help needed

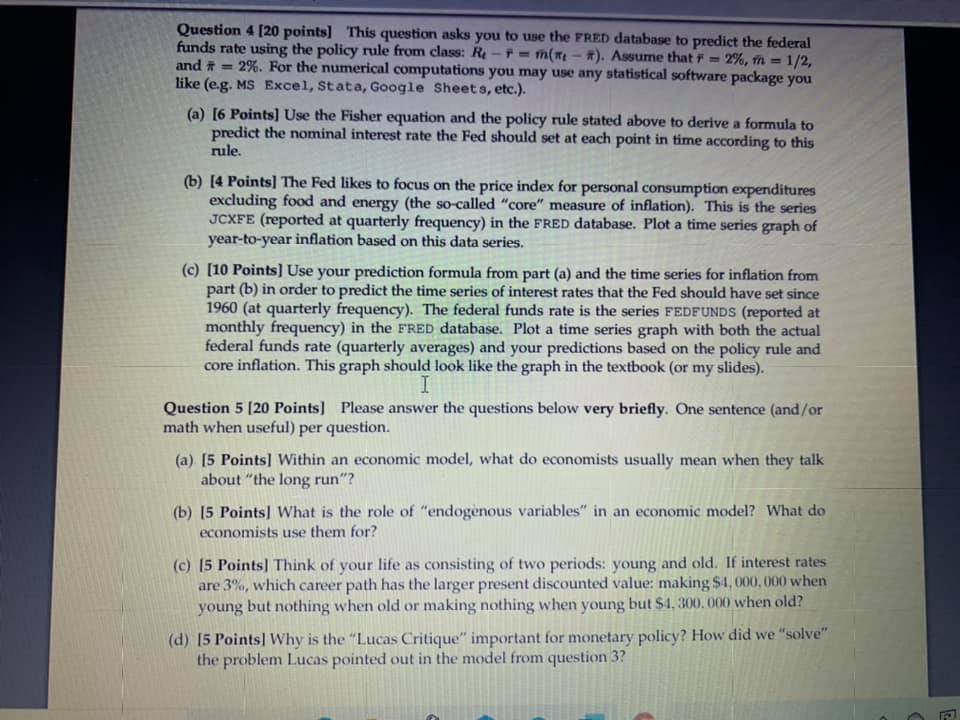

Question 4 [20 points] This question asks you to use the FRED database to predict the federal funds rate using the policy rule from class: Re - P = m(*t - 7). Assume that F = 2%, m = 1/2, and # = 2%. For the numerical computations you may use any statistical software package you like (e.g. MS Excel, Stata, Google Sheets, etc.). (a) [6 Points] Use the Fisher equation and the policy rule stated above to derive a formula to rule. predict the nominal interest rate the Fed should set at each point in time according to this (b) [4 Points] The Fed likes to focus on the price index for personal consumption expenditures excluding food and energy (the so-called "core" measure of inflation). This is the series JCXFE (reported at quarterly frequency) in the FRED database. Plot a time series graph of year-to-year inflation based on this data series. (c) [10 Points] Use your prediction formula from part (a) and the time series for inflation from part (b) in order to predict the time series of interest rates that the Fed should have set since 1960 (at quarterly frequency). The federal funds rate is the series FEDFUNDS (reported at monthly frequency) in the FRED database. Plot a time series graph with both the actual federal funds rate (quarterly averages) and your predictions based on the policy rule and core inflation. This graph should look like the graph in the textbook (or my slides). I Question 5 [20 Points] Please answer the questions below very briefly. One sentence (and/ or math when useful) per question. (a) [5 Points] Within an economic model, what do economists usually mean when they talk about "the long run"? (b) [5 Points] What is the role of "endogenous variables" in an economic model? What do economists use them for? (c) [5 Points] Think of your life as consisting of two periods: young and old. If interest rates are 3%, which career path has the larger present discounted value: making $4, 000, 090 when young but nothing when old or making nothing when young but $4, 300. 000 when old? (d) [5 Points] Why is the "Lucas Critique" important for monetary policy? How did we "solve" the problem Lucas pointed out in the model from question 3