PLEASE HELP!!!

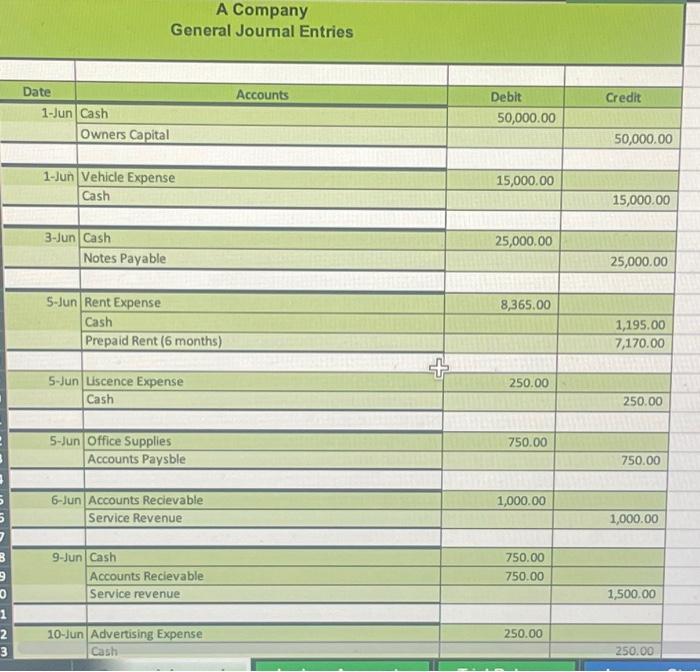

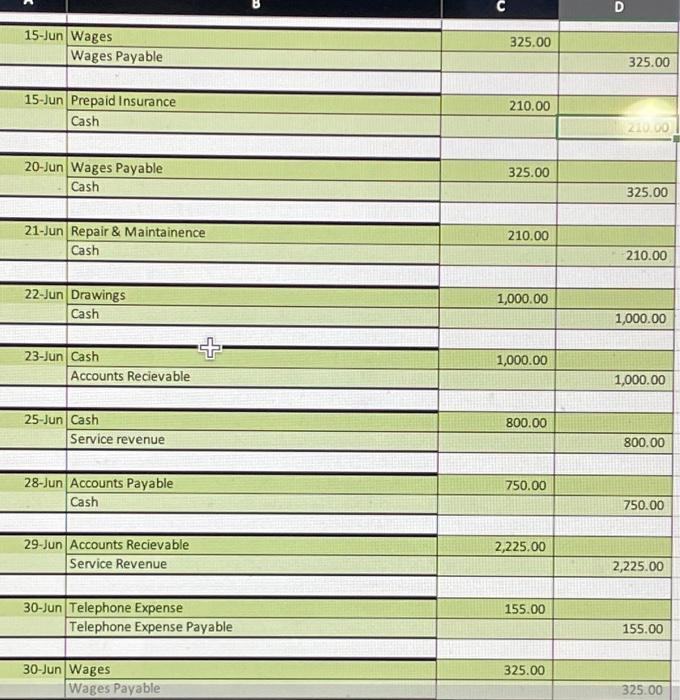

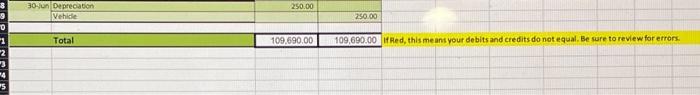

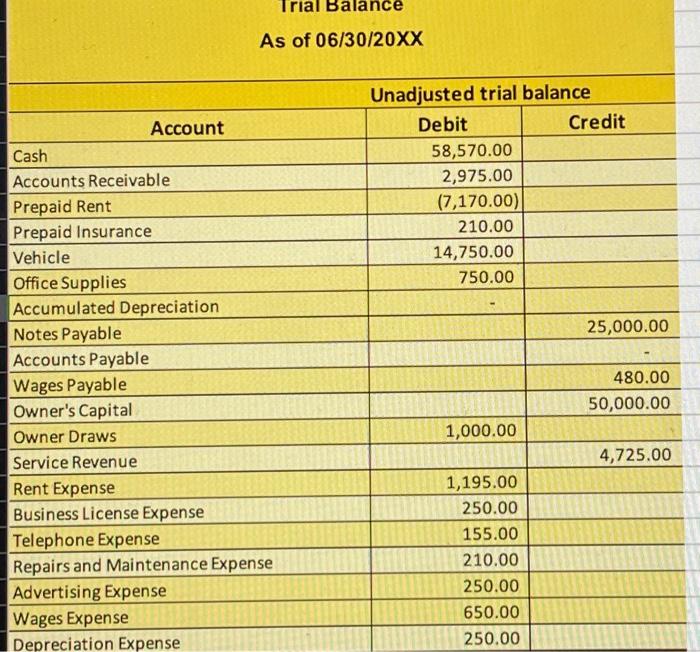

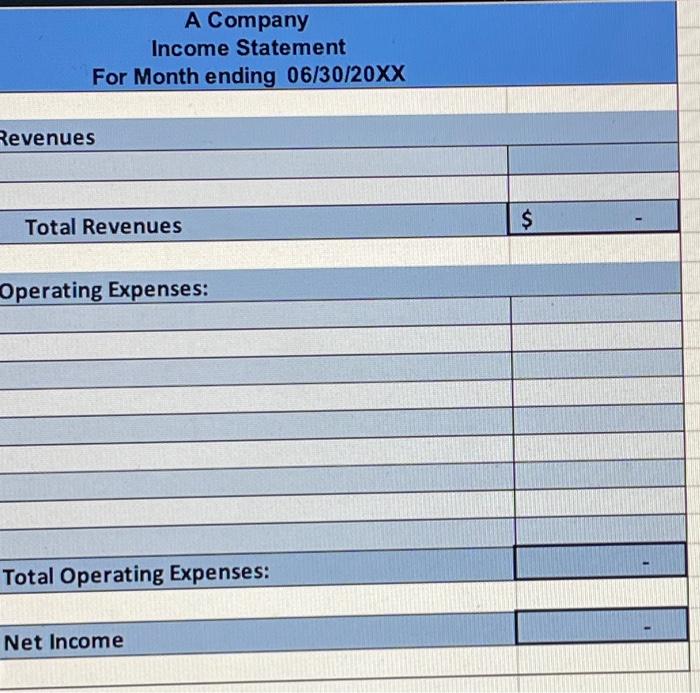

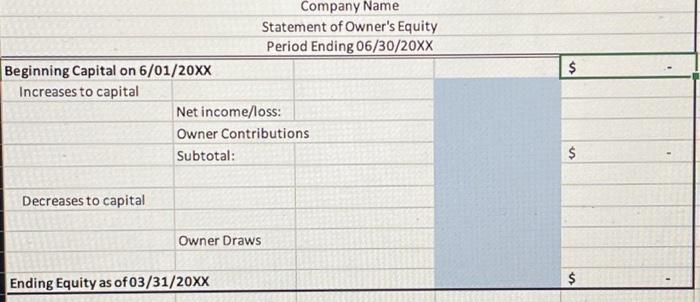

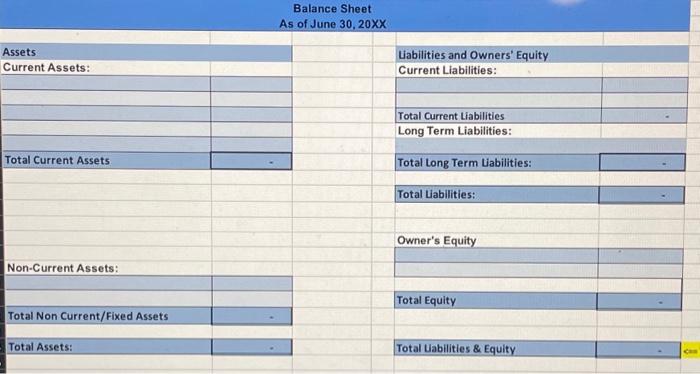

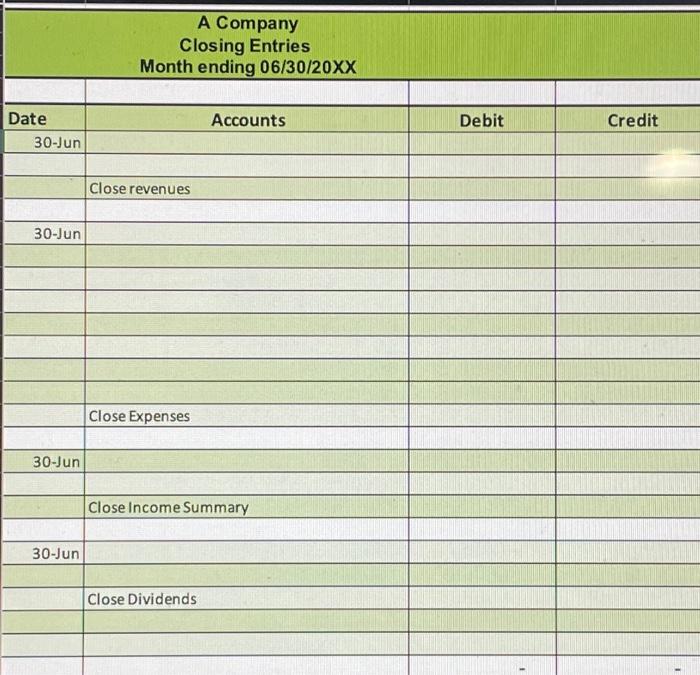

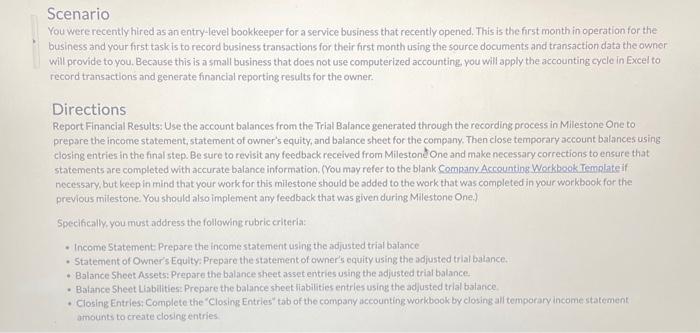

As of 06/30/20XX Company Name Statement of Owner's Equity Period Ending 06/30/20XX A Company General Journal Entries A Company Income Statement For Month ending 06/30/20XX Total Revenues $ Operating Expenses: Total Operating Expenses: Net Income Balance Sheet As of June 30,20X Assets Current Assets: \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline Total Current Assets & \\ \hline & \\ \hline & \\ \hline Non-Current Assets: & \\ \hline Total Assets: \\ \hline \end{tabular} 'Labilities and Owners' Equity Current Liabilities: \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline Total Current Liabilities & \\ \hline Long Term Liabilities: & \\ \hline \end{tabular} Total