Help needed please!

They did not answer the right answer from my previous question and had to post another one again.

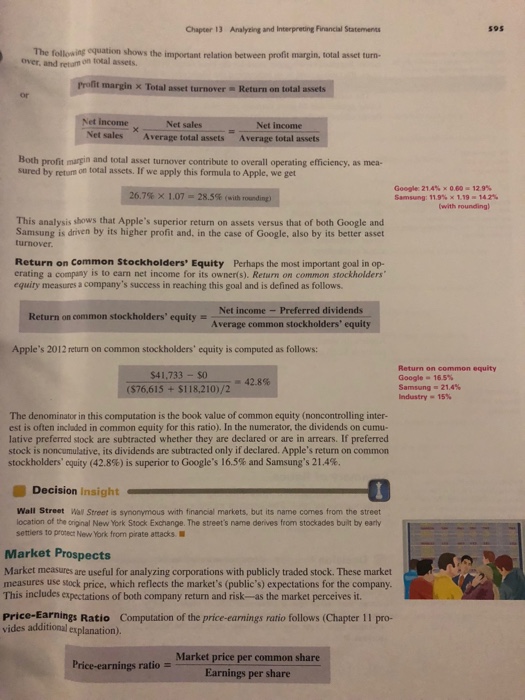

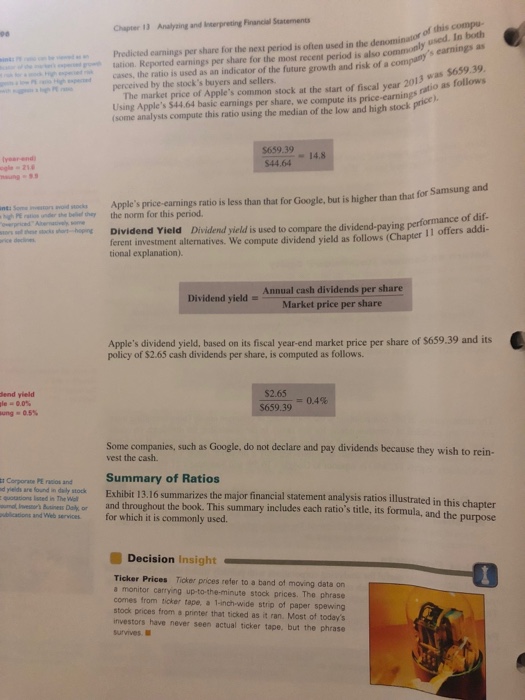

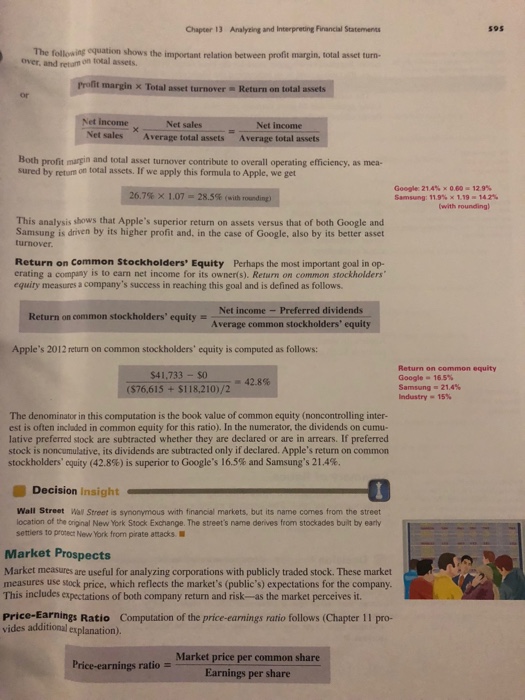

Chapter 13 Analyting and Interpreting Financial Statements The following equation shows the important relation between profit margin, total asset turn- s95 over, and retum on total assets. t margin Total asset turnover Return on total assets or Net income Net sales Net sales Net income Average total assets A verage total assets Both profit margin and total asset turnover contribute to overall operating efficiency, as mea- sured by retum on total assets. If we apply this formula to Apple, we get Google 21.4% x 0.0012.9% Samsung: 11.9% 1,19 . 142% 26.7% 1.07-28.5% (with (with rounding) This analysis shows that Apple's superior return on assets versus that of both Google and Samsung is driven by its higher profit and, in the case of Google, also by its better asset turnover. Return on Common Stockholders' Equity Perhaps the most important goal in op- erating a company is to earn net income for its owner(s). Return on common stockholders equity measures a company's success in reaching this goal and is defined as follows. Net income- Preferred dividends Average common stockholders' equity Return on common stockholders' equity Apple's 2012 return on common stockholders' equity is computed as follows: $41,733 - $0 ($76,615 +$118,210)/2 Return on common equity Google-165% Samsung 21.4% Industry-15% -42.8% The denominator in this computation is the book value of common equity (noncontrolling inter- est is often incladed in common equity for this ratio). In the numerator, the dividends on cumu- lative preferred stock are subtracted whether they are declared or are in arrears. If preferred stock is noncumulative, its dividends are subtracted only if declared. Apple's return on common stockholders' equity (42.8%) is superior to Google's 16.5% and Samsung's 21.4%. Decision Insight Wall Street Wall Street is synonymous with financial markets, but its name comes from the street ocation of the original New York Stock Exchange. The street's name derives from stockades built by earty settiers to proect New York from pirate attacks. B Market Prospects Market measures are useful for analyzing corporations with publicly traded stock. These market measures use stock price, which reflects the market's (public's) expectations for the company This includes expectations of both company return and risk-as the market perceives it. Price-Earnings Ratio Computation of the price-earnings ratio follows (Chapter 11 pro- vides additional explanation). Market price per common share Earnings per share Price-earnings ratio