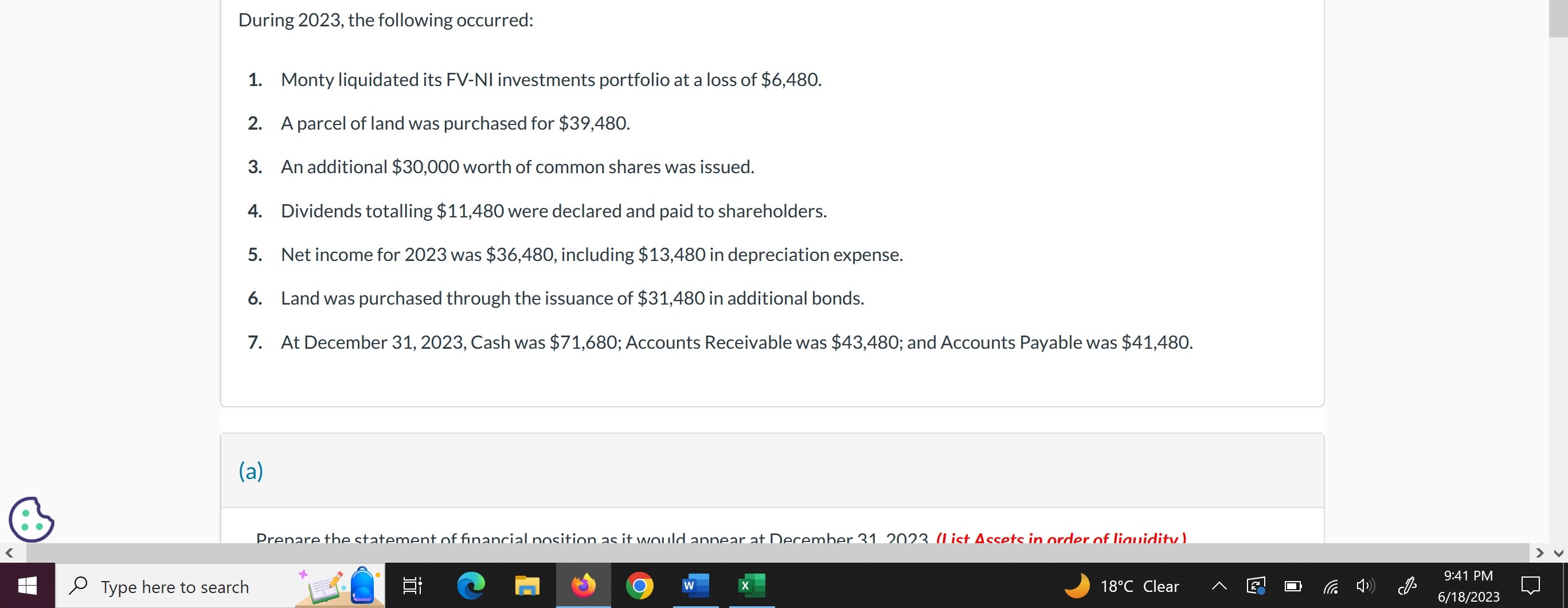

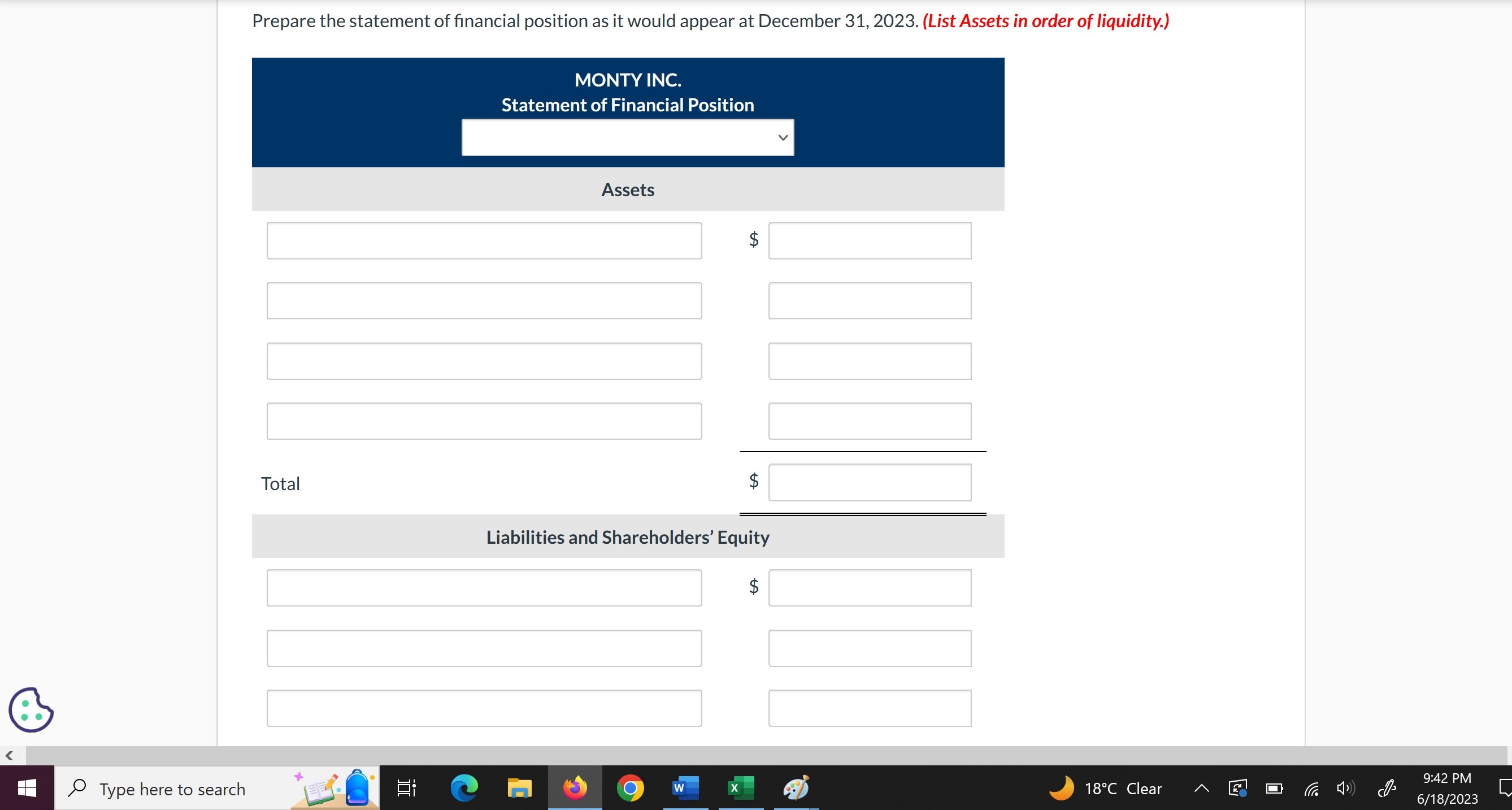

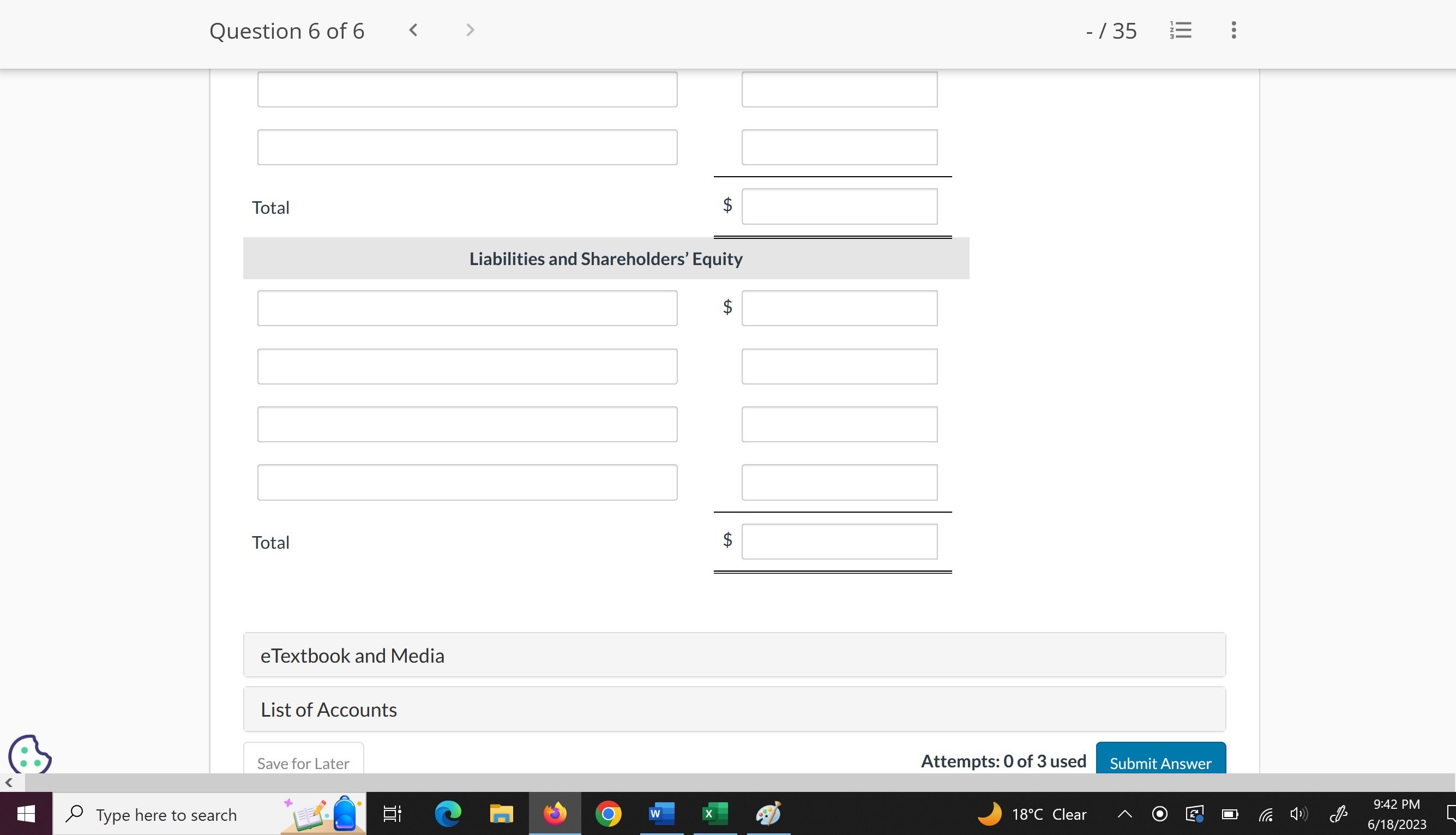

Current Attempt in Progress Monty Inc. had the following statement of financial position at the end of operations for 2022: During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. 5. Net income for 2023 was $36,480, including $13,480 in depreciation expense. 6. Land was purchased through the issuance of $31,480 in additional bonds. 7. At December 31,2023 , Cash was $71,680; Accounts Receivable was $43,480; and Accounts Payable was $41,480. Prepare the statement of financial position as it would appear at December 31, 2023. (List Assets in order of liquidity.) MONTY INC. Statement of Financial Position Assets $ Total $ Liabilities and Shareholders' Equity $ B Question 6 of 6 135 Total $ Liabilities and Shareholders' Equity eTextbook and Media List of Accounts Save for Later Save for Later Type here to search Attempts: 0 of 3 used Attempts: 0 of 3 used Current Attempt in Progress Monty Inc. had the following statement of financial position at the end of operations for 2022: During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. 5. Net income for 2023 was $36,480, including $13,480 in depreciation expense. 6. Land was purchased through the issuance of $31,480 in additional bonds. 