Long Term Liabilities: Total Labilities: Owner's Equity \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline Total Equity & \\ \hline & \\ \hline Total Uabilities \& Equity & \\ \hline \end{tabular} A Company Closing Entries Month ending 06/30/20XX Scenario You were recently hired as an entry-level bookkeeper for a service business that recently opened. This is the first month in operation for the business and your first task is to record business transactions for their first month using the source documents and transaction data the owner will provide to you. Because this is a small business that does not use computerized accounting you will apply the accounting cycle in Excel to record transactions and generate financial reporting results for the owner. Directions Report Financial Results: Use the account balances from the Trial Balance generated through the recording process in Milestone One to prepare the income statement, statement of owner's equity, and balance sheet for the company. Then close temporary account balances using closing entries in the final step. Be sure to revisit any feedback received from Mileston One and make necessary corrections to ensure that statements are completed with accurate balance information. (You may refer to the blank Company Accounting Wockbook Template if necessary, but keep in mind that your work for this milestone should be added to the work that was completed in your workbook for the previous milestone. You should also implement any feedback that was given during Milestone One.) Specifically, you must address the following rubric criteria: - Income Statement Prepare the income statement using the adjusted trial balance - Statement of Owner's Equity: Prepare the statement of owner's equity using the adjusted trial balance. - Balance Sheet Assets: Prepare the balance sheet asset entries using the adjusted trial balance. - Balance Sheet Liabilities- Prepare the balance sbeet liabilities entries using the adjusted trial balance - Closing Entries: Complete the 'Closing Entries' tab of the company accounting workbook by closing ali temporary income statement amounts to create closing entries