7. At December 31,2023 , Cash was $71,680; Accounts Receivable was $43,480; and Accounts Payable was $41,480. Prepare the statement of financial position as it would appear at December 31, 2023. (List Assets in order of liquidity.) MONTY INC. Statement of Financial Position Assets $ Total $ Liabilities and Shareholders' Equity $ B Question 6 of 6 135 Total $ Liabilities and Shareholders' Equity eTextbook and Media List of Accounts Save for Later Save for Later Type here to search Attempts: 0 of 3 used Attempts: 0 of 3 used

Current Attempt in Progress Monty Inc. had the following statement of financial position at the end of operations for 2022: During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. 5. Net income for 2023 was $36,480, including $13,480 in depreciation expense. 6. Land was purchased through the issuance of $31,480 in additional bonds. 7. At December 31,2023 , Cash was $71,680; Accounts Receivable was $43,480; and Accounts Payable was $41,480. Prepare the statement of financial position as it would appear at December 31, 2023. (List Assets in order of liquidity.) MONTY INC. Statement of Financial Position Assets $ Total $ Liabilities and Shareholders' Equity $ B Question 6 of 6 135 Total $ Liabilities and Shareholders' Equity eTextbook and Media List of Accounts Save for Later Save for Later Type here to search Attempts: 0 of 3 used Attempts: 0 of 3 used Current Attempt in Progress Monty Inc. had the following statement of financial position at the end of operations for 2022: During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. During 2023, the following occurred: 1. Monty liquidated its FV-NI investments portfolio at a loss of $6,480. 2. A parcel of land was purchased for $39,480. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $11,480 were declared and paid to shareholders. 5. Net income for 2023 was $36,480, including $13,480 in depreciation expense. 6. Land was purchased through the issuance of $31,480 in additional bonds. 7. At December 31,2023 , Cash was $71,680; Accounts Receivable was $43,480; and Accounts Payable was $41,480. Prepare the statement of financial position as it would appear at December 31, 2023. (List Assets in order of liquidity.) MONTY INC. Statement of Financial Position Assets $ Total $ Liabilities and Shareholders' Equity $ B Question 6 of 6 135 Total $ Liabilities and Shareholders' Equity eTextbook and Media List of Accounts Save for Later Save for Later Type here to search Attempts: 0 of 3 used Attempts: 0 of 3 used Